24/08/2023

How do US consumers choose to moderate their alcohol consumption?

IWSR analyses the addressable market for the no/low-alcohol category in the US

The trend for moderation is increasingly prevalent in the US: A third of legal drinking age (LDA) adults in the US (37%) say they have not consumed alcohol in the past six months (surveyed by IWSR in April 2023) – compared to an average figure of 24% across 15 key markets (Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, South Africa, Spain, Taiwan, UK, US).

The abstention rate is even higher amongst younger consumers in the US, with over half (54%) of Gen Z LDA adults claiming not to have had an alcoholic drink over the same timescale.

Amongst US consumers who do drink, more than 50% say they are moderating their alcohol consumption (IWSR consumer research, February 2023), but only 26% say they are drinking no-alcohol alternatives to their favourite full-strength drinks as a result – unchanged from the figure recorded in September 2022.

“Moderation strategies remain the same, with over half of people in the US cutting down on their alcohol consumption,” says Susie Goldspink, Head of No- and Low-alcohol Insights, IWSR. “But, as was the case last year, this is not directly translating into purchases of no- and low-alcohol drinks.”

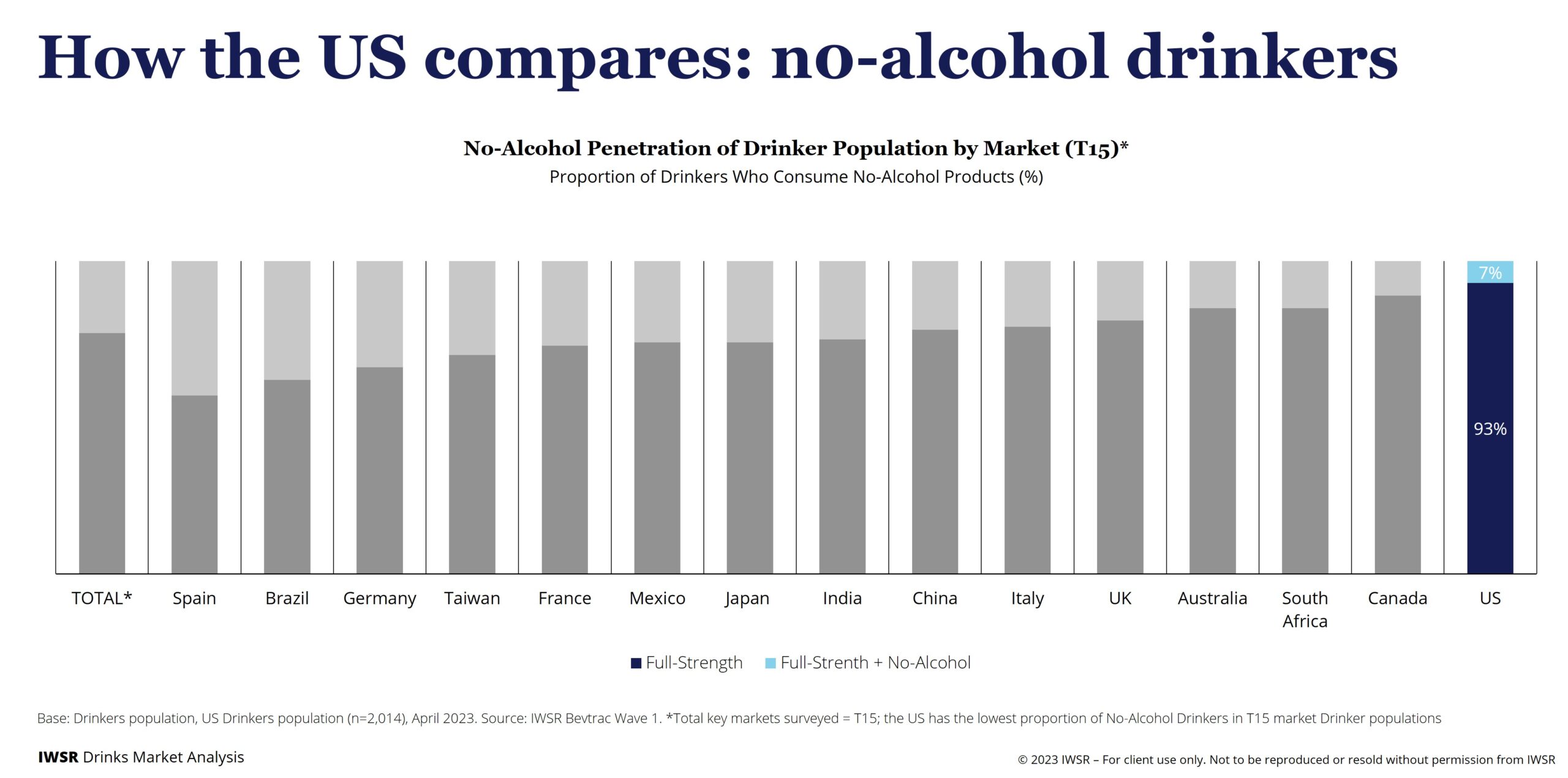

Indeed, of the 15 key markets, the US has the lowest penetration of no-alcohol consumption among people who also drink alcohol: only 7% of consumers, compared to a weighted average of 23% across all 15 markets.

Again, younger LDA drinkers in the US are more likely to consume both full-strength and no-alcohol products: 18% of Gen Z and 11% of Millennials, ahead of Gen X (6%) and Boomers (3%).

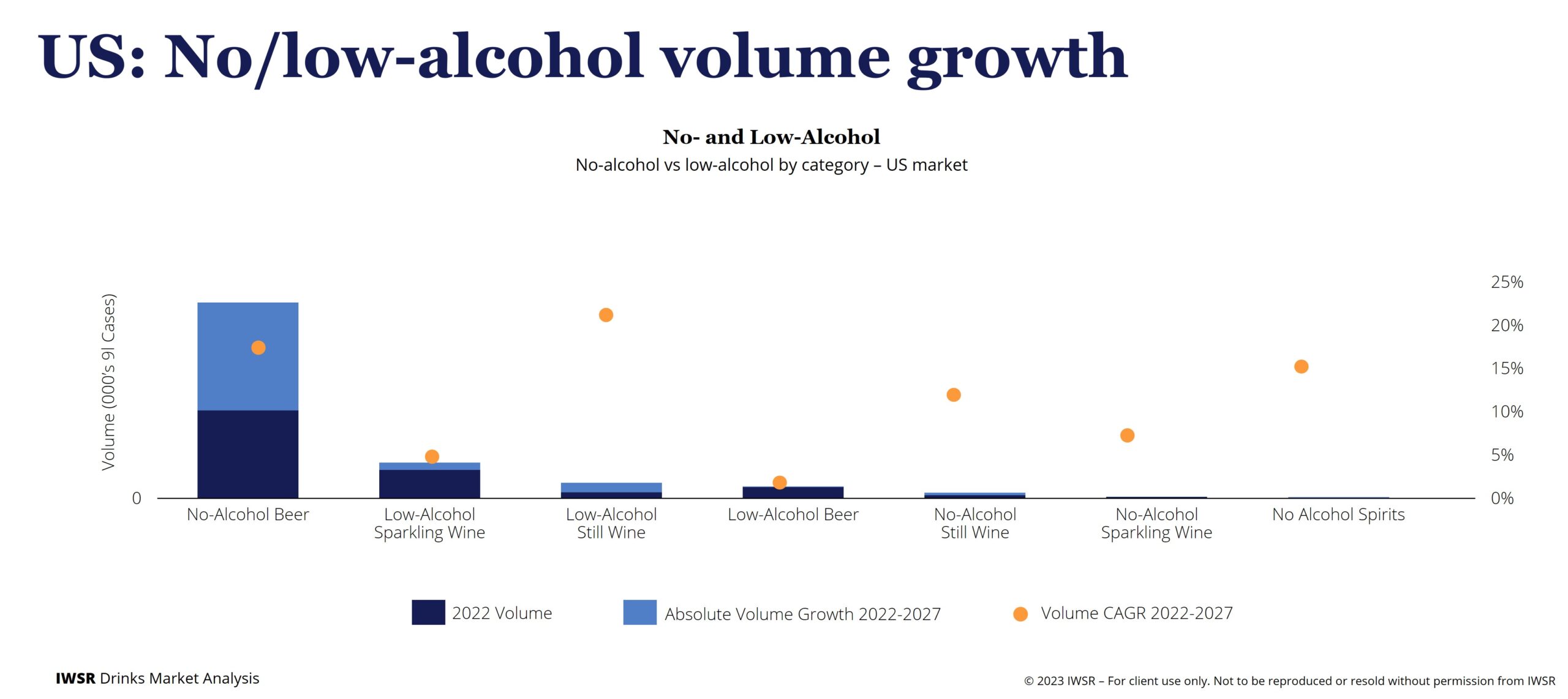

This ample headroom for no/low growth is reinforced by IWSR volume forecasts for the years ahead: while the total beverage alcohol (TBA) market in the US is predicted to decline at a compound annual growth rate (CAGR) of -1.5% between 2022 and 2027, no-alcohol volumes are expected to grow at a CAGR of over +15% over the same timescale.

Beer and wine respectively will continue to dominate the no- and low-alcohol spaces in volume terms, although no-alcohol spirits and RTDs are expected to show significant growth, from a low base, in the coming years.

How do people choose to moderate?

Despite this positive outlook for no/low in the US, people have a number of moderation strategies open to them: 35% of no/low consumers say they choose to moderate by not drinking on certain occasions, with 26% switching to lower-ABV options and 20% switching to non-alcoholic drinks, when surveyed in Q3 2022.

Asked what they most recently chose to drink instead of alcohol, 43% said water, followed by soft drinks (40%) and tea/coffee/hot drinks (33%). Low-alcohol beers, wines and spirits were preferred by 26% of those surveyed, but only 16% chose no-alcohol products.

“Water is the most popular choice to reduce alcohol intake, with 60% of Gen Z consumers selecting this option,” says Goldspink. “Boomers are more likely to choose coffee, tea or another hot drink, while Millennials are more likely to combine full-strength wine or beer with a soft drink on the same occasion.”

What are the barriers to increased no/low consumption?

Among consumers who avoid no and low altogether, not liking the taste of no/low products, lack of availability and cost are all significant factors. This is particularly true of older consumers, says Richard Halstead, COO Consumer Insights, IWSR.

“Those who avoid no/low drinks tend to be from older generations, led by Boomers and followed by Gen Xs,” he says. “The barriers for non-consumers last year were unchanged from 2021, with a dislike of no/low products that are on the market ranking highly.”

Among existing consumers of no/low products, lack of availability and taste are the main factors preventing them from drinking more, IWSR research shows. “The barriers to more no/low consumption are similar across consumer segments,” Halstead explains.

“A higher percentage of Boomers consider no- and low-alcohol drinks to be expensive compared to other age groups. Amongst Americans who consume no/low frequently, availability in bars or restaurants and a perception of low quality are major barriers to opting for no/low products more often.”

However, there is evidence that people are increasingly choosing no-alcohol products not as a direct replacement for full-strength drinks, but as an alternative to other non-alcoholic options such as soft drinks or hot drinks.

When asked what they would normally have drunk the last time they chose a no-alcohol product, 45% of those surveyed by IWSR mentioned other non-alcoholic drinks categories – such as tea/coffee or water – and only 20% mentioned alcohol.

“No-alcohol drinks are more likely to recruit from soft drinks occasions than alcohol,” says Goldspink. “Water, followed by coffee/tea and other hot drinks and soft drinks, are the beverages being replaced the most by no-alcohol drinks. A similar pattern is observed across age, gender and consumer type.”

The opportunity for no/low-alcohol products in the US:

With the current uncertain economic conditions, many consumers may continue to select lower-cost alternatives to no/low-alcohol products, such as water. But as no/low-alcohol products increasingly come to market, building brand equity and having a clear go-to-market strategy will be keys to success.

Aside from a few no-alcohol beer brands, there aren’t many widely known no-alcohol brands in the mainstream yet. As more products tap into the moderation trend, there is a large opportunity for brands to focus on consumer education. Product messaging will also be key – regardless of alcohol content, taste is what matters most to consumers.

You may also be interested in reading:

Global beverage alcohol shows subdued growth 2022-2027, whilst value outlook is more positive

Factors shaping NPD for the no-alcohol category

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, North America | TREND: All, Moderation |