21/09/2023

How big is the slowdown in the US beverage alcohol market, and how long will it last?

Following a post-pandemic correction, IWSR expects future beverage alcohol growth in the US to be more subdued

Pre-existing trends in the US beverage alcohol market were intensified by Covid-19. Now that the volatility brought by the pandemic has receded, the normalisation of the market signals a return to historic trends – but with exceptions.

"In many ways, the immediate pandemic impact was an acceleration of underlying market trends"

| Marten Lodewijks, Director of Consulting - Americas

“In many ways, the immediate pandemic impact was an acceleration of underlying market trends,” explains Marten Lodewijks, Director of Consulting – Americas, IWSR.

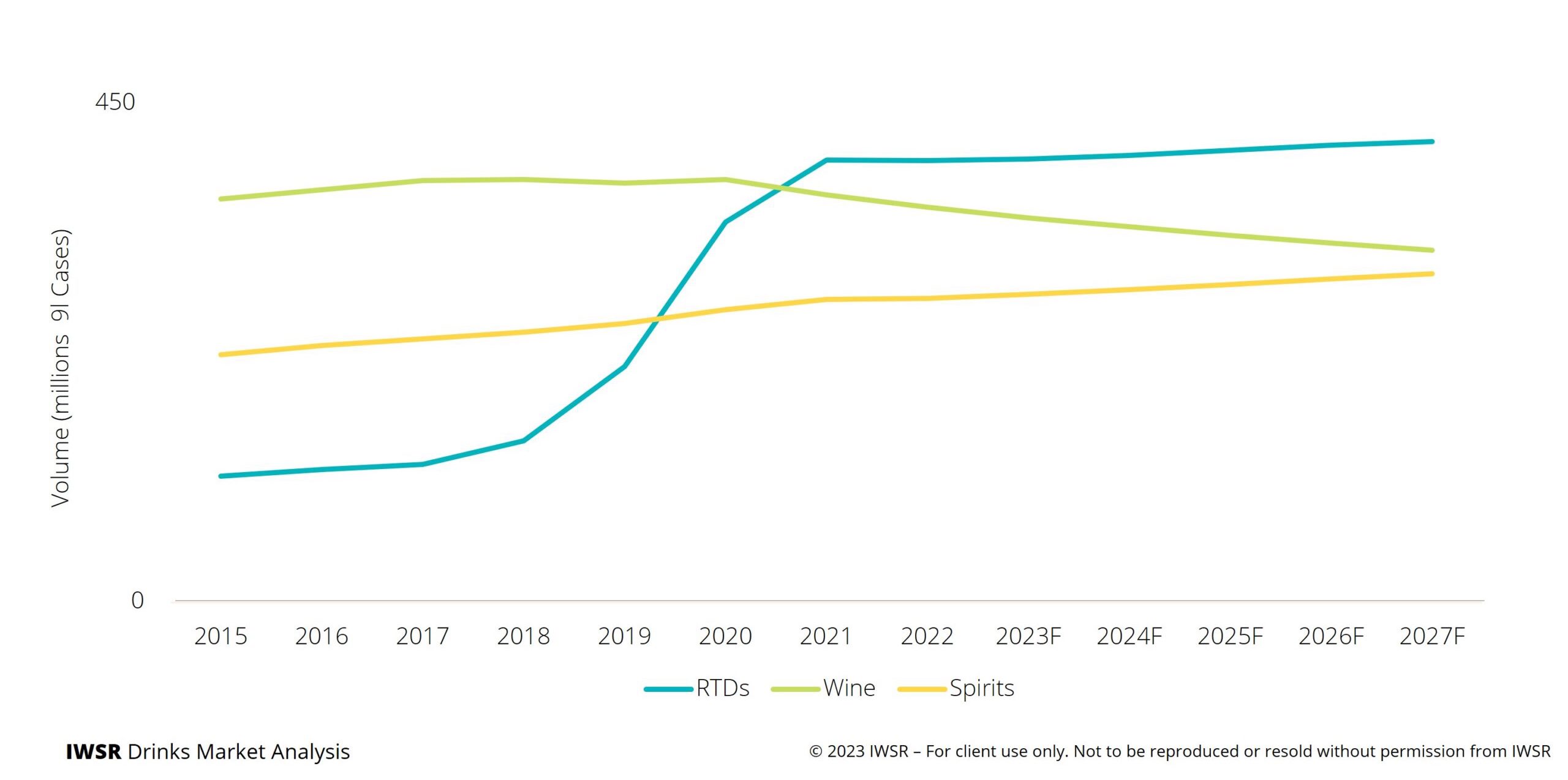

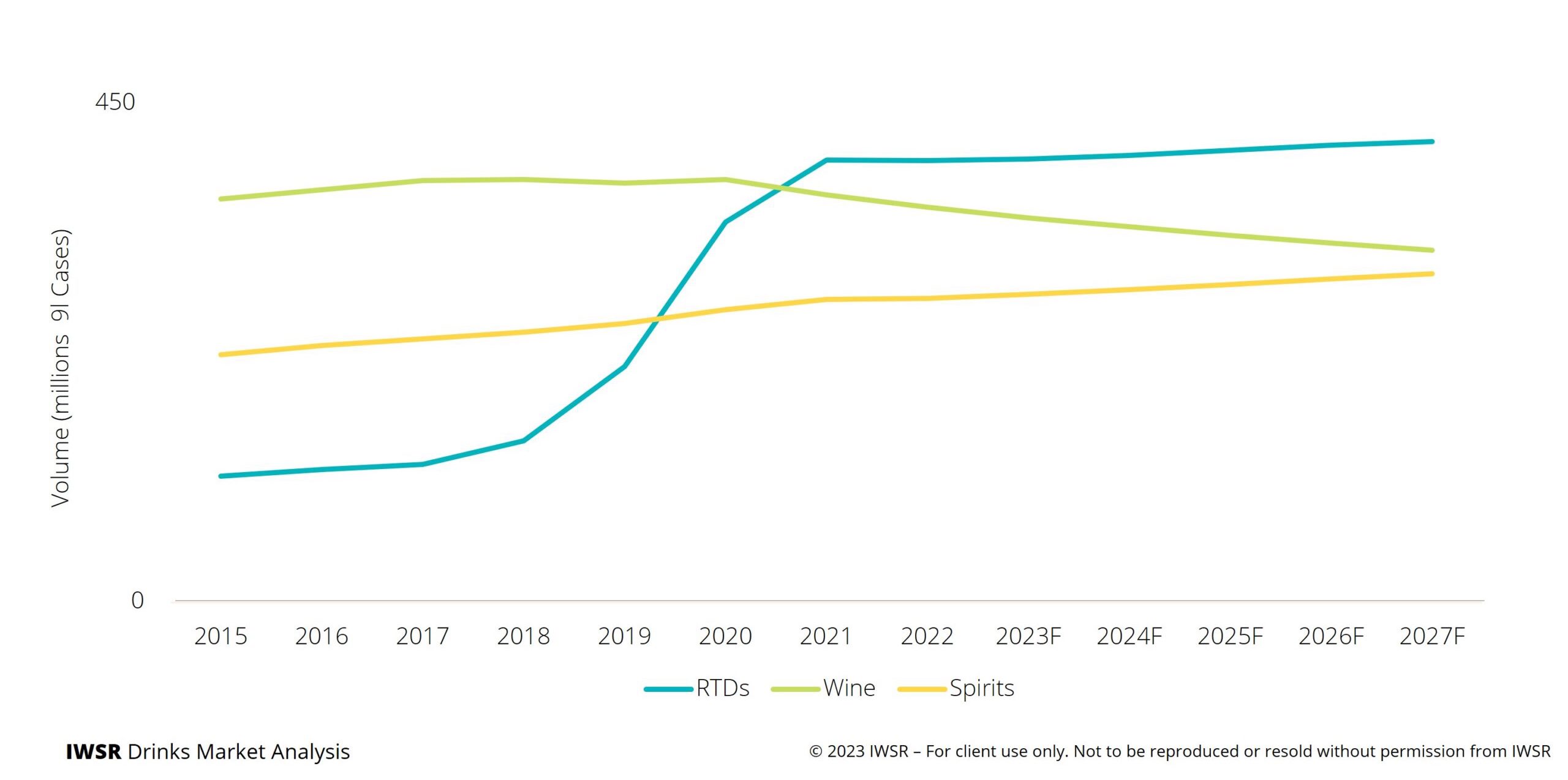

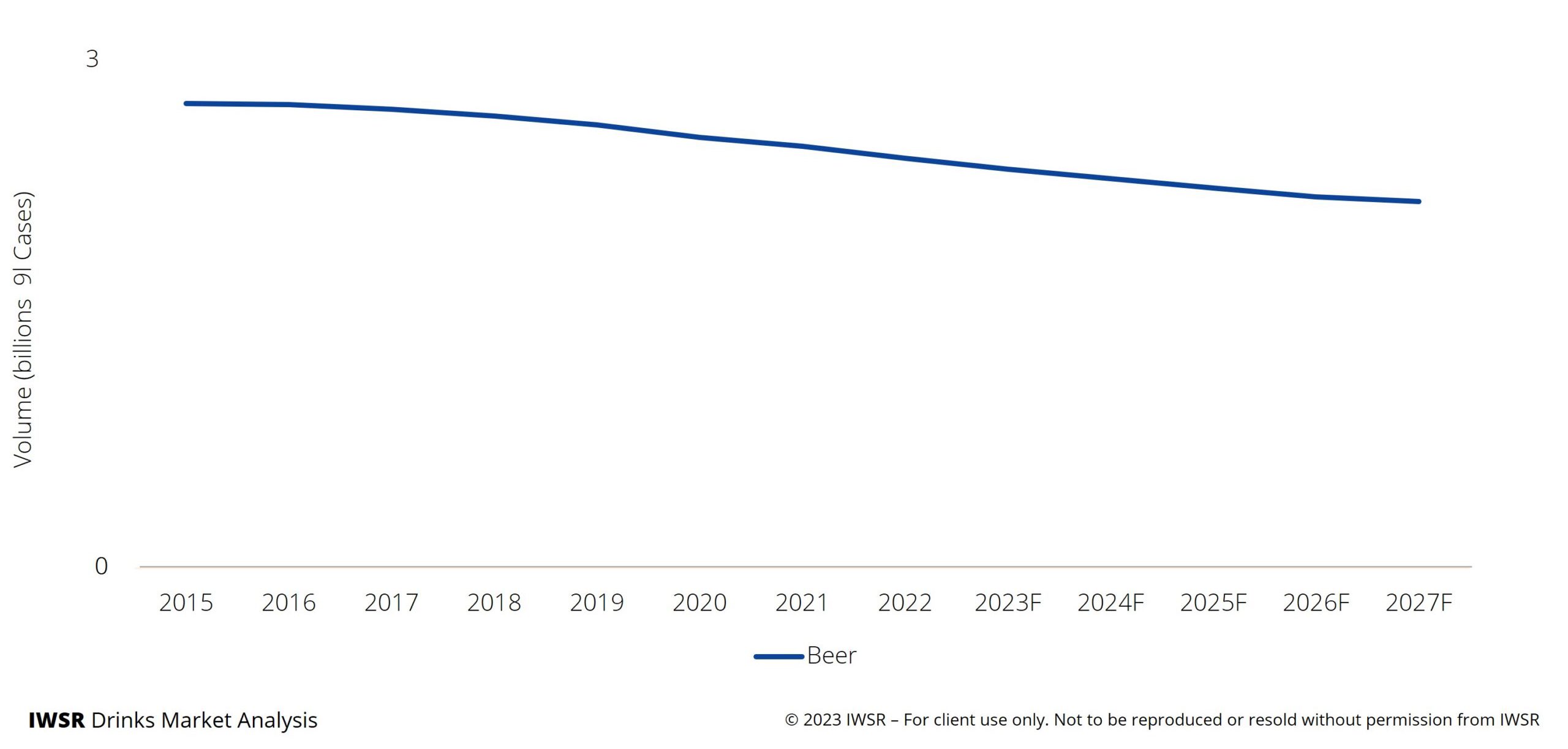

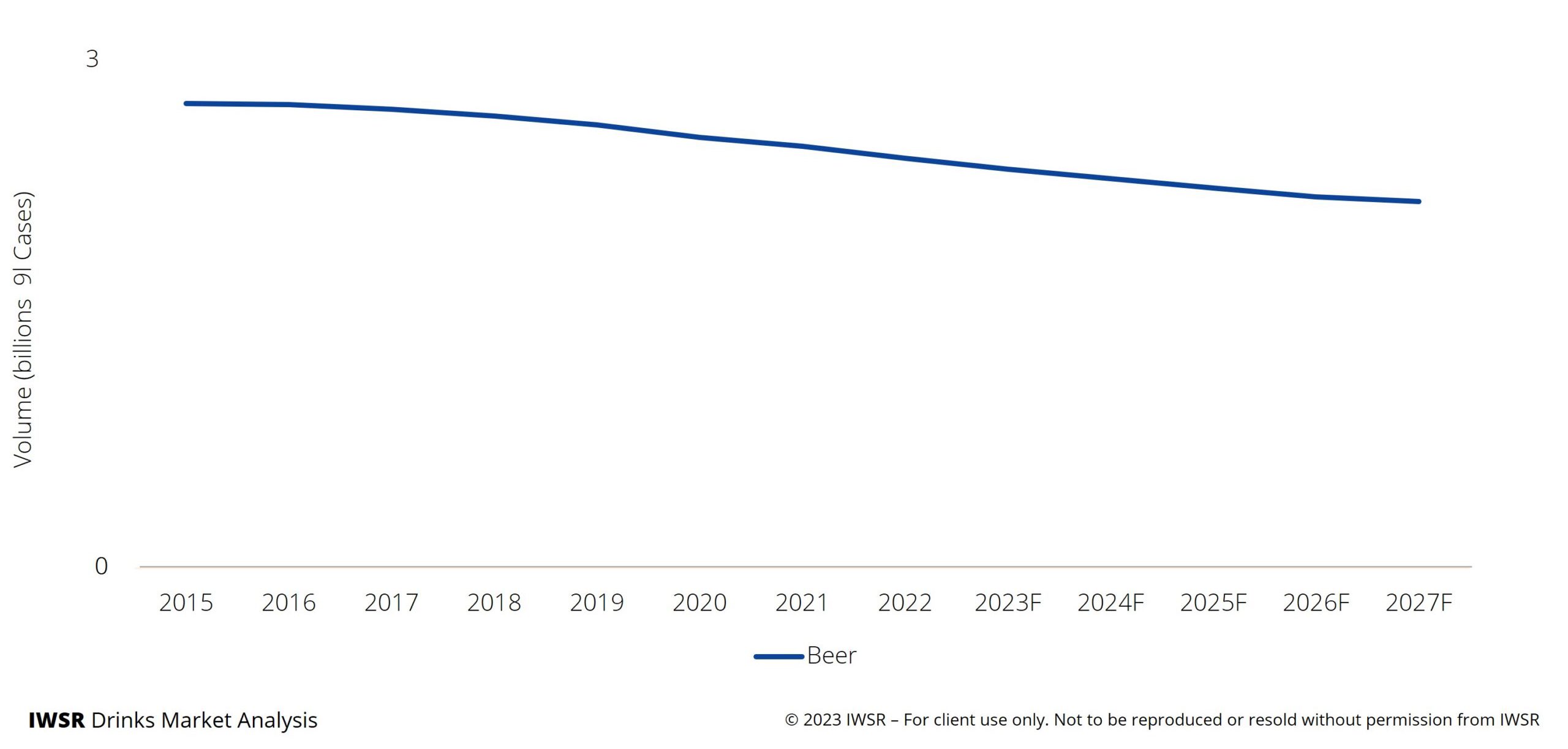

Beer volumes accelerated their rate of decline, with -2% volume CAGR, 2019-2021, compared to the slower -1% historical volume CAGR, 2014-2019. The RTD and spirits categories both saw accelerated growth rates compared to pre-Covid trends, with volume CAGRs of +37% for RTDs and +4% for spirits, 2019-2021, compared to volume CAGRs of +13% and +3%, 2014-2019, respectively. The rate of premiumisation, which accelerated through Covid, has started to moderate across some categories. Ecommerce sales also grew sharply as regulations were eased to accommodate Covid-19 lockdowns.

US Beverage Alcohol Market Volume Consumption by Category

Volume consumption for RTDs, wine and spirits

US Beverage Alcohol Market Volume Consumption by Category

Volume consumption for beer

“What we’re seeing now is that the rocket fuel that was the pandemic has burned out, and all of those trends have gone back to far more realistic growth (or decline) rates. Few have fundamentally changed; they’ve been dialled up or down,” comments Lodewijks.

These market shifts have impacted the beverage alcohol market as a whole, but also on a category level, and in terms of a number of significant consumer trends – involving moderation, the on-trade, RTDs and ecommerce.

Category trends

In 2022, beverage alcohol categories in the US generally returned to long-term trends: still wine volumes fell by -3%, according to IWSR data, and are projected to see a -3% volume CAGR decline, 2022-2027. Spirits meanwhile entered a transitional phase following good growth during the pandemic, ending the year fractionally up on 2021 thanks to volume gains for agave spirits and US whiskey. Volumes are forecast to grow at +2% CAGR, 2022-2027, as the spirits category moderates following the rapid growth of previous years (+4% volume CAGR, 2019-2021).

Beer continued to decline, with volumes falling -3% in 2022 despite an uptick in imports from Mexico. The evolution of the RTD category continued: growth for premium RTDs failed to offset the slump of hard seltzers following huge pandemic gains, and overall RTDs declined slightly on the year in volume terms. Beer is expected to continue to see volumes decline by -2% CAGR, 2022-2027, and RTD growth will moderate to +1% volume CAGR, 2022-2027.

IWSR’s consumer data reinforces these market trends: consumer recalled data from April 2023 shows that recalled volume is down across almost all categories. “As each segment continues to return to normal, the rate of consumption will slow at rates exceeding prior forecasts,” says Lodewijks.

“These had total beverage alcohol increasing by volume, whereas declines are now expected. Factors relevant to this reversal include ongoing economic uncertainty, with lower levels of disposable income, persistent inflation – especially within the on-trade – and an increased focus on moderation, as the ‘drink less but better’ trend continues. Consumer preferences are evolving and this will continue to impact growth.”

Moderation and no/low

“Younger legal drinking age (LDA) consumers are not approaching alcohol in the same way as prior generations,” says Richard Halstead, COO Consumer Research, IWSR. “The health and wellness trend that emerged during the pandemic has accelerated the trend for moderation, mindful drinking and the rise of non-alcoholic products – which are growing at much faster rates than their full-strength counterparts.

When asked in April 2023, 54% of Gen Z LDA+ adults in the US say they have not consumed an alcoholic beverage in the past six months, compared to 37% of the total LDA population.

Asked about the biggest change to their alcohol consumption behaviour in the past six months, health and moderation was by far the most mentioned topic by consumers, followed by cost of living, going out less and prioritising at-home consumption.

Between 2018 and 2022, volumes of both no- and low-alcohol products in the US more than doubled, and IWSR expects strong growth to continue in the years ahead, forecasting a volume CAGR gain of +17% for no-alcohol between 2022 and 2027.

On-trade recovery

On-trade sales in the US were severely impacted by Covid-19 lockdowns and restrictions, with sales by value slumping by -50% in 2020 – before improving in 2021 (+57%).

However, the channel is yet to return to the levels of 2019 and, according to IWSR consumer research, 59% of alcohol consumers in the US say they are going out less, voicing a strong preference for at-home consumption.

“The pandemic effectively highlighted just how expensive the on-trade can be. Consumers started buying their favourite drinks at home and when lockdowns eased, became much more aware of the on-trade mark-up,” says Adam Rogers, Research Director for North America, IWSR.

The issue gets compounded further as venue operators still face a supply chain that’s under pressure and have to make up for lost revenue by reducing investment in staff and/or increasing prices.

“Beverage alcohol pricing has gone up in the on-trade at nearly double the rate of off-premise increases,” notes Rogers.

“Reduced disposable income has curtailed hedonistic consumption, and consumers appear to be focusing on preserving quality in their beverage alcohol choices by moderating their consumption, such as by going out less, or by enjoying their favourite brands at home and choosing more cost-effective options when going out.”

According to IWSR’s consumer tracking, low-tempo at-home drinking occasions are now dominant. Asked about the last time they drank alcohol, 62% of consumers referenced the home, versus 32% who mentioned the on-trade.

RTD evolution

The explosive growth of RTDs – spearheaded by hard seltzers – was perhaps the most significant beverage alcohol trend of the pandemic in the US. RTD volumes in the US grew by +61% in 2020 and a further +15% in 2021. Hard seltzers alone accounted for 80% of category growth between 2014 and 2021.

The surge for hard seltzers was unsustainable, however, and as demand cooled, the segment experienced volume losses of -10% in 2022.

Now the RTD category is evolving and premiumising, with consumers gravitating to different sub-category choices, such as spirit-based products and premium cocktails and long drinks, amongst others. Hard seltzers too are increasingly prioritising higher value propositions.

Ecommerce growth moderates

Beverage alcohol sales in the ecommerce channel grew dramatically in the US during Covid-19 pandemic restrictions, with value surging by +79% in 2020 and by +14% in 2021.

Between 2018 and 2021, the total value of beverage alcohol ecommerce sales increased at a CAGR of +41%, well above TBA market value CAGR growth of +5%. As a result, ecommerce’s share of the overall off-trade channel grew from 2% to 4%.

Growth, however, plateaued in 2022. “Ecommerce has slowed recently following a significant uptick in previous years, as people returned to their typical purchasing habits,” says Lodewijks. “This slow-down was most evident in the direct-to-consumer (D2C) wine segment. However, the convenience of online purchasing is still attractive, and the omnichannel segment in particular will be a key driver for growth”

A shift in go-to-market strategies

Following this post-pandemic correction, IWSR expects future beverage alcohol growth in the US to be more subdued.

The industry continues to face a number of unprecedented factors that are reshaping the market. A disconnect between supply and demand means category level volume fluctuations persist while inventory levels are at all-time highs. The high costs of living are leading to decreases in disposable income, with consumers responding through moderation strategies for economic reasons. Younger LDA consumers, meanwhile, are approaching alcohol very differently from generations prior, and are the driving force behind the moderation trend as a lifestyle choice.

These underlying trends mean it is more important than ever for brand owners to innovate creatively and boldly, but through NPD launches that are strategic and well thought-out. Brand owners should consider testing new products in the market and then optimising before scaling nation-wide. Strategic planning will be critical to mitigate the risks of a more precarious macroeconomic climate and shifting consumer attitudes.

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, North America | TREND: All |