For American consumers, living with Covid-19 has become the new normal, and will be so for sometime yet. Throughout the pandemic, new habits have been learned, and will now sit alongside long-established behaviours that are starting to return now that the market is normalising. This has significant implications for alcoholic drinks brands and retailers, which must devise strategies with one eye on the past and another on the future.

“Understanding these evolving shopping habits offers producers and retailers a perspective on the expected rhythm of change and the need to plan for channel synergies,” says Mariana Fletcher, Head of Analytics and Insights for the Americas at IWSR Drinks Market Analysis.

Spending remains strong, boosted by increased comfort levels

Despite the upheaval the pandemic has caused to people’s day-to-day lives over the past 18 months, spending on alcoholic drinks has been constantly resilient, IWSR consumer data shows. Spending in the off-premise remains in growth, driven by a rebound in incomes since August 2020.

“There has been solid momentum in US drinkers’ spending patterns as there is less hesitancy to spend on alcohol. This is likely to continue in the immediate future, with positive net-spend predictions,” says Fletcher.

Millennials continue to be one of the most enthusiastic drinking demographics, consuming a wider range of alcoholic beverages while also being the generation that is more likely to have a higher spend average. IWSR consumer research shows that consumers who have higher levels of comfortability – including millennials – generally have higher spend intentions.

The proportion of US drinkers classified as generally ‘comfortable’ with life has shot up to 60%, compared with 35% in August 2020, and as a result have become more content shopping in stores, socialising, and going to events. The overall positive change in spending is largely due to fewer Americans spending less, rather than people actively spending more.

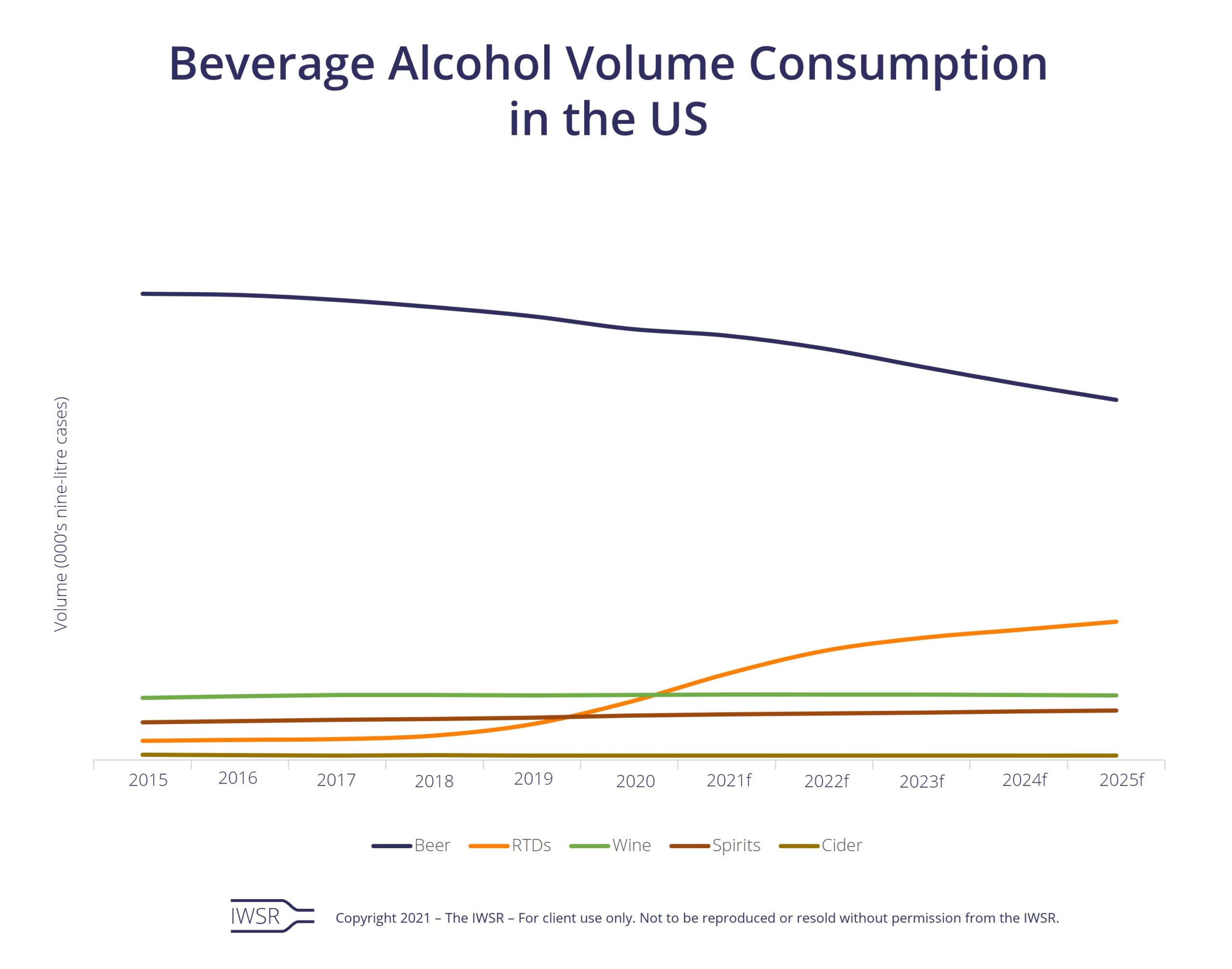

Some drinks categories have benefited more from this trend than others. Spend in the off-premise may be growing, but this growth is primarily occurring across a narrower range of beverages – such as easy-to-drink, social beverages including hard seltzers, pre-mixed cocktails, craft beer and sparkling wine. There is also a positive self-reported spending outlook for the total beer and Tequila categories.

Multi-channel off-trade approach is important

Since the start of the pandemic, “for producers, the key to success has been more related to how they shift and pace operational efforts and innovation than how to keep the category relevant,” says Fletcher.

As consumer confidence rises, behaviours are changing once more, with older habits resurfacing to sit alongside new ones. As US cities resume somewhat normal activities, LDA consumers who buy alcohol are starting to integrate brick and mortar stores into their purchase journeys, while ecommerce continues to rise.

IWSR data shows that self-reported e-shopping is slowing stateside, but usage levels still show a net +15% higher frequency in June 2021 after the peak in August 2020 of +34% and the December 2020 increase of +25%.

Meanwhile, physical stores are starting to bounce back as lockdown restrictions ease, with supermarkets, club stores and liquor stores all showing increased usage. IWSR self-reported consumer data shows that +7% of US drinkers had increased their usage levels in supermarkets in June 2021, compared to 3% last August, for example.

Consumers’ intentions for the next two months suggest that a mix of physical and online stores will continue to gain momentum. “It will therefore be up to brands and retailers to formulate multichannel strategies that can flex according to changing market conditions,” says Fletcher.

On-trade visits grow, but not to the detriment of home consumption

The US on-premise has been a particularly volatile environment since the start of the pandemic due to differing local government restrictions. However, more people feel increasingly confident going out to on-trade establishments this year compared to last year, with IWSR consumer data showing a net increase in likelihood of consumers visiting restaurants and bars.

For those who have been to a bar and consumed alcohol, the top 10 popular drinks include craft beer, Tequila, and hard seltzer – which, despite rising to prominence in the off-trade, has successfully made the transition to the on-trade channel, with 44% of drinkers saying they chose it on a recent on-premise visit.

The fact that hard seltzers have already made it into the top 10 drinks chosen in the on-premise is critical for the category, considering that hard seltzers did not exist on menus before the pandemic.

Conversely, fresh cocktails are also proving to be particularly popular, and are the choice of more than half of those who have consumed alcohol in the on-premise. “These new trends mean the composition of drinks on the menu could therefore look different in the next 12 months than say two years ago,” adds Fletcher.

Even with higher propensity of on-premise consumption, drinking at home continues in 2021 with most people reporting that they plan to maintain their drinking occasions in the house, including having a drink before or after a meal, while watching TV, or hanging out with friends and family.

A consistent majority said they are more likely to be drinking alcohol in the future across all in-home occasions. There is also a widespread view among US drinkers that that outdoor and online socialising habits will continue, even after lockdown restrictions have ceased. The increase in future home occasions is driven by millennials (25–39s) and Gen X (40–54s) consumers. LDA Gen Z (21–24s) consumers are less likely to be increasing their home occasions.

“Future distribution and innovation should take into account the speed of consumer behavioural changes, particularly as they relate to place of consumption (occasions) and trends among generations or other relevant segments,” says Fletcher.

You may also be interested in reading:

Brewers turn to product diversification to secure long-term growth in the US

Vodka’s premiumisation challenges and convergence with hard seltzers

Hard seltzers are evolving, not dying

Category

Market

- Beer

- Brandy

- Cider

- Gin

- Irish Whiskey

- Low-/No-Alcohol

- Mixed Drinks

- RTDs

- Rum

- Scotch

- Spirits

- Tequila

- US Whiskey

- Vodka

- Whisky

- Wine