27/04/2023

Key statistics: the no-alcohol and low-alcohol market

IWSR analyses the growth drivers for the no/low-alcohol market

The No- and Low-Alcohol Market:

Category performance and growth drivers

- No-alcohol products spearhead overall category growth

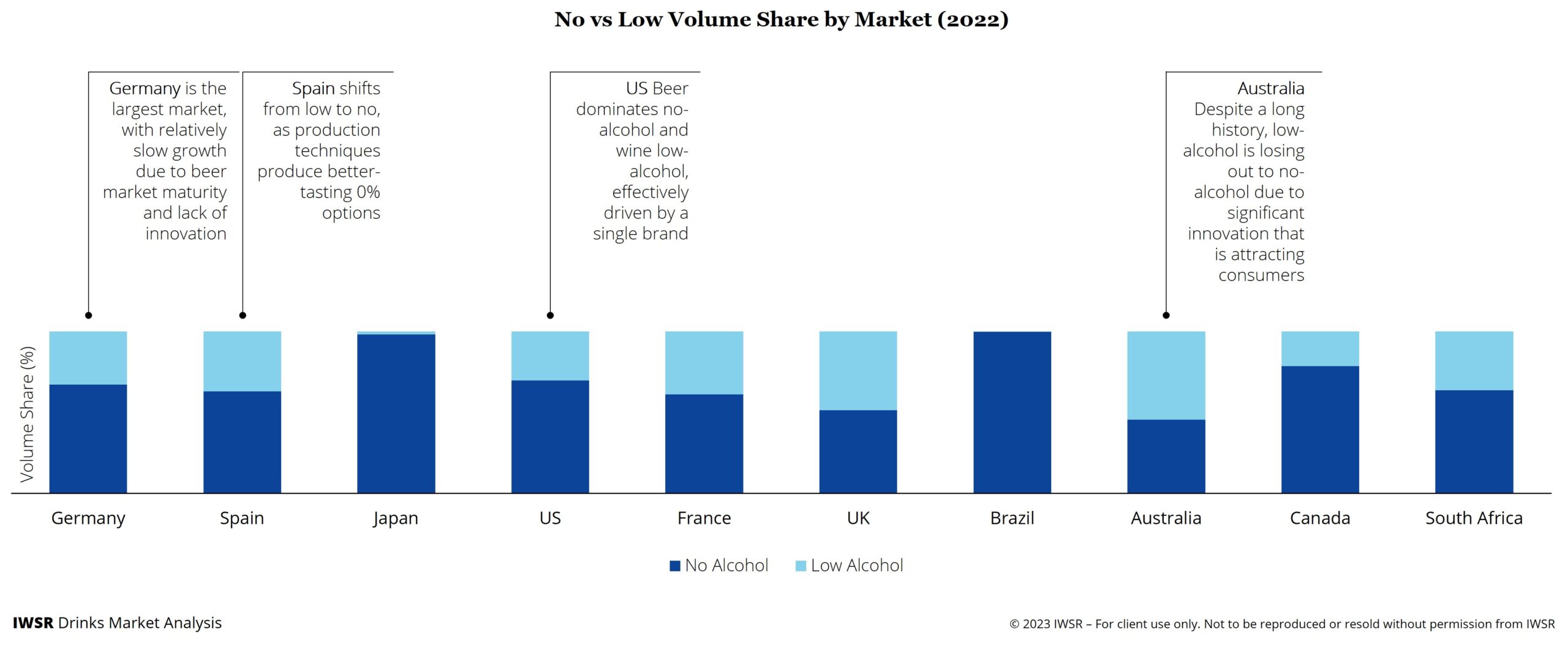

- No-alcohol volumes grew 9% in 2022, increasing their share of the overall no/low-alcohol space in the world’s 10 leading no/low markets to 70%, up from 65% in 2018.

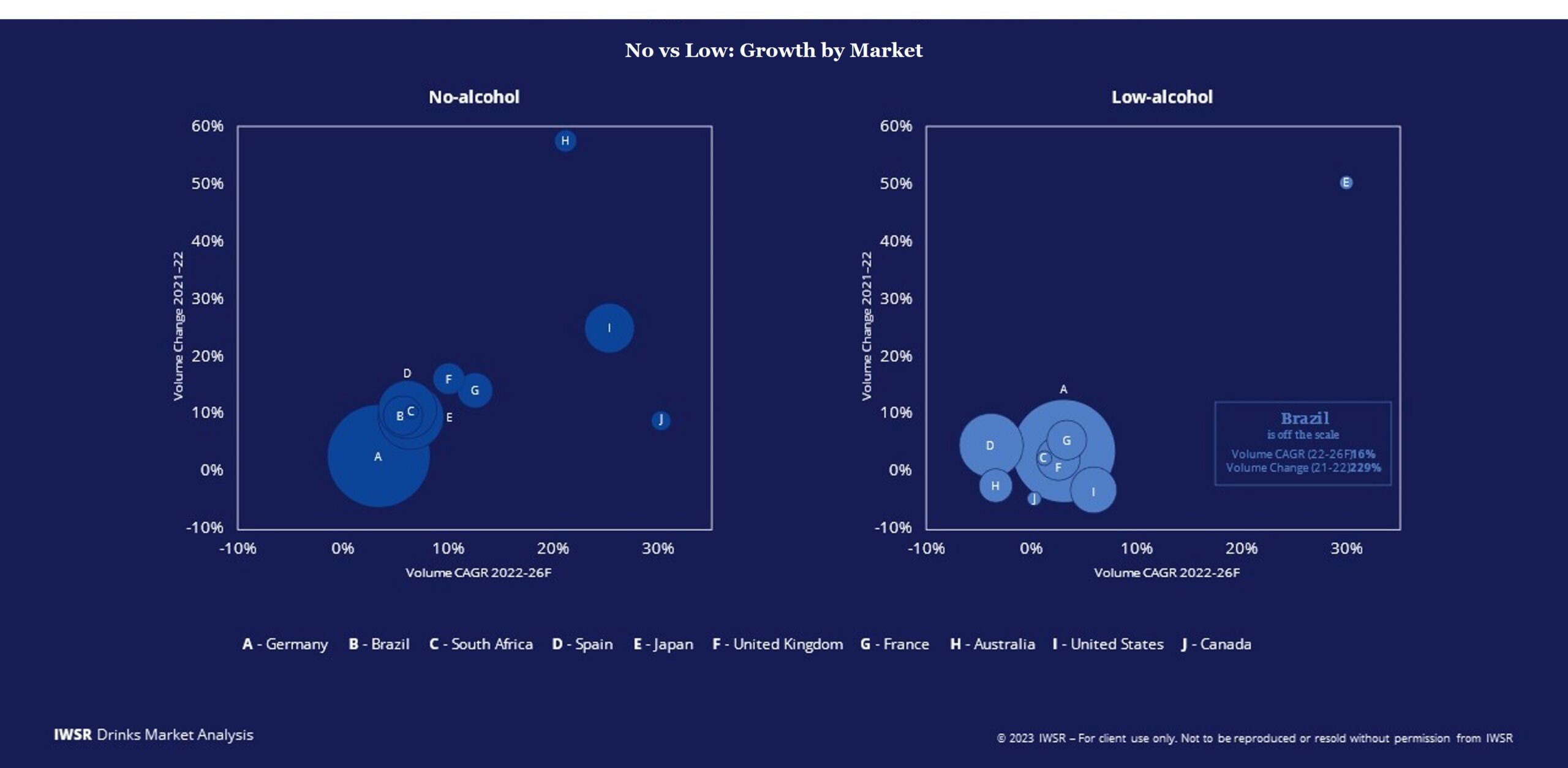

- The majority (41%) of no/low consumers choose no/low options on certain occasions, and full-strength on others. This behaviour is driving no- over low-alcohol growth across many key markets. Pair this with the rise of functionality, much of which is restricted to no-alcohol by regulations, and the result is a strong performance from no-alcohol overall. The countries where low-alcohol is leading growth rates, such as Japan and Brazil, are early-stage low-alcohol markets with a small volume base.

- The pace of growth of the no/low-alcohol category is expected to surpass that of the last 4 years, with forecast volume CAGR of +7%, 2022-26, compared to +5%, 2018-22. No-alcohol will spearhead this growth, expected to account for over 90% of the forecast total category volume growth. IWSR expects no-alcohol volumes to grow at a compound annual growth rate (CAGR) of +9% between 2022 and 2026.

Who is driving this growth?

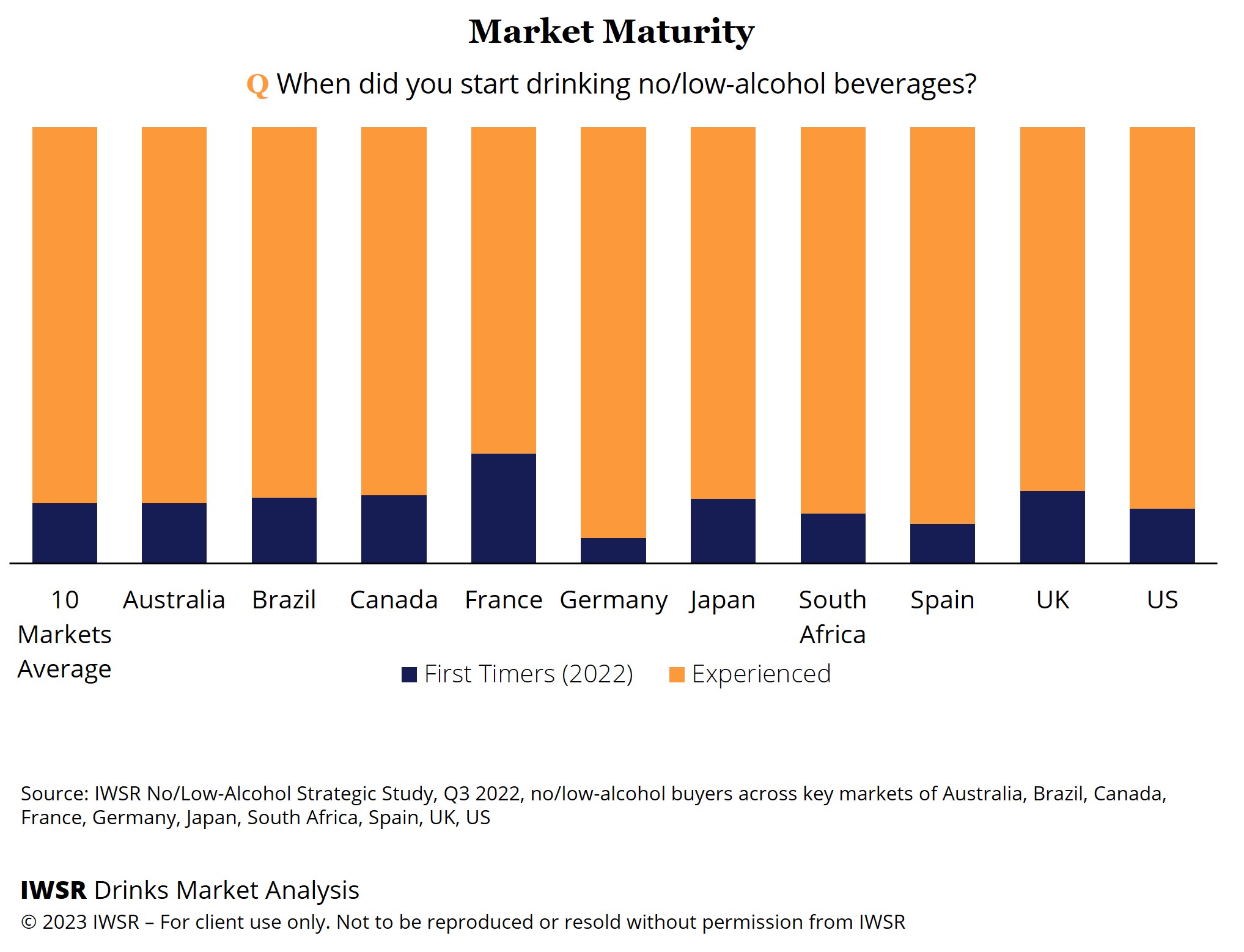

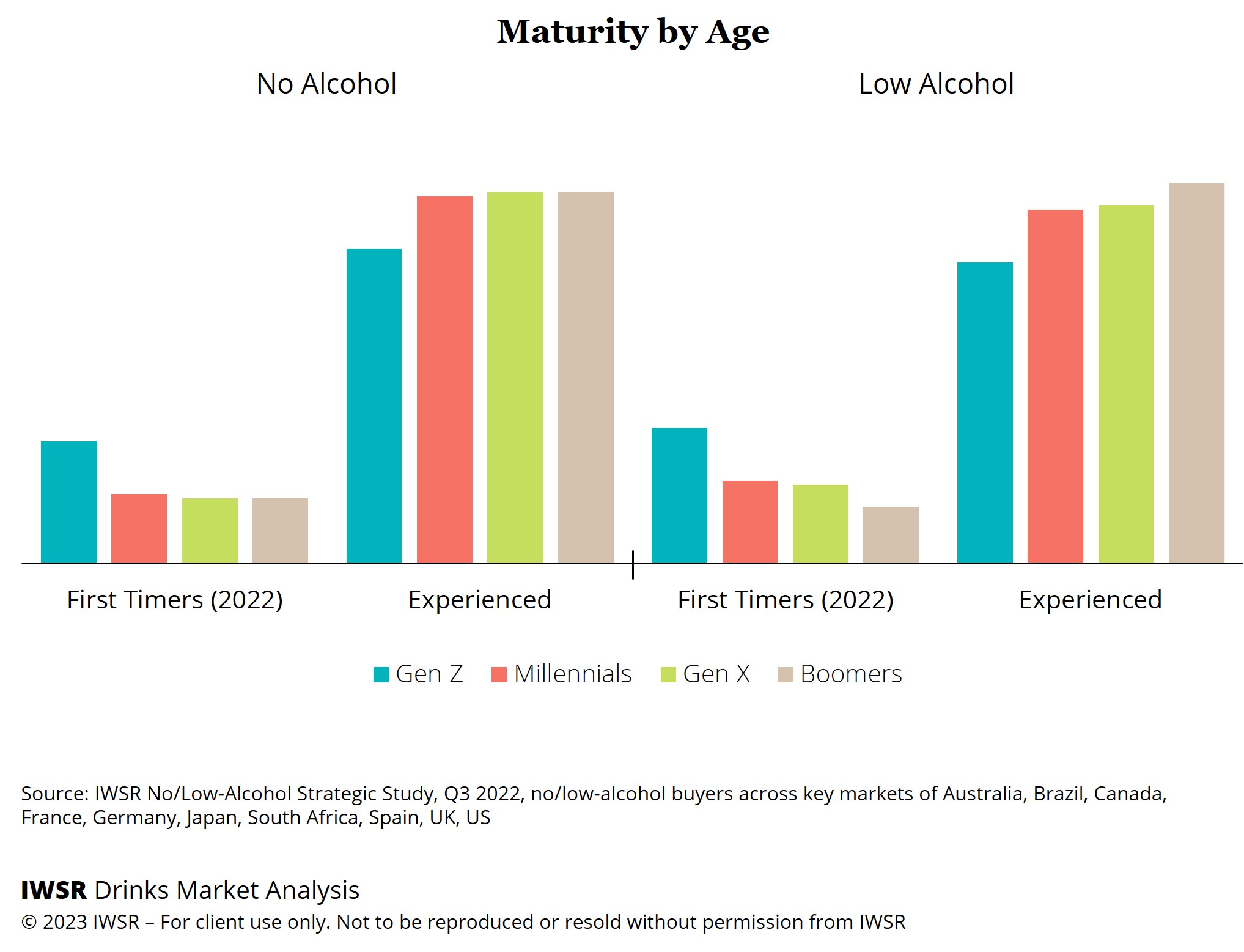

- No/low consumers are generally experienced in the category with most being consumers for more than a year; recruitment is highest in the Gen Z age group (legal-drinking aged)

- France has the highest number of new recruits, with 25% of no-alcohol drinkers joining the category in 2022.

- Germany is one of the largest no/low-alcohol markets in the world and a considerable share of older no/low consumers. This level of maturity and a lack of product innovation means that category recruitment is low, with only 6% of no-alcohol consumers joining in 2022.

- There has been a significant increase in recruits to no-alcohol in Spain.

- Australia, France and US have the highest proportion of Millennial new entrants in the low-alcohol category; and Australia, France and Canada in no-alcohol.

- 43% of US no/low consumers are Millennials, an increase on last year and by far the largest group.

- Millennials are the largest consumer group in Australia, accounting for 36% of no/low consumers. They are more likely than other age groups to be Blenders, switching between alcohol and no/low on the same occasion.

- The UK, US and Australia show the lowest proportion of Boomers for low-alcohol beverages across markets.

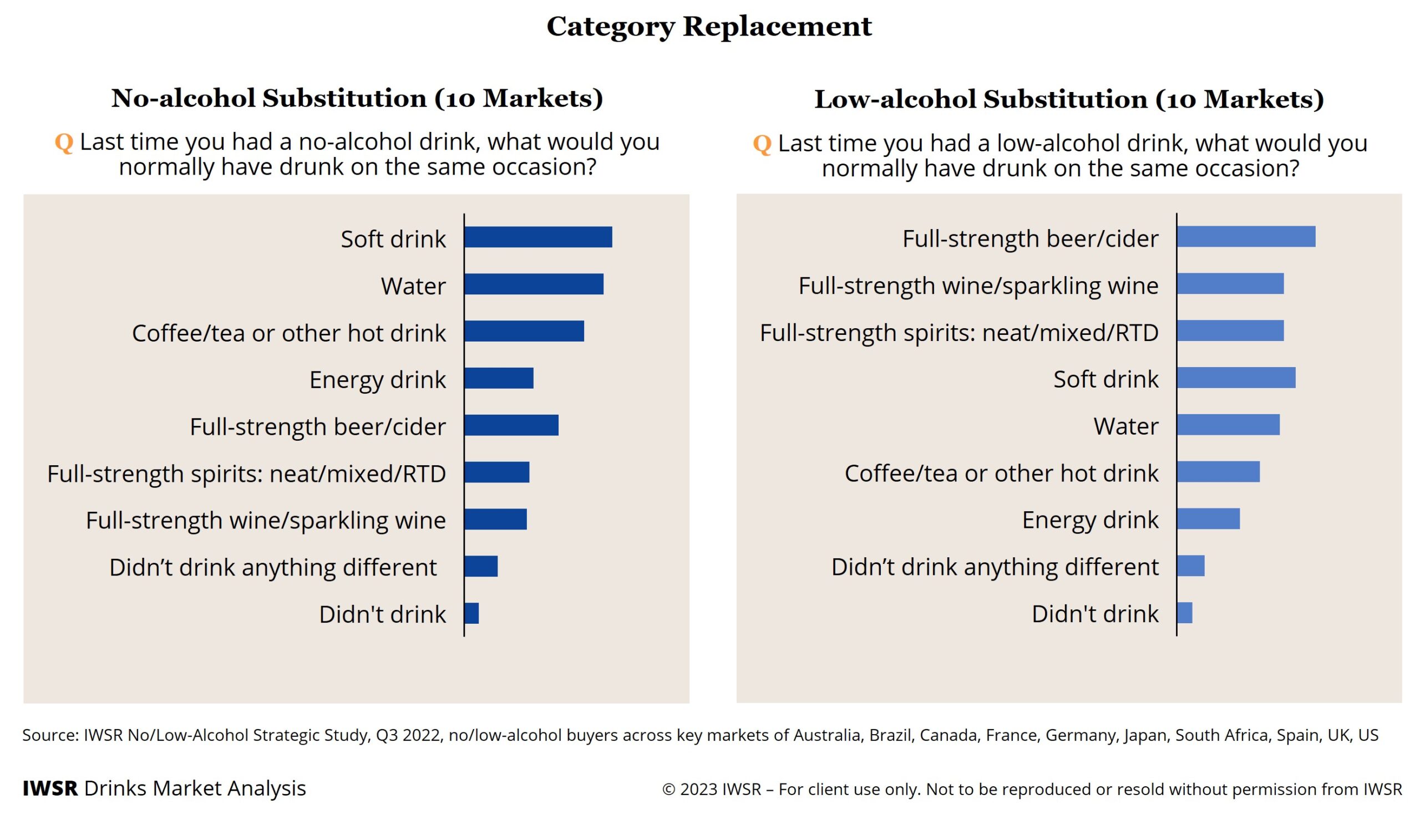

Where are consumers switching from?

- No/low consumers tend to switch between alcohol and no/low options, both in the same occasion and between different ones.

- No-alcohol is mostly replacing non-alcoholic drinks (such as soft drinks and water) in the same occasion, presenting an incremental growth opportunity for producers.

- The UK has the closest gap between replacement of alcoholic and non-alcoholic drinks, suggesting the category is more about alcohol replacement in this market than in others.

- Low-alcohol tends to substitute full-strength alcohol

- Most countries follow the same broad trend of replacing alcohol with low-alcohol.

- In the US, there is an even split between alcohol and non-alcohol being replaced with low-alcohol, suggesting that soft drinks and alcohol are swapped more than in other markets, perhaps due to a well-established RTD category and blurred category boundaries.

What’s next?

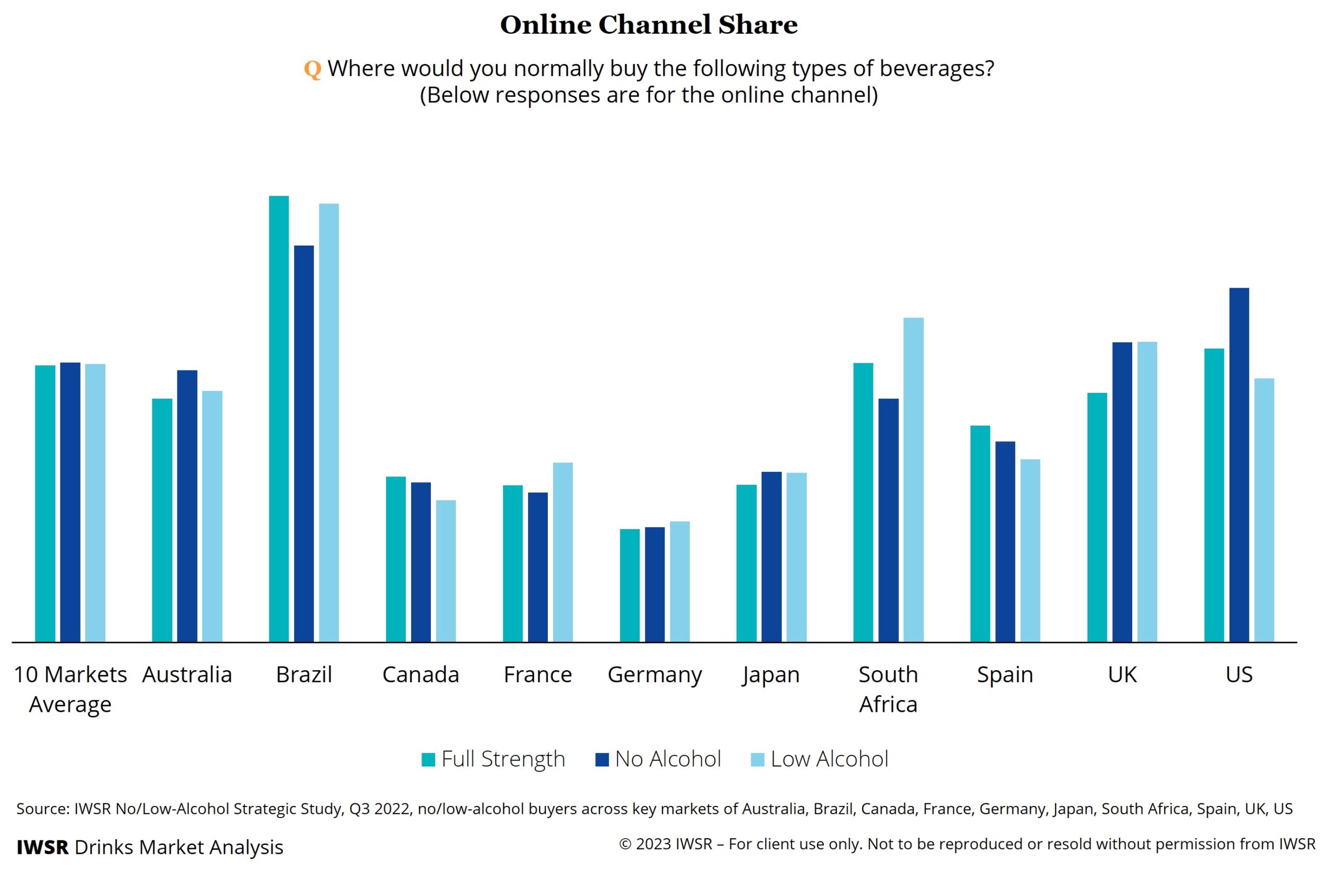

- No-alcohol is opening up different advertising and sales channel approaches than low-alcohol, with fewer restrictions bringing opportunities in ecommerce.

- Reduced restrictions on sales of no-alcohol mean it is well-positioned to take advantage of online and D2C sales, as well as to explore new outlets where people would not typically consume or purchase alcohol. Nonetheless, true integration of no/low into the consumer mindset still requires its acceptance in the mainstream on-trade, as in Spain

- Availability is a priority for further category growth. In markets like France retail shelves are still tied up by traditional no-alcohol brands that are low priced and aren’t recruiting new consumers. Shelf life of no-alcohol spirits and draught beer is a challenge.

- New markets, such as those in the Middle East; advancements in technology to help improve the taste of no/low-alcohol; product innovation; and greater recognition for no/low, are driving the outlook for the category.

You may also be interested in reading:

No- and low-alcohol category value surpasses $11bn in 2022

Key drivers for the US no/low-alcohol market

Moderation trend drives demand for no-alcohol products in the UK

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, No/Low-Alcohol | MARKET: All | TREND: All, Moderation |