Badge drinking, otherwise known as conspicuous consumption, allows consumers to display their social status and wealth through the medium of alcoholic drinks brands. Practiced around the world, it is most common in the emerging markets. Traditionally, badge drinking has been inextricably linked to the VIP areas of the on-trade, particularly in parts of Africa and Asia.

There are some variations, however, in the badge-drinking cultures of different markets. In South Africa and Nigeria, conspicuous consumption has “fuelled a high-profile, bling-oriented on-trade culture in which bottles on tables are the ultimate status indicator,” says Dan Mettyear, Research Director for Africa at IWSR. “Consumers in these markets are highly conscious of how they are perceived by their peers – especially by members of the sex they are attracted to – and alcoholic drinks play a big role in constructing or projecting a desired image.”

In Asia, badge drinking is most prevalent in countries such as China, where, as in South Africa and Nigeria, it frequently takes the form of bottle service in bars and clubs. However, there is another type of badge drinking that occurs in China’s traditional on-trade, in which consumers can display their status in private booths to a select group of guests. Banqueting also allows consumers to conspicuously showcase their status via high-end bottles of baijiu.

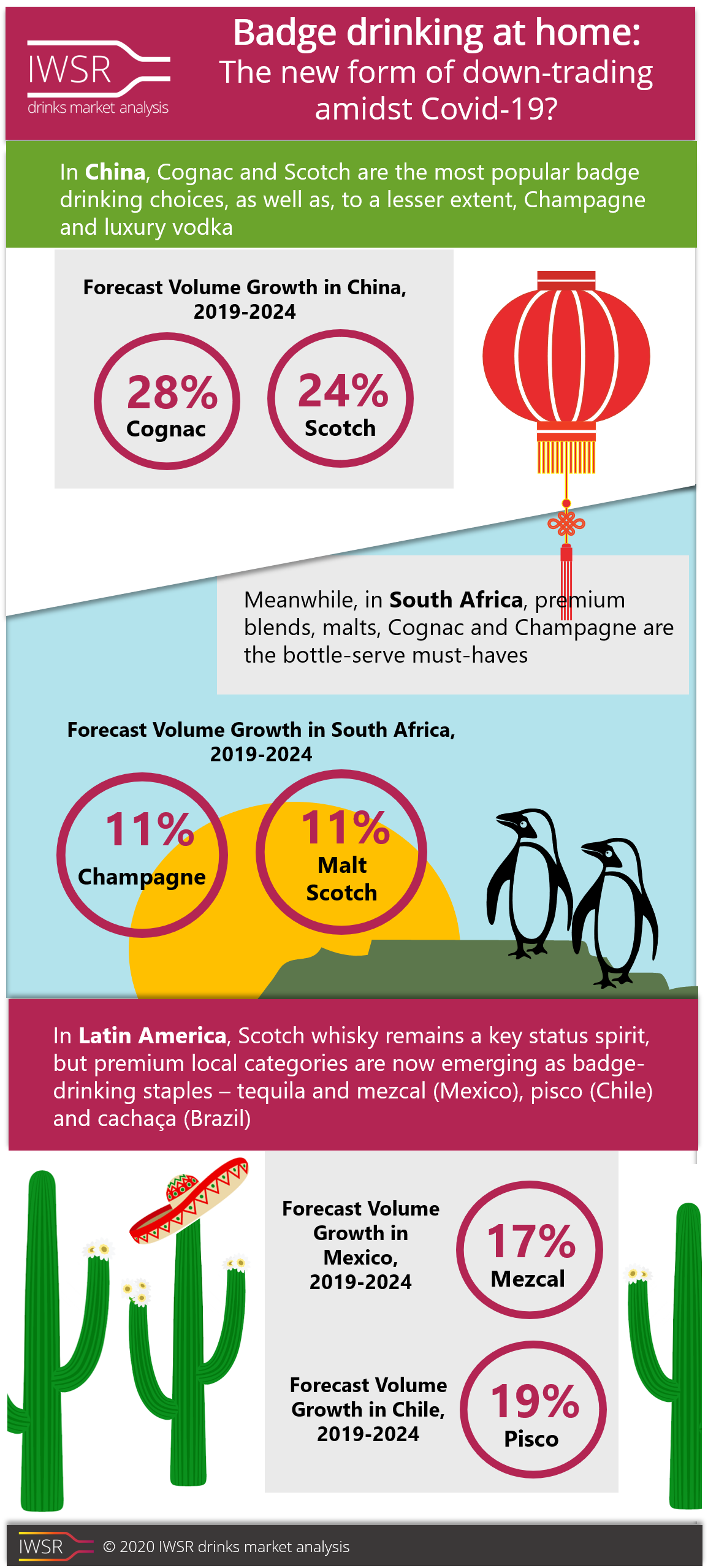

Brown spirits are most commonly used to display status in badge-drinking markets. In China, for example, Cognac and Scotch are the most popular status drinks, as well as, to a lesser extent, Champagne and luxury vodka. Premium blended Scotch is the international status drink of choice for Indian consumers, as long as the distribution is in place and disposable income is available. Meanwhile, in South Africa, premium blends, malts, Cognac and Champagne are the bottle-serve must-haves.

In Latin America, Scotch whisky remains a key status spirit, but premium local categories are now emerging as badge-drinking staples – namely tequila and mezcal (Mexico), pisco (Chile) and cachaça (Brazil) – while gin has become a fashionable gifting item. These spirits offer differentiation for consumers who are looking to stand out. “Younger LDA consumers in Latin America are also increasingly choosing craft brands as a vehicle for badge drinking; they want to be perceived by their peers as being ‘in the know’,” remarks Luciano Anavi, IWSR’s senior analyst for Latin America.

However, typical badge-drinking behaviour has started to decrease in some markets as the economy slows. Increasingly, consumers in emerging markets are switching the lavish on-trade for daytime, at-home drinking occasions, and this move is being hastened by the pandemic.

“The trend towards more at-home drinking had already been present in several Asian countries before Covid-19; the pandemic is likely to accelerate this move,” says Tommy Keeling, IWSR’s Asia-Pacific Research Director. Keeling adds that traditional aspirational categories, namely blended Scotch and Cognac, have suffered in China due to the closure of the on-trade, which has “made it less easy to show off status to others”.

Conversely, single malts, which are less aligned to peacocking and more related to personal choice, have performed well in China since lockdown measures were introduced. “Badge categories that were already in decline, such as blended Scotch in South Korea, are likely to suffer permanent damage from which they don’t recover – similar to what happened following the 2008 financial crash,” adds Keeling. “With single malts, consumers can share their personal choice through social media – in this medium, what consumers perceive to be a more sophisticated choice such as a single malt or fine wine often plays better.”

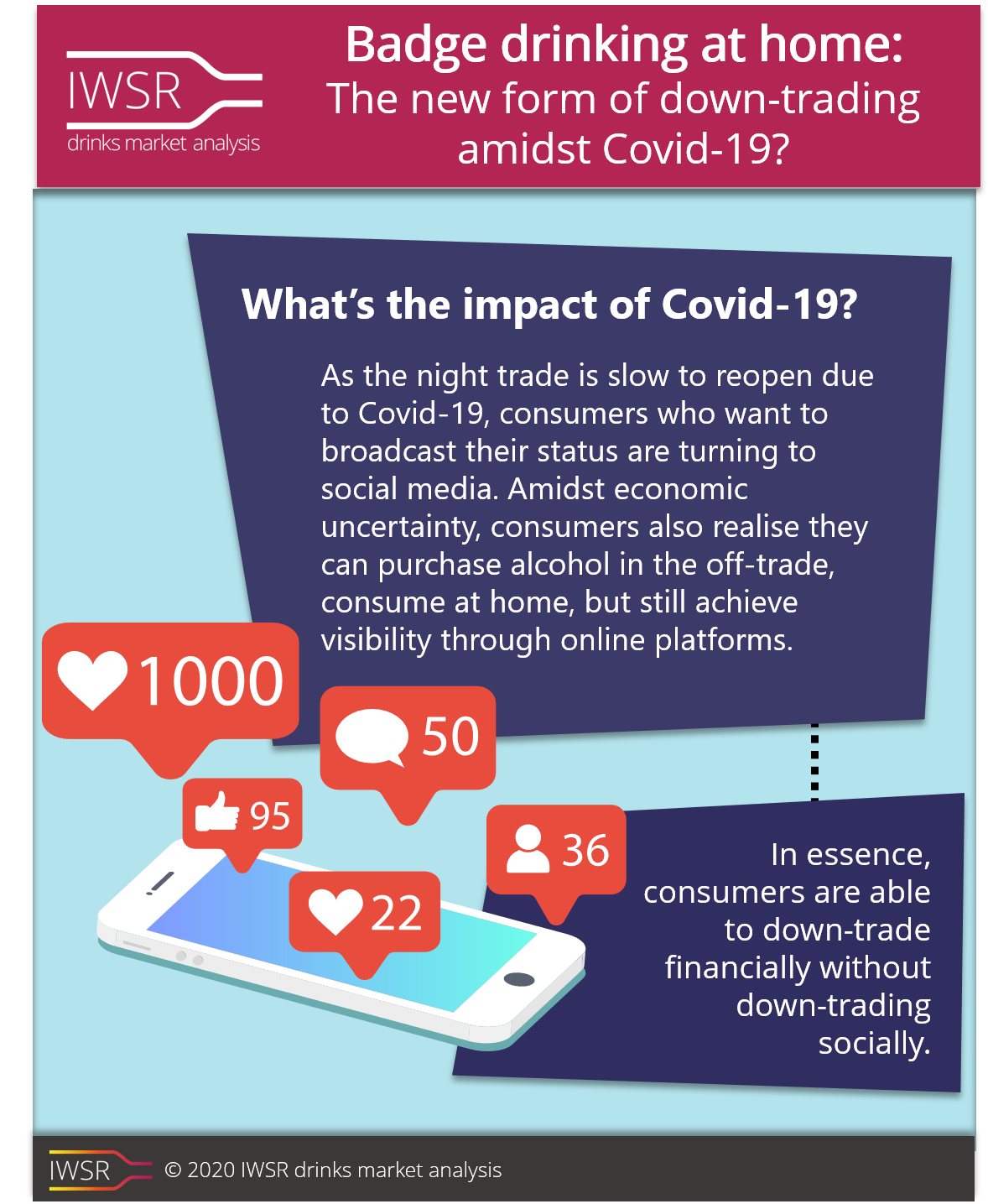

Social media is playing a key role in the evolution of badge-drinking culture. The night-time trade has been slow to re-open in many markets following Covid-19 lockdown measures, so consumers who want to broadcast their status have turned to online platforms. Furthermore, as economies slow in the wake of the pandemic, consumers realise they can save money by purchasing alcohol in the off-trade, and then consuming it at home. However, they still achieve visibility by showing off their drink of choice on social media platforms. In essence, they are able to down-trade financially without down-trading socially.

“Not only is social media enabling this kind of down-trading to take place but, for status brands, it is also a hugely important space in which to engage consumers and stay active – particularly through influencers, who are now a must,” says Mettyear.

In some emerging markets, smaller home-based gatherings are becoming part of the ‘new normal’, with a proportional amount of badge drinking potentially transferring to this type event in the longer term, or at least until a vaccine is actively used. “At-home badge drinking will never completely replace the high-energy exposure of night-time on-trade badge drinking,” notes Mettyear. “However,” he adds, “with decreasing disposable incomes, displays of status through social media will at least provide some refuge for consumers looking to maintain their position.”

Badge drinking, as well as other key trends driving the global beverage alcohol industry, are explored in greater detail in IWSR’s Global Trends 2020 report.

If you’d like to receive IWSR’s industry insights straight into your Inbox, sign up here.

You can view the full Badge Drinking infographic below

Category

Market

- Beer

- Brandy

- Cider

- Gin

- Irish Whiskey

- Low-/No-Alcohol

- Mixed Drinks

- RTDs

- Rum

- Scotch

- Spirits

- Tequila

- US Whiskey

- Vodka

- Whisky

- Wine