Despite recent government directives to stay-at-home (resulting in on-premise closures) across 29 states, beverage alcohol sales are buoyant as a result of shifts to retail, which includes ecommerce delivery and click-and-pick options.

“As consumer panic leads to stockpile buying, and as consumers indulge in crisis comfort buying, we expect beverage alcohol sales to continue to increase in the short-term,” notes Brandy Rand, COO of the Americas at the IWSR. Rand adds, “short-term stockpiling will likely lead to a lag in sales in the medium-term, but we expect overall sales to regulate over the coming months, with long-term forecasts predicated on COVID-19 mitigation and the re-opening of the US economy.”

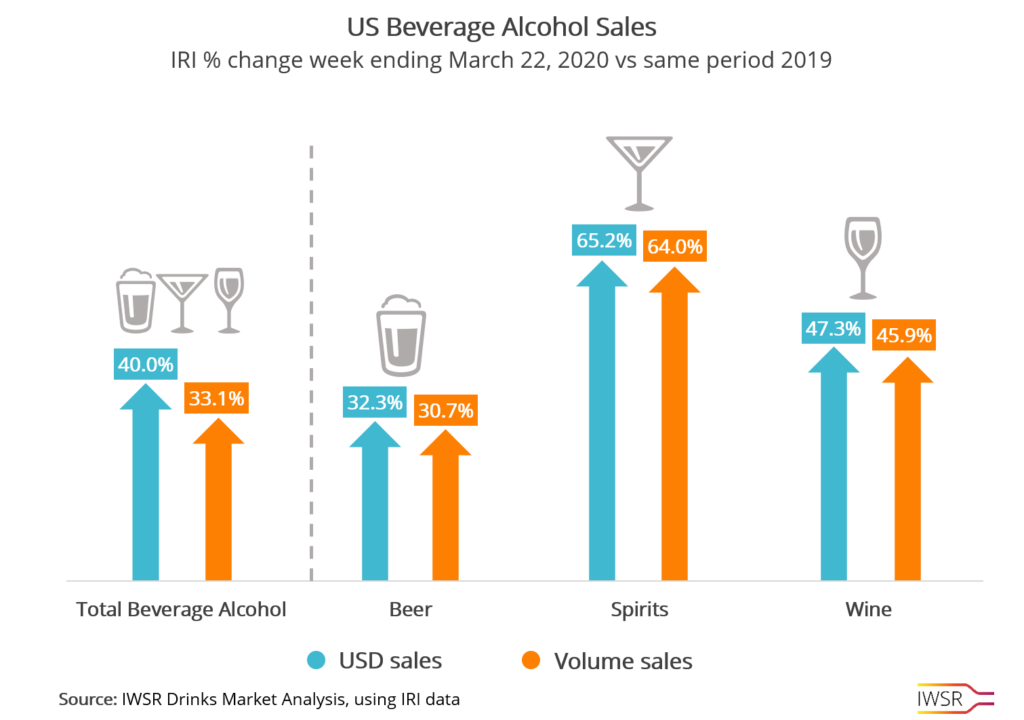

The recent growth rate in alcohol purchases has been increasing at a much higher pace than overall 2019 growth, which underscores the scale of the current consumer panic and comfort buying. In comparison to IRI’s weekly data for March 2020, IWSR, which tracks total annualized beverage alcohol consumption, showed preliminary 2019 full-year trends up 0.3% in volume and 2.5% in value.

IRI week-over-week data shows a steady increase in volume and value sales across beer, spirits and wine in the US. Figures for week ending March 22nd show total beverage alcohol USD sales increased 40% vs the same period last year, and volume sales increased 33% vs last year. These numbers are higher than those of the previous week ending March 15 as well, and show a mix of increased purchase in both value and premium brands across categories.

Standout IRI-tracked categories over the latest week of March 22nd include premium box and table wine, flavoured malt beverages (FMBs), non-alcoholic mixers and premixed cocktails. Softening sales are evident in higher-end sparkling wine, non-alcoholic beer and imported beer.

It is not surprising to see mixers and premixed cocktails trending in current purchasing decisions. With on-premise establishments shuttered, happy hour video chats the new social norm, and people, including bartenders, sharing videos of interesting cocktail recipes on social media, consumers will want to recreate the cocktail experience at home.

IRI data also indicates key trends across packaging showing a jump in large-format wine and spirits sales in the week ending March 22 compared to previous weeks. Spirits packaging in 1 litre , 1.5 litre and 1.75 litre and wine sized 1.5 litre and higher, including popular 3-litre boxed wines, outpaced smaller formats. Larger size formats and value brands tend to benefit from panic buying as people look to stock their home as much as possible in light of the lockdown.

Top-selling volume brands like Tito’s, White Claw and Barefoot have all been enjoying accelerated growth rates, not only annually according to IWSR, but in IRI channels over the last several weeks. The Budweiser family of brands has reversed a 52-week volume decline, posting growth week ending March 22. “During uncertain times, comfort purchasing tends to drive the consumption of standard or premium brands that people already know, especially ones they’ve consumed in the on-premise,” notes Rand. Across spirits, whiskey brands like Wild Turkey, Crown Royal, Jack Daniel’s, Bulleit and Maker’s Mark are all seeing increased purchase at retail. Mixable-friendly vodka also seems to be a bright spot.

Interestingly, Corona brands have seen a spike with sales volumes up 28.8%. Across social media, consumers highlight Corona brand purchases as a tongue-in-cheek response to the term “coronavirus”.

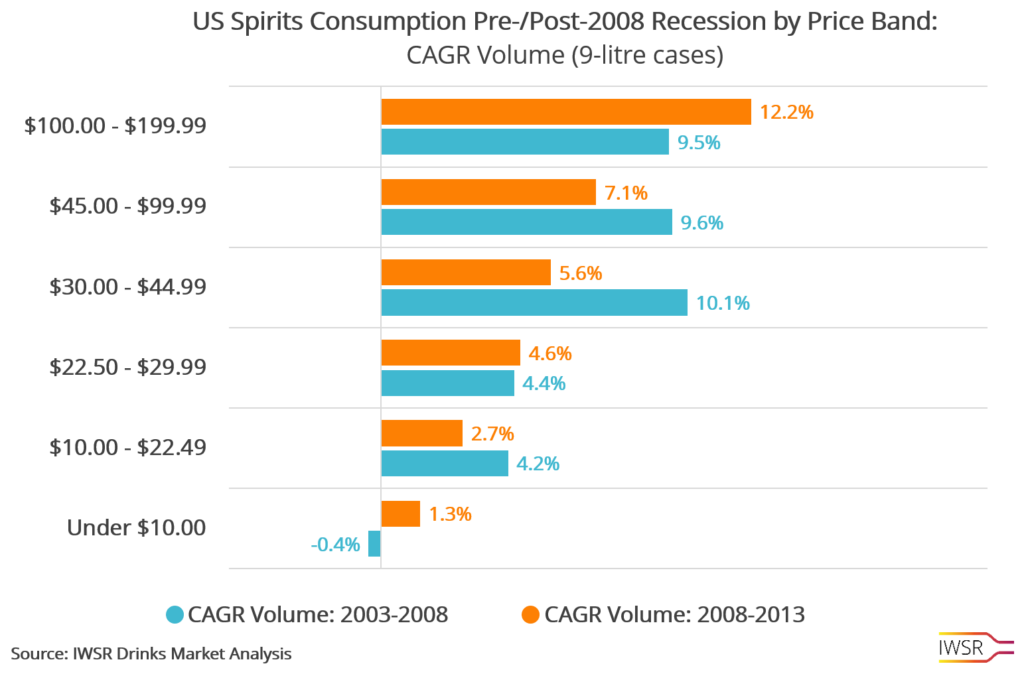

While not of the global magnitude of the COVID-19 pandemic, the 2008 recession gives some indication of changing consumer purchasing both before and after. Total beverage alcohol 5-year volume CAGR growth 2003-2008 was 1.0%, while the following 5-year volume CAGR growth 2008-2013 softened to 0.1%, largely driven by declines in beer consumption post-recession.

In looking at US spirits volume by price band, pre- and post-recession, the super high-end and value end both outpaced pre-recession volumes. Brands in the mid- to upper $20 price range maintained consistency.

In the current COVID-19 environment, beverage alcohol sales are healthy across all price segments in the US as of now, with the full economic reality yet to sink in. The recent sales surge will likely regulate, as the country navigates through COVID-19 and on-premise slowly reopens.

You may also be interested in reading:

Social drinking at a time of social distancing

How the US Beverage Alcohol Industry is Responding to the COVID-19 Crisis

The categories succeeding in the ecommerce channel

To stay ahead of market trends and analysis, subscribe to receive our Industry Insights directly to your inbox.

Category

Market

- Beer

- Brandy

- Cider

- Gin

- Irish Whiskey

- Low-/No-Alcohol

- Mixed Drinks

- RTDs

- Rum

- Scotch

- Spirits

- Tequila

- US Whiskey

- Vodka

- Whisky

- Wine