Younger LDA consumers are increasingly being drawn to beverage alcohol products that successfully embody converging trends around wellbeing, provenance and environmental awareness – a trend that is described by the IWSR as ‘Better for me, better for the world’.

This movement cuts across the spirits, beer and wine categories, and is becoming particularly influential in developed markets, especially Australia and New Zealand, western Europe and North America.

“Per capita alcohol consumption in Australia has been declining for many years and, as people drink less, they are focusing more on quality,” explains Tommy Keeling, IWSR’s Asia-Pacific Research Director. “Consumers are becoming more mindful of what they are drinking, and paying more attention to where it’s from, what’s in it and how it’s made.”

Low barriers to entry

The trend is most obvious in categories with relatively low barriers to entry, such as clear spirits, craft beer and RTDs – the latter especially in New Zealand, where low-/no-sugar RTDs that are light, refreshing and relatively low in alcohol have witnessed huge growth over the past 18 months.

“It’s relatively easy to make an RTD, and you’ve got an almost unlimited variety of flavours,” says Keeling. “There has been an explosion of small, local brands that mostly play on the health or moderation aspect – zero or very low sugar, at about 4% ABV.”

One recent success story in New Zealand has been Part Time Rangers, a five-strong range of RTDs created by two 20-something brothers, Oliver and William Deane, with 10% of its profits donated to animal conservation charities such as the Big Life Foundation, Sustainable Oceans Society and Rhinos Without Borders.

Small-scale start-ups like this are aided by the fact that retail listings in New Zealand are often decided at a very local level, in contrast to Australia, where decision-making is made more centrally, and the duopoly of Woolworths and Coles dominates the retail scene.

Tapping into provenance cues

This is also a trend that lends itself to craft spirits, especially gin, where local distillers can incorporate locally sourced botanicals to reinforce their provenance message. One – perhaps extreme – example has been the phenomenon of green ant gin in Australia, with the insects said to impart flavours of lemon and coriander.

However, there is more than one way to play the provenance card. Just look, for example, at the success in New Zealand of the super-premium Scapegrace gin brand: although it is distilled in Christchurch, it uses a host of botanicals from around the world, and its bottle is modelled on an old jenever flask from the Netherlands.

Craft beer can similarly surf the twin trends of local ingredients and provenance, as can single-vineyard wines, as well as those produced using organic, biodynamic and ‘natural’ production methods. “Organic wines are doing OK, and will continue to grow,” says Keeling, describing the momentum of the overall category in Australia and New Zealand. “But lower-end, mass-market cask wines are generally shrinking as people trade up and learn more about premium wine options.”

Will this be a long-term trend?

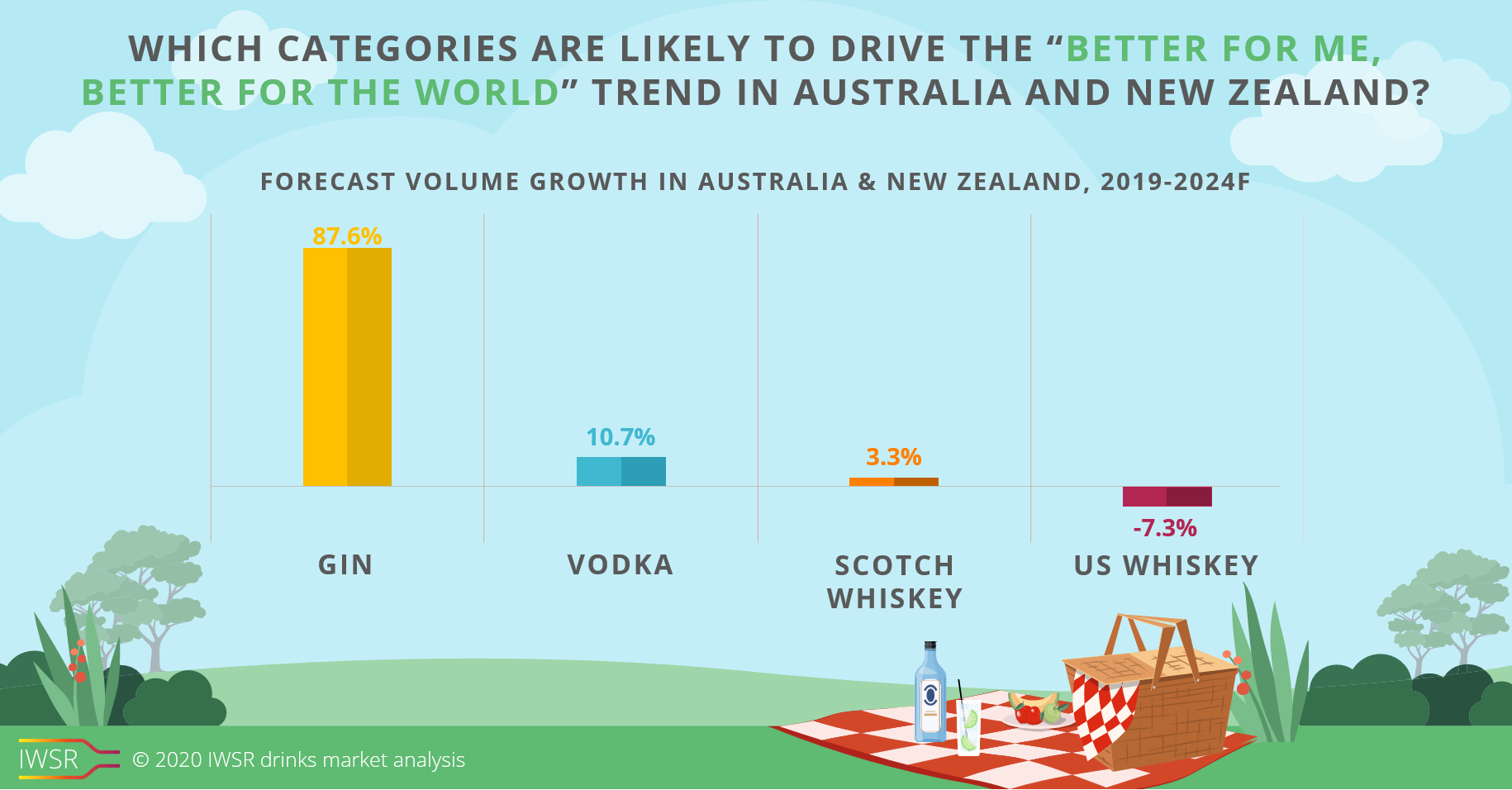

The momentum of the ‘better for me, better for the world’ trend is driven by the overall outlook for clear spirits in Australia in general – particularly that of local craft gin and vodka. This growth may come at the expense of more traditional categories, such as more mainstream US and Scotch whiskies. “In Australia, these drinks are very dependent on the whisky and cola, which is still very popular, but may lose out as consumers seek options that they perceive to be healthier,” Keeling points out. However, the trend could benefit single malt whisky, with its cues of provenance and authenticity, and its premium-plus positioning.

When reviewing the expected outlook for these categories, IWSR data suggests that, in New Zealand and Australia, vodka and gin volumes will likely grow by 10.7% and 87.6% respectively from 2019 to 2024; by contrast, over the same period, US whiskey volumes will likely decline -7.3%, but Scotch whiskey is predicted to grow by 3.3%. Meanwhile, RTD volumes in the region are likely to remain flat as declines for the dominant whisky/rum and cola segment are offset by dynamic growth in healthier, lighter products.

Can the trend hold beyond Australasia?

Beyond Australasia, the ‘better for me, better for the world’ trend is taking root in a number of developed markets around the globe, particularly in northern Europe, the US and Canada, where millennials and Gen-Z consumers are tapping into the premiumisation trend, and drinking less, but better.

“It’s still in its relatively early stages, but I think there will be a generational shift as the older generation ages,” says Keeling. “Older, more established brands are likely to stagnate and decline, but there will be continued growth for new brands centred on cues geared towards authenticity and quality.”

However, the impact of the Covid-19 pandemic could pose a short-term threat to the trend, as smaller producers tend to be disproportionately reliant on ‘cellar door’ sales and on-premise consumption, and are more likely to have narrow margins and less cash in the bank. This potential lack of financial viability is likely to lead to consolidation in the medium term, but the overall trend will survive.

“Covid-19 might be a bit of a hiccup, but it’s unlikely that the trend is going to reverse in the medium and long-term,” remarks Keeling.

To learn more about the key trends driving the beverage alcohol industry, and the likely impact of Covid-19 on these trends, read the IWSR’s Global Trends Report 2020.

You may also be interested in reading:

Eco-Packaging Trends Across Spirits, Wine and Beer

Consumer demand for carbon neutrality drives innovation across wine, beer and spirits

Veganism inspires drinks brands to innovate

Category

Market

- Beer

- Brandy

- Cider

- Gin

- Irish Whiskey

- Low-/No-Alcohol

- Mixed Drinks

- RTDs

- Rum

- Scotch

- Spirits

- Tequila

- US Whiskey

- Vodka

- Whisky

- Wine