22/09/2022

Premiumisation surged during Covid; will it continue?

IWSR analyses the drivers for premiumisation in recent years and how the current economic climate may impact the trend

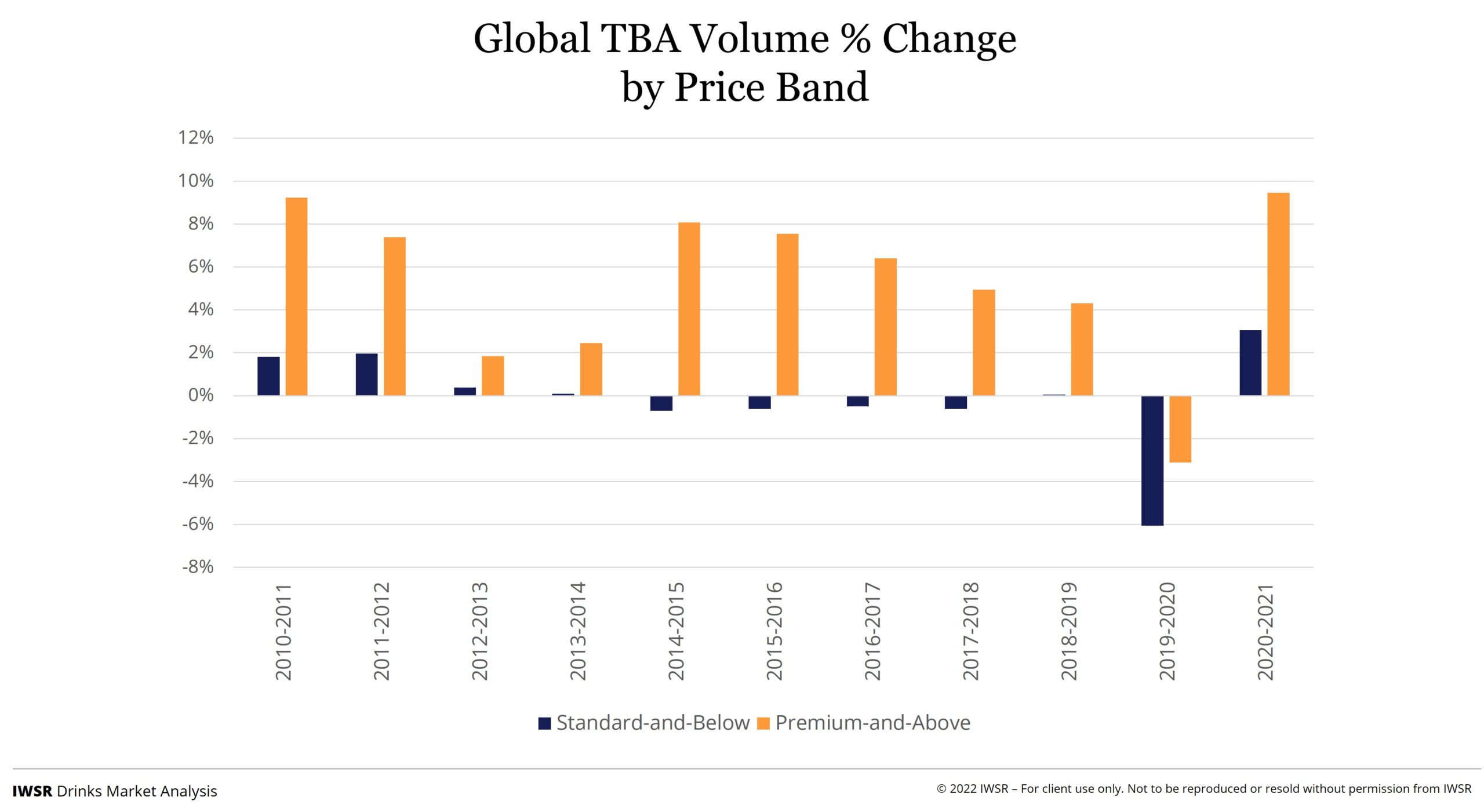

Over the past few years, growth within the beverage alcohol industry has arisen mainly from people spending more money on better quality beverages, less often, both in the developed world but far more significantly in emerging markets.

Overall volume consumption of beverage alcohol is largely on a downward long-term trajectory. However, relative economic stability combined with a remarkable increase in affluence across Asia, chiefly in China, has provided alcohol producers with a rapidly growing source of new consumers seeking to define themselves as more sophisticated drinkers than their parents. In practice, this has meant a generational switch from local (and sometimes illicit) beverages to national and then global brands.

The desire for higher quality drinks, at premium prices, also thrived during the Covid pandemic. Restricted from going out to their favourite restaurants and bars, consumers around the world spent their discretionary budgets on luxury experiences they could bring into the home, such as streamed entertainment services, gourmet meals, make-at-home cocktails, and sophisticated wines and spirits.

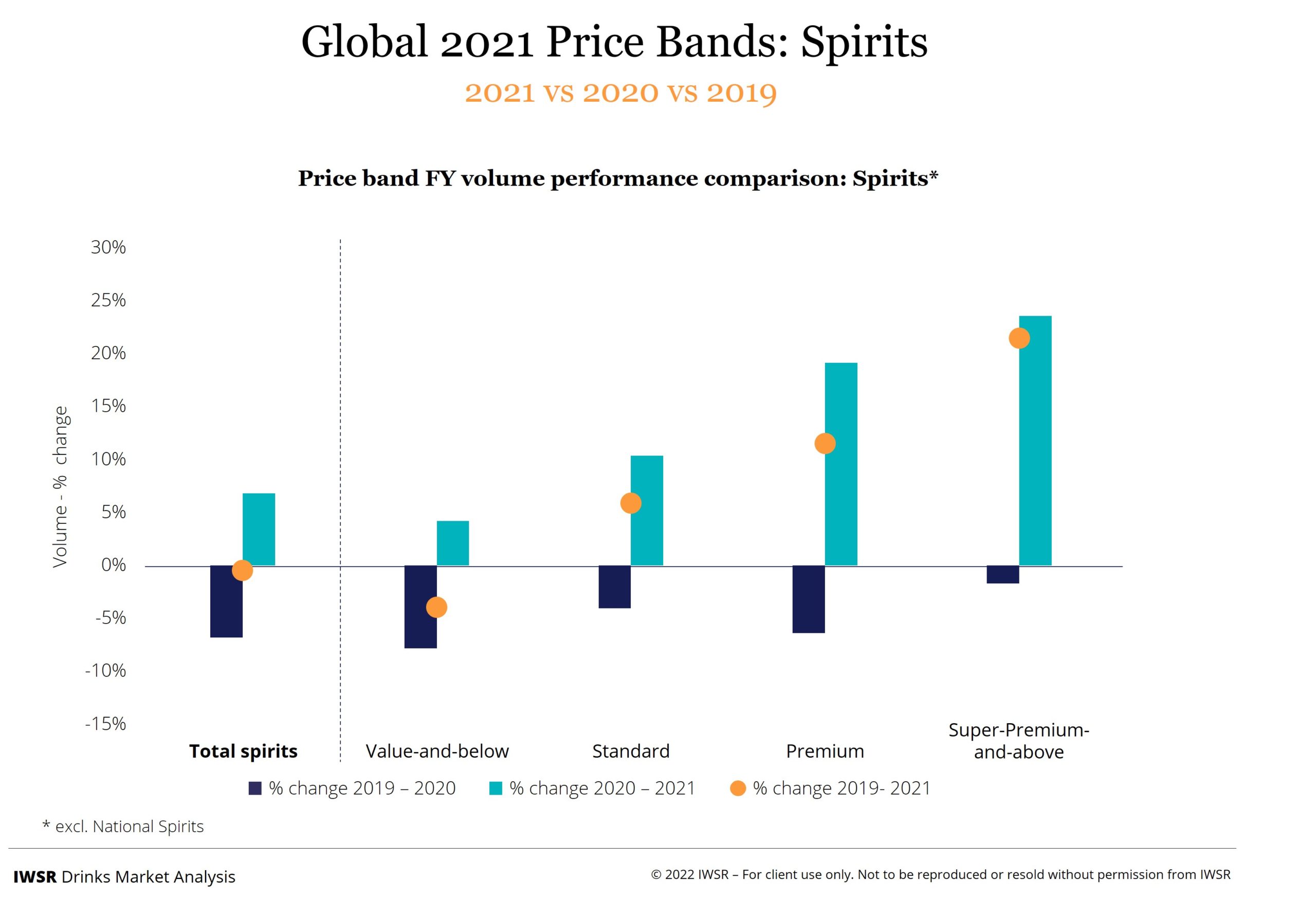

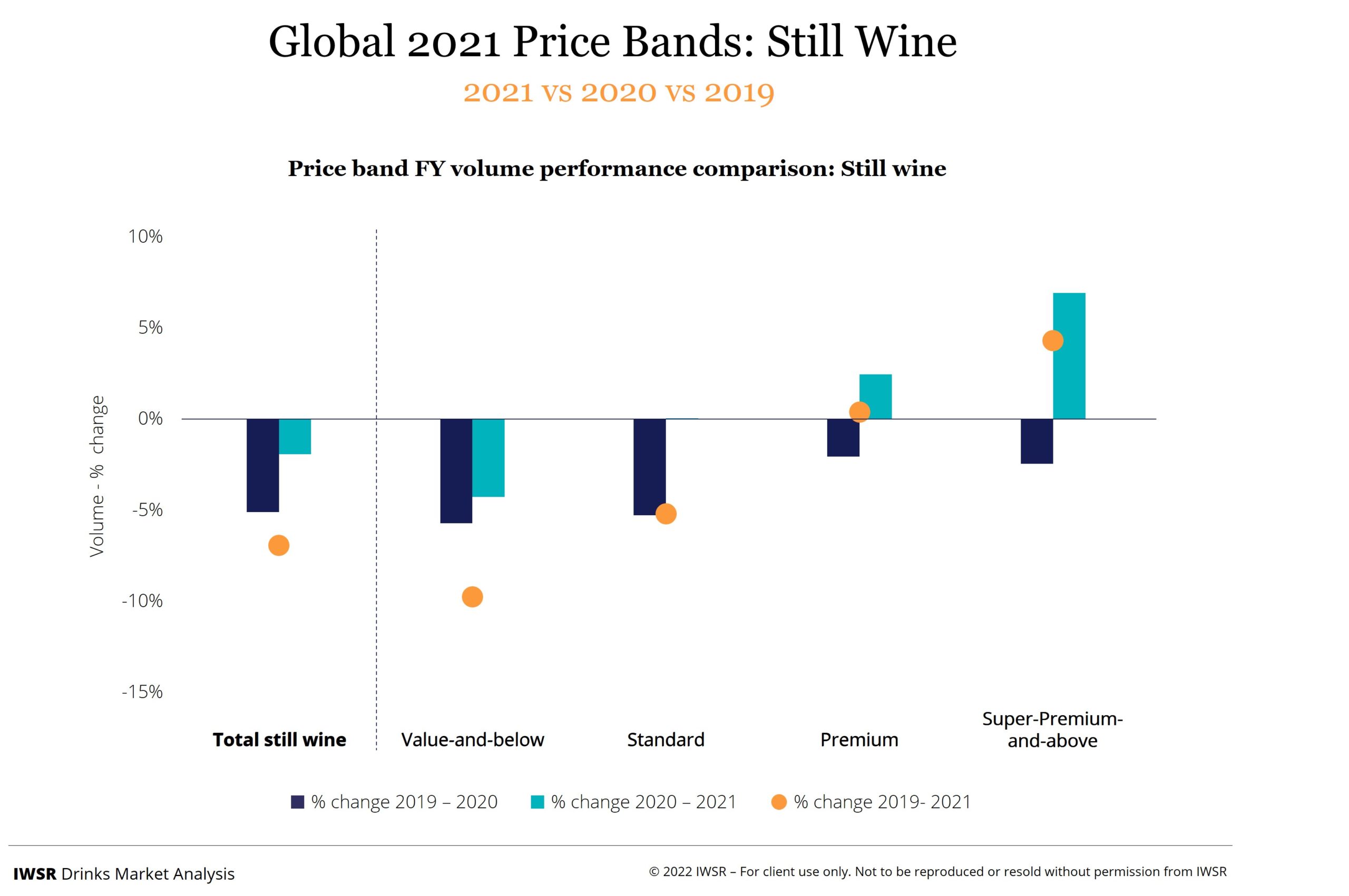

Premiumisation in spirits and wines was broad-based across many geographies during the height of the Covid pandemic. Globally, premium-and-above brands (excluding baijiu) grew 6% compared to 2019. High-end alcohol beverages have seen remarkable resilience despite wider spending concerns across FMCG.

Premium spirits, for example, did very well in markets including Brazil, Argentina, China, as well as in Europe and North America. Although still wine dominates the evening meal occasion, sparkling wine started to enjoy a broader range of drinking occasions, with consumers increasingly choosing it for informal meal and non-meal occasions, such as aperitifs and brunch to pre-night outs and high-energy nightlife. The trend in alcohol sales by value is uniformly positive over 2021, and up in all categories versus 2019.

Today, the drink-less-but-better trend faces another threat in many of its key markets: spiralling energy costs and inflation, which, combined with legacy effects of the pandemic in the form of indebted governments, disrupted supply chains and periodic lockdowns in China, are threatening a major global recession.

The negative effects of inflation and rising living costs will not affect all consumers equally – either by geography or social class. Citizens of Asia, the US and Europe are experiencing very different economic pressures (or, in some cases, lack of pressure). American consumers appear to be cutting back on going out, but not on spending generally. Unemployment is at historic lows in many markets. Indian consumers are still enjoying a booming economy.

However, within income groups, the consequences of rising costs and falling incomes may be more consistent. For affluent consumers, paying more for food and heating will be a relatively smaller issue; for middle income consumers, they will necessitate harder choices and trade-offs; and for low-income consumers, they will be more existential and likely will necessitate some form of government intervention to maintain social order.

How will the global alcohol industry fare amid these latest threats to its prosperity? As a discretionary purchase, it is likely to lose some volume as less well-off consumers rein in spending. But will it also lose its premiumisation momentum?

To help address these questions and offer a benchmark to alcohol businesses and investors as they formalise short-run tactics and longer-term strategy, IWSR is launching a major multi-wave 17-market study that will track consumer attitudes and sensitivity to price fluctuations across beverage alcohol.

The IWSR Consumer Price Sensitivity Barometer, which will be published over two waves (Q4 2022 and Q2 2023), will track shifts in consumer sensitivity to price changes by alcohol beverage category, going out to on-premise locations, demand changes by category, and attitudes towards trading up/down across categories.

IWSR analysis during the Covid era found that consumers who had a strong liking for certain types of alcohol, and felt they were a key element of their lifestyle, were more likely to stick with these categories during periods of disruption, such as a lockdown. Those with higher connection levels to a given category were also more likely to trade up. The upcoming Study will track a consumer’s level of commitment to a given drinks category in the current economic climate, and how this commitment level might influence their purchasing behaviour and sensitivity to price changes.

To access the Study findings, please get in touch with your IWSR Account Manager or email enquiries@theiwsr.com

You may also be interested in reading:

Drinks companies diversify as category lines blur

Economic tensions are high. What does this mean for premium beverage alcohol in the US?

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Premiumisation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.