23/11/2023

Has premiumisation stalled?

IWSR analyses the evolution of the premiumisation trend for total beverage alcohol in 2023

The long-running premiumisation trend in beverage alcohol weakened significantly in the first half of 2023, as consumers felt the full impact of economic pressures and geopolitical uncertainty.

Key trends fuelling the deceleration included the slowing of premium-and-above agave expansion in the US, losses across the wine category – including Champagne – and softer growth for high-end beer in markets such as Brazil and Spain.

Nevertheless, pockets of premiumisation endure in Asia in particular, with high-end baijiu performing well in China, and markets such as India, the Philippines and Thailand recording dynamic growth in high-end spirits consumption. Meanwhile, beer was boosted by the reopening on-premise in China and trading up in the UK, US and Mexico.

Premium+ volumes grow at a slower rate

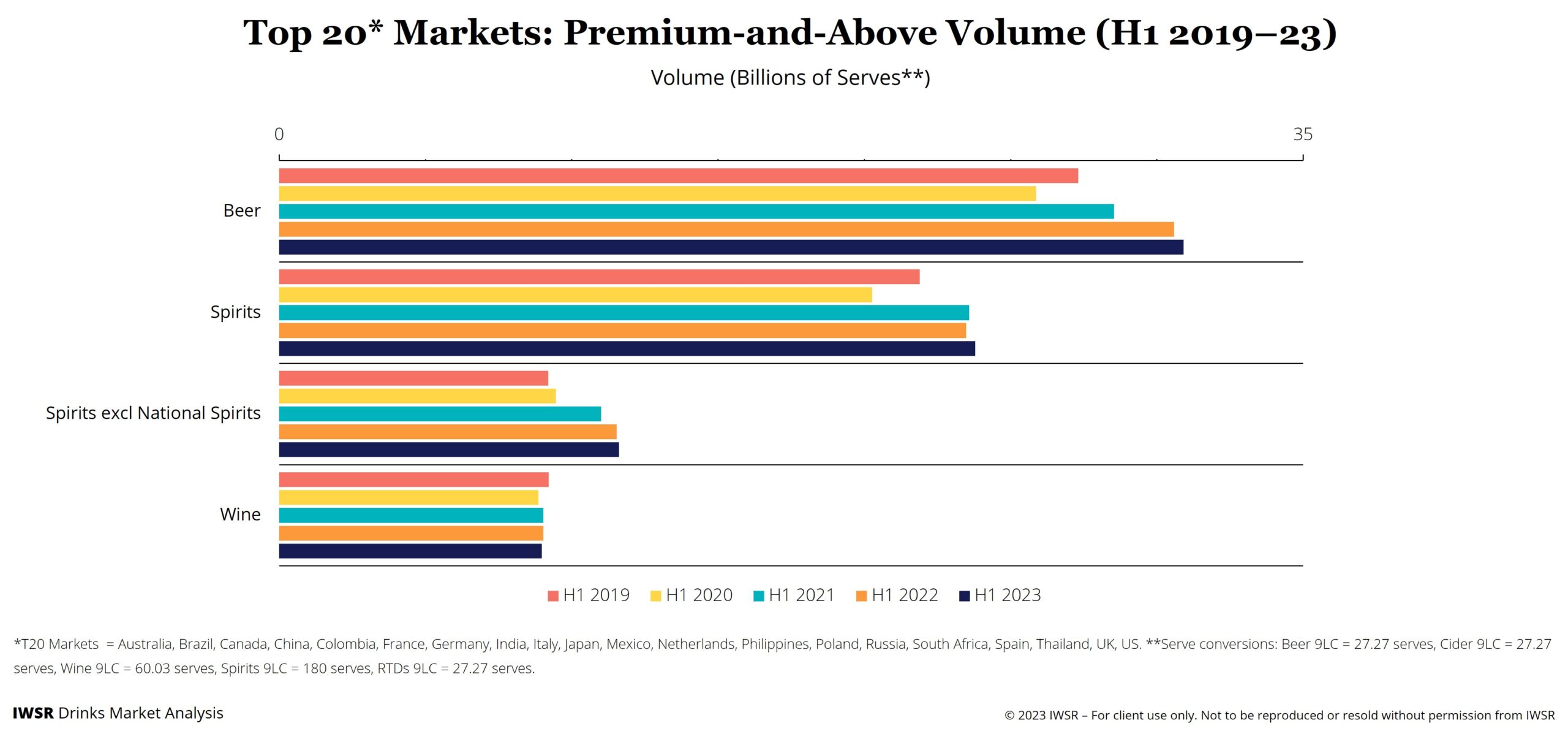

Across 20 key markets (that make up over 75% of total global volumes), total beverage alcohol premium-plus volume consumption in the first half of 2023 was 11% higher than for the same period in 2019; however, this growth rate is slowing, with volumes only increasing by 1% between H1 2022 and 2023. A similar trend of slowing growth is evident across premium+ volumes for total beer and spirits as well (see chart below).

“The growth rate of premium-and-above products weakened significantly across beer and spirits during the first half of 2023, although their share of overall category volumes broadly continued to increase,” notes Emily Neill, COO Research, IWSR.

“Economic pressures did not relent, as inflation remained high – a backdrop that was more globally widespread than during the same period last year. Geopolitical uncertainty from the war in Ukraine heightened the pressures mounting on brand owners, which passed on increased costs to consumers.”

Consumption was boosted by the reopening of the on-premise in Asia following prolonged pandemic restrictions, with consumers eager to return to socialising in bars and restaurants in China and beyond.

This helped premium-and-above spirits volumes in China to rise by +2% in H1 2023 versus H1 2022, or by +7% if national spirits are excluded – a return to pre-pandemic levels. Other hotspots in the region include India, the Philippines and Thailand.

China’s higher-end beer market also returned to growth in H1 2023 vs 2022, boosted by strong performances from local brands, and from international products in the reopening on-premise.

However, outside Asia, consumers are withdrawing from the on-premise as post-pandemic behaviours become entrenched and the cost-of-living crisis hampers a full recovery for the channel. Instead, many consumers say they are using home-premise consumption to maintain relationships with premium brands.

For example, in H1 2023, consumption of premium-and-above spirits went into reverse vs H1 2022 in markets including Brazil, Colombia and the UK. Meanwhile, volume declines in premium-plus Cognac and Armagnac were driven by a double-digit drop in the US – due to the cost-of-living challenges – that was unable to be offset by Cognac’s recovery in China.

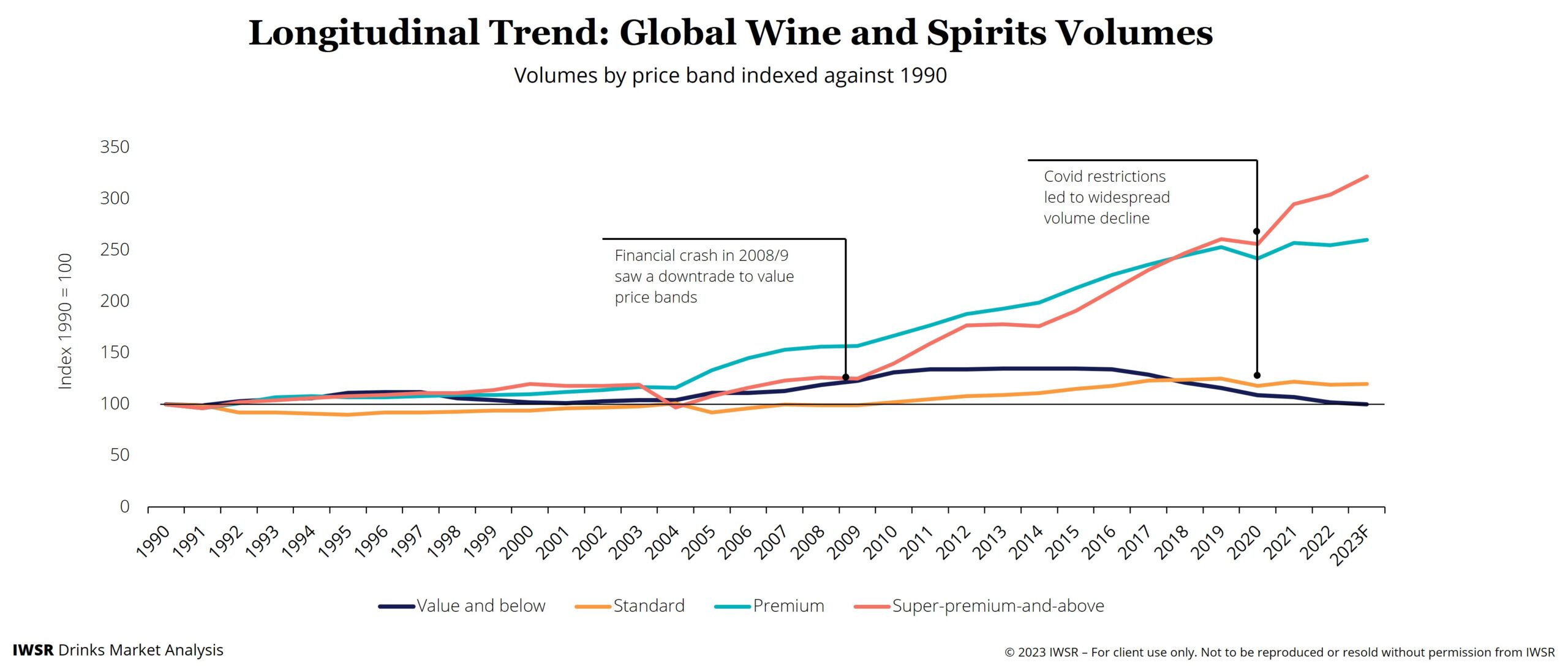

Nevertheless, an analysis of previous periods of economic turbulence suggests that downturns pause – but don’t stop – the longer-term trend of premiumisation. While volatility may persist in the short term, the longer-term picture is one of stability.

Historical trends point to longer-term stability

During the financial crash of 2008-9, consumers traded down to value-priced products, but premium-plus products proved to be resilient (see chart below).

That downturn was demand-led, but the Covid-19 pandemic brought massive supply chain disruption and a supply-led downturn in consumption. Today, the impact of moderation – both economic and health-related – is also being more keenly felt in the marketplace.

These factors have combined with multiple pressures on the macro-economic landscape, including price increases fuelled by inflation and rising costs, the impact of the wars in Ukraine and Gaza, and the cost-of-living crisis impacting disposable incomes.

“Despite the overall downturn, there is still evidence of premiumisation in H1 2023, particularly in spirits and beer,” points out Neill. She also highlights the resilience being exhibited by beer, particularly at higher price points and in Asia. “Beer may be a category that benefits as consumers trade down from other categories,” Neill suggests. “Beer is generally more affordable, including premium variants.”

Neill concludes: “As premiumisation decelerates, careful consideration should be given to how it evolves across different categories and regions. Despite overall category declines, pockets of premiumisation still exist in many markets.

“In the longer term, the premiumisation trend looks to be structural in many parts of the beverage alcohol market – and it is likely to withstand shorter-term economic and geopolitical turbulence, as it has done in the past.”

It is all the more vital that brand owners closely monitor volume trends – especially at a servings level – so that they can understand precisely what people are drinking, and why. As consumers think more keenly about what to buy, and how much to spend, quality credentials are more important than ever.

You may also be interested in reading:

Home consumption vs the on-trade: have pandemic behaviours become entrenched?

How is Gen Z approaching beverage alcohol?

Purchasing channels evolve for high-end spirits post-Covid

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Premiumisation |