This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

12/04/2023

Consumers opt to spend less on beverage alcohol, but confidence in the future is improving

IWSR tracks consumer sensitivity to price changes across total beverage alcohol

Latest findings from IWSR show that although stated alcohol spend is falling in many markets, consumer confidence about finances and the future is trending more positive than in 2022. This is especially true of Europe, where consumers show signs of improved sentiment following lows in late 2022.

“To allay the impact of the cost-of-living crisis, beverage alcohol consumers are becoming more selective in how and when they spend on alcohol,” comments Richard Halstead, COO Consumer Insights, IWSR Drinks Market Analysis. “After the pandemic, at-home drinking is still preferred, but there is a strong motivation to go out, just with less frequency and more mindfulness in alcohol consumption and spending,” he adds.

Key findings from wave two of IWSR’s consumer barometer price sensitivity tracking (based on consumer surveys conducted in February 2023) across the 17 key markets of Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Poland, South Africa, Spain, Taiwan, the UK, and the US, show:

Alcohol’s share of wallet is declining

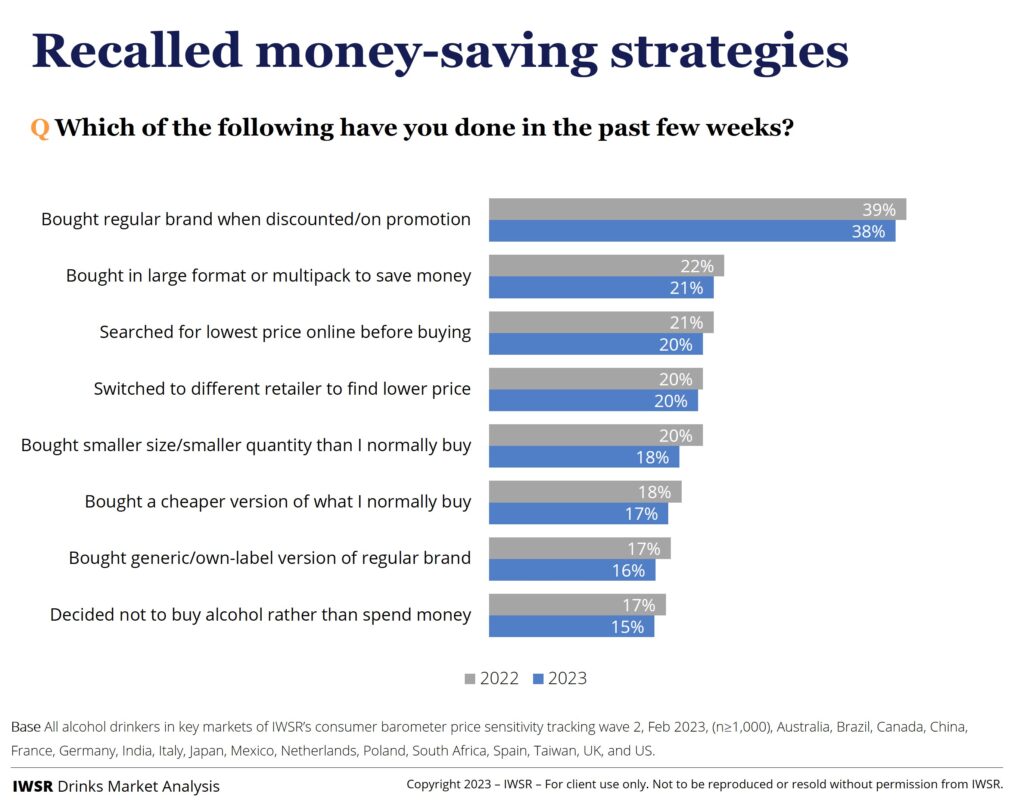

Consumers are cutting back on their alcohol expenditure as their spend on necessities like meat, fish, poultry, and cleaning products increases. This trend is most pronounced in the UK, where inflation has been rising at double-digit rates, but is also notable in Germany and Australia. In these countries, as well as in France and Canada, where there are also moderation or financial pressures, deciding not to buy alcohol was found to be the second most popular strategy for saving money.

Consumers have polarising price expectations, though premiumisation persists

Premium consumption behaviour continues in many markets, but is growing at a more moderate rate than previously. Premiumisation for certain categories is strongest in markets where more positive general sentiment prevails, such as stated Champagne spend in China, and stated spend for tequila/mezcal in the US and Mexico.

Most alcohol categories – especially spirits – show an increase in the acceptable price ceiling, and many categories show a broadening of acceptable price range (both up and down). Price ceilings have risen for most whiskies, as well as categories including gin, vodka, pre-mixed alcohol drinks, and still and sparkling wine. For select categories in some markets, the price floor is lower than the previous wave (based on consumer surveys conducted in October 2022), such as for beer, Champagne, still wine, vodka, and Irish whiskey.

Category consumption momentum stalls

With consumers more mindful of their alcohol consumption, category momentum remains marginally in positive territory but has lost ground since Wave 1 of IWSR’s price sensitivity tracking (based on consumer surveys conducted in October 2022, when consumers were asked how consumption has changed in the past six months):

- Whiskies remain more positive than other categories, however consumer momentum for it slows in Australia due to adverse economic and tax conditions.

- Spirits momentum is consistent across most markets. Outside of the whisky category, tequila/mezcal is the top spirits performer.

- Cognac retains momentum at a global level, with notable growth in its consumption rate in China, most likely connected with the re-opening of China’s on-trade as Covid-19 restrictions came to an end.

- Bitters/spirit aperitifs are performing well at a global level, led by North America and China.

Drinkers prefer to cut back as a form of moderation

There is consistently positive sentiment towards the idea of moderation, especially as a money-saving strategy. This supports the resilience of the premiumisation trend, with many consumers choosing to drink better quality less often, rather than having to down-trade. Relying on promotions is the top money-saving strategy, enabling consumers to still stick with their preferred brand or drink type.

On-premise resists economic pressures, but consumers are conscious of costs

On-premise demand is largely holding up in Europe and the Americas, while the relaxation of Covid-19 restrictions in China, Japan, and Taiwan have boosted on-premise visiting intentions. Across key markets, millennials and Gen Z of legal drinking age are driving on-premise visits. Consumers in India and China are amongst the ones most willing to trade-up while in the on-premise. In other markets, going out without drinking alcohol is a popular money-saving strategy, as is opting for cheaper beverage options.

Staying-in and enjoying the at-home drinking occasion has a strong pull in most markets. China is the outlier, with the relieving of lockdown restrictions resulting in a significant increase in going-out sentiment.

You may also be interested in reading:

Consumer confidence in the US remains broadly positive

Factors shaping new product development for the no-alcohol category

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All |