10/11/2022

Key trends driving the US spirit-based RTD segment in 2022 and beyond

Product innovation, a growing consumer base, and greater product availability, are all driving the spirit-based RTD segment in the US

New findings from IWSR show the spirit-based ready-to-drink (RTD) segment continues to be a key growth driver in the evolution and outlook of the US RTD market.

Growing consumer preference for spirit-based RTDs is reflected in a wave of new entries launching into the market. In 2020, fewer than a thousand new spirit-based drinks were introduced, a figure that has accelerated to more than 1600 in 2022. Innovation is playing an important role in maintaining drinkers’ interest and keeping the segment visible and relevant. Many of the leading hard seltzer brands are launching spirit-based variants under the same name to capitalise on consumer demand.

While most spirit-based RTDs are positioned at higher prices, there is evidence of brands making efforts to increase options in lower-price ranges. Standard and value price tiers saw the arrival of mezcal and other whisky RTDs in 2022, while premium and super-premium have gained more products made with tequila and rum.

However, the vast majority of the spirit-based RTD market still falls into the premium-and-above price tiers, and the price of spirit-based RTDs is more than double that of malt-based offerings. This higher price point has historically restricted the consumption levels of spirit-based products and amplified the share of other malt-based options. As the overall market premiumises, price is becoming less of a deterrent for drinkers.

In contrast to wine- and malt-based RTDs, which have a pronounced gender bias, spirit-based offerings are generally enjoyed by men and women alike. Of the segment’s growing consumer base, more than two-thirds still associate their consumption with ‘relaxing at home’, but IWSR findings show that penetration in the on-premise has jumped from just 3.5% in 2019 to almost 11% in 2022. This channel is expected to be a valuable growth outlet moving forward.

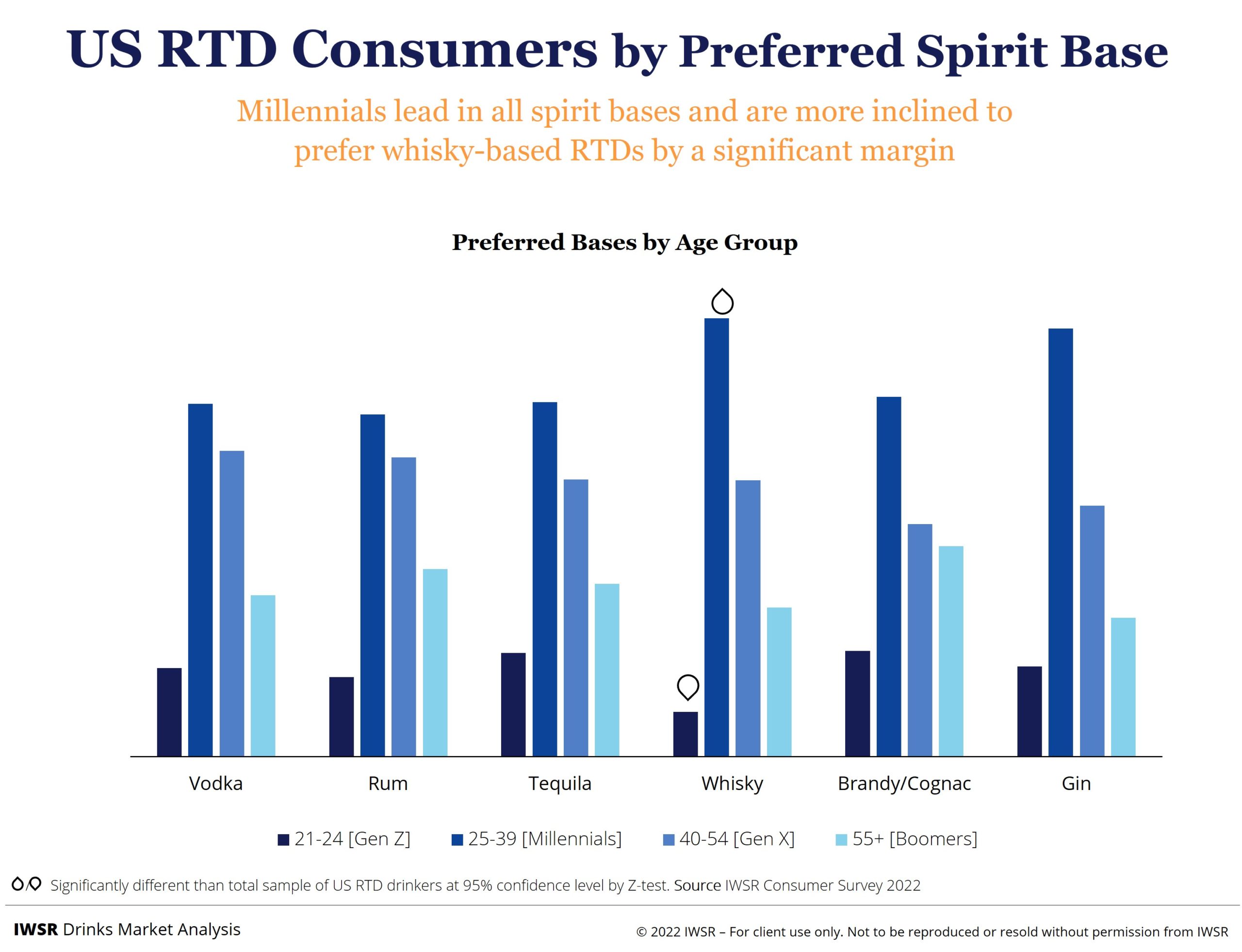

All spirits bases look set to contribute to the progress of the segment, but it will be whisky-based RTDs that are registering the fastest growth. Many high-profile whisky brands have identified the opportunities that exist and have unveiled a series of well-received brand extensions. IWSR analysis shows that whisky RTDs in can formats are driving volumes and single-serve glass bottles are pushing up value in the US.

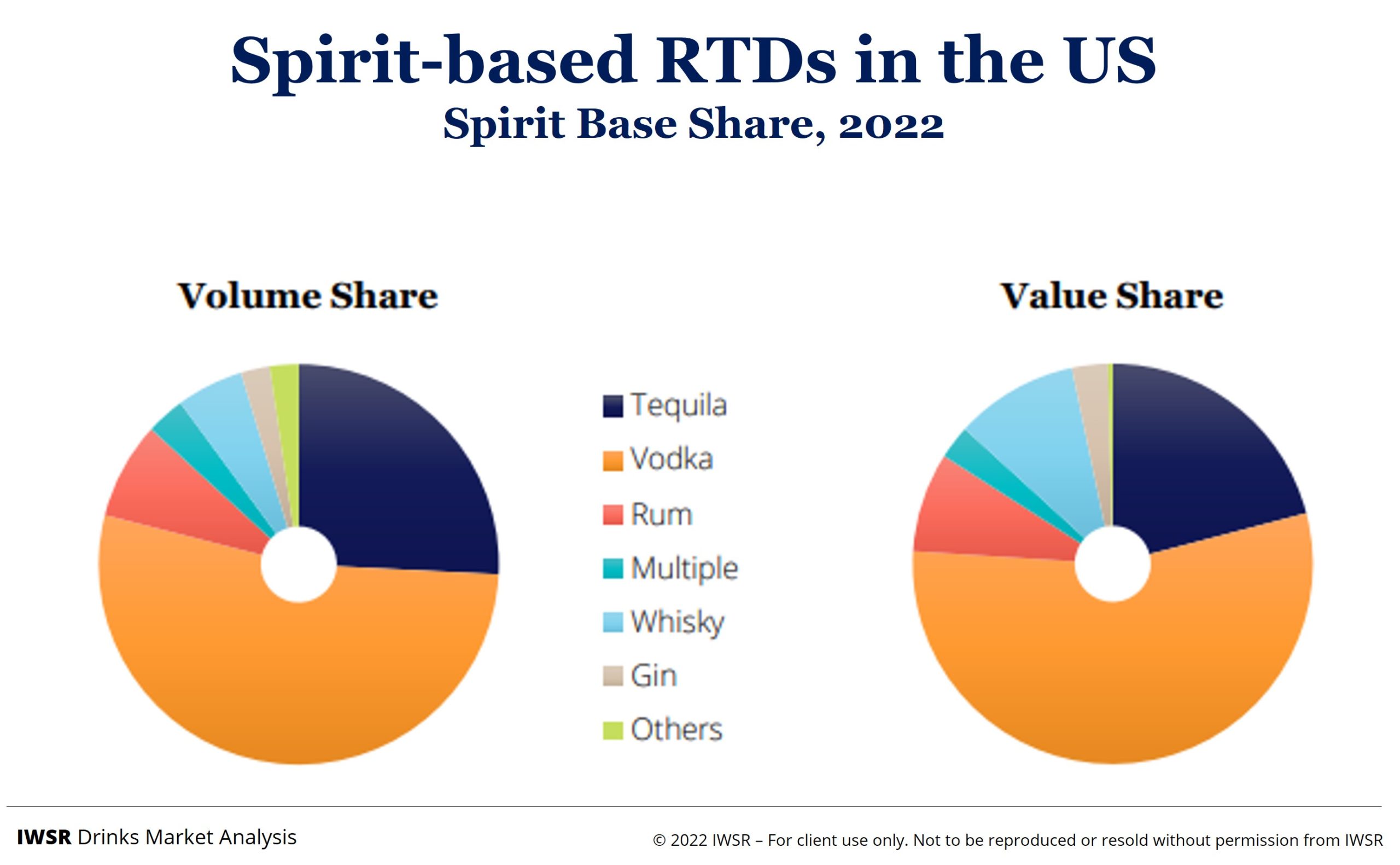

Vodka-based RTDs overtook tequila as the leading RTD spirit base in 2021 in volume terms, however, new-to-market Margaritas and Ranch Waters will help to maintain tequila’s relevance in the spirit-based RTD landscape. The long drink continues to propel gin-based RTDs upwards, while new innovations from leading brands in Piña Colada, Mai Tai, and Tropical Punch are boosting rum-based drinks.

Gains across the spirits-based spectrum, combined with a surge in new product development, a rising consumer disposition to spirit-based RTDs, the premiumisation trend, a gender-neutral appeal, and increasing availability in the on-premise, are all driving the advancement of a dynamic spirit-based RTD segment in the US.

You may also be interested in reading:

Why is Brown-Forman investing in the premium rum category?

Value growth of ready-to-drink category outpaces volume growth

Is tequila’s future under threat?

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, RTDs | MARKET: All, North America | TREND: All, Convenience |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.