09/03/2023

Key trends for wine in 2023 and beyond

IWSR analysis shows that long-term challenges persist, but premiumisation continues and there are signs of a post-Covid rebound in some markets

Overall, the short- and medium-term trend for wine is challenging, with the long-term trend of slowly-declining volumes in many markets expected to continue. However, the influence of ecommerce, which boomed during the pandemic, is expected to continue to grow, and there are opportunities, too, in the premium space, as well as in sparkling wines and alternative wines.

While economic uncertainties are leading wine consumers in many markets to cut back on discretionary spend (especially in the on-trade), regular wine drinker numbers have bounced back, driven by the return of some younger adult consumers to the category as the on-trade has reopened.

Fewer people are drinking less wine every year

Globally, wine is a category in slow decline and there are few signs of this changing imminently. Apart from RTDs, all drinks categories experienced a drop in sales in the Covid year of 2020. But whereas spirits are bouncing back strongly, and beer is returning to favour in developing markets, wine’s long-term diminution has continued. Wine volumes for H1 2021-2022 were down -5%, and of the top 20 wine markets, only Brazil is drinking more wine now than it did in 2017.

Moreover, in many core markets, the number of adults who are classified as regular wine drinkers is continuing to fall, with the decline at its greatest in the LDA-34 segment.

An increasing reliance on older drinkers, who are mostly set in their ways, and continued challenges in recruiting new, younger adults suggest wine producers will need to innovate in order to capture share of younger LDA drinkers.

Ecommerce and sparkling wine will continue to grow

Like many other consumer goods, wine saw a spike in ecommerce during the pandemic, with many consumers ordering online for the first time. Fears that this behaviour would fall away once the world returned to normal have proved unfounded, with participation rates post-Covid either stable or growing. In many key markets, although growth in wine ecommerce is moderating, online’s share of alcohol sales is trending upwards.

There is also opportunity for further growth. In markets such as the US, Canada, and Brazil, as much as a third of wine drinkers who don’t currently order online are open to the idea of doing so.

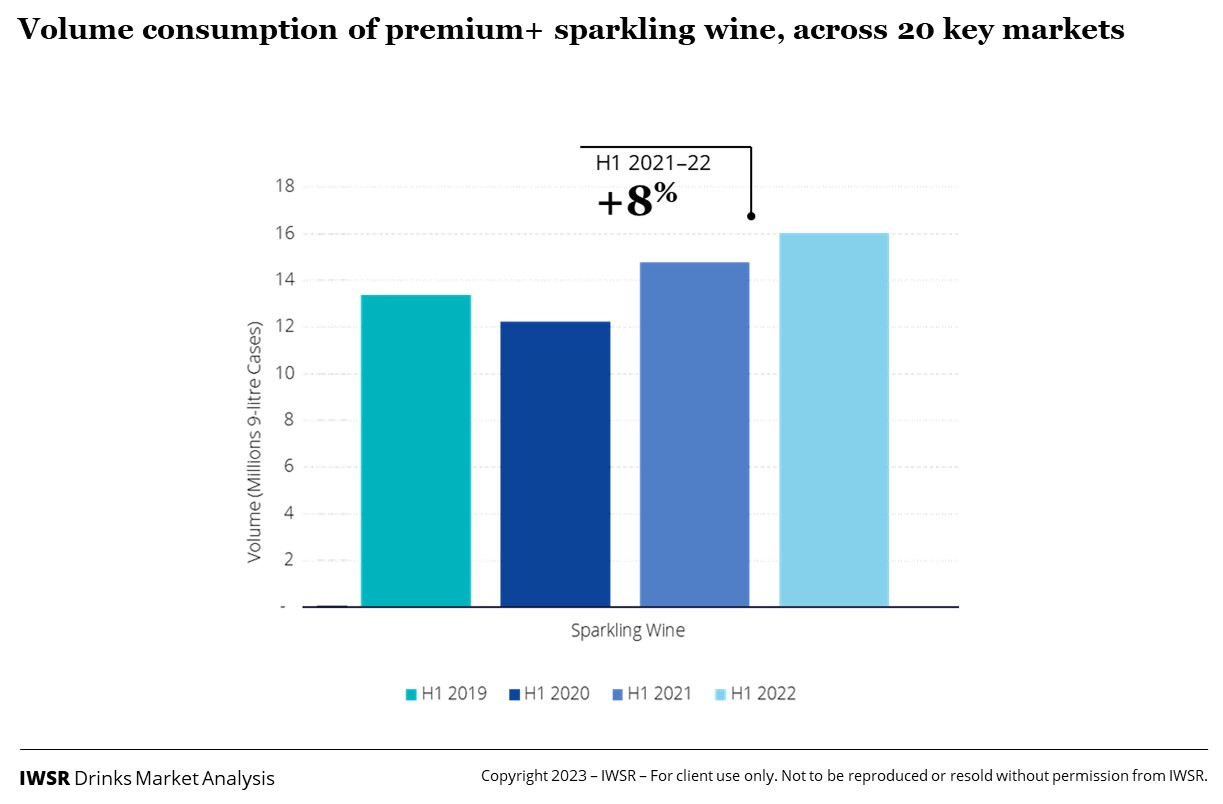

Sparkling wine also came out of the pandemic stronger than it went in. The lack of big, formal celebratory occasions led to Prosecco and Champagne, in particular, being drunk more informally at home, and consumers have reassessed their attitude to the category as a result.

In the US and Canada, for example, sparkling wine is much more likely to be seen as suitable for informal consumption at home than it was pre-2020.

Short-term boost in younger adult wine drinkers provides momentum

Wine’s overall numbers might be trending downwards, but some key areas have, nonetheless, shown a strong recovery since the pandemic. The US, UK, and Japan have all seen a resurgence in their total number of wine drinkers. Overall figures might still be lower than they were in 2015, but they are significantly better than in 2021.

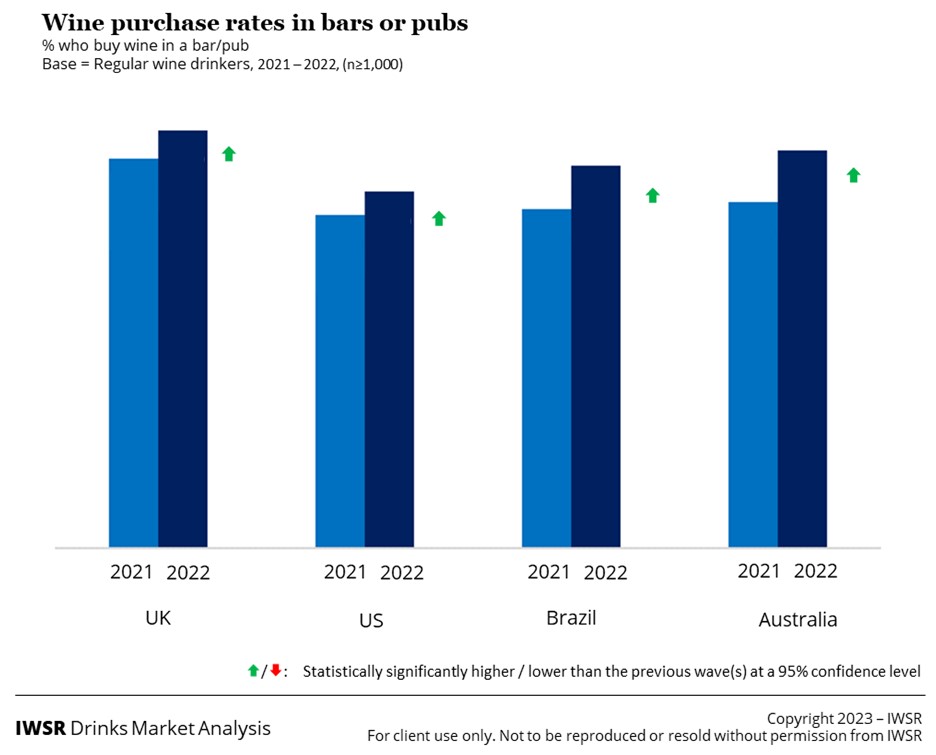

Much of the recent growth has been driven by hospitality-starved populations returning to the on-trade once bars and restaurants re-opened. Purchase rates in bars and pubs, in particular, rose sharply last year, mostly driven by younger adult drinkers.

These younger, often more engaged, wine drinkers interact with the category differently. Their knowledge is lower, they tend to drink less wine on each occasion and have the highest levels of moderation. They are also less engaged with mainstream brands. However, they are more willing to explore the category and have a ‘buy less but better’ attitude. This is contributing to the ongoing premiumisation trend in wine as well.

This post-Covid hospitality boom, however, could be threatened by the cost-of-living crisis. The next 12 months will reveal whether these upturns prove to be a correction after Covid, a temporary blip, or a more sustained positive trend.

Low-alcohol wines fare better than no-alcohol in many markets

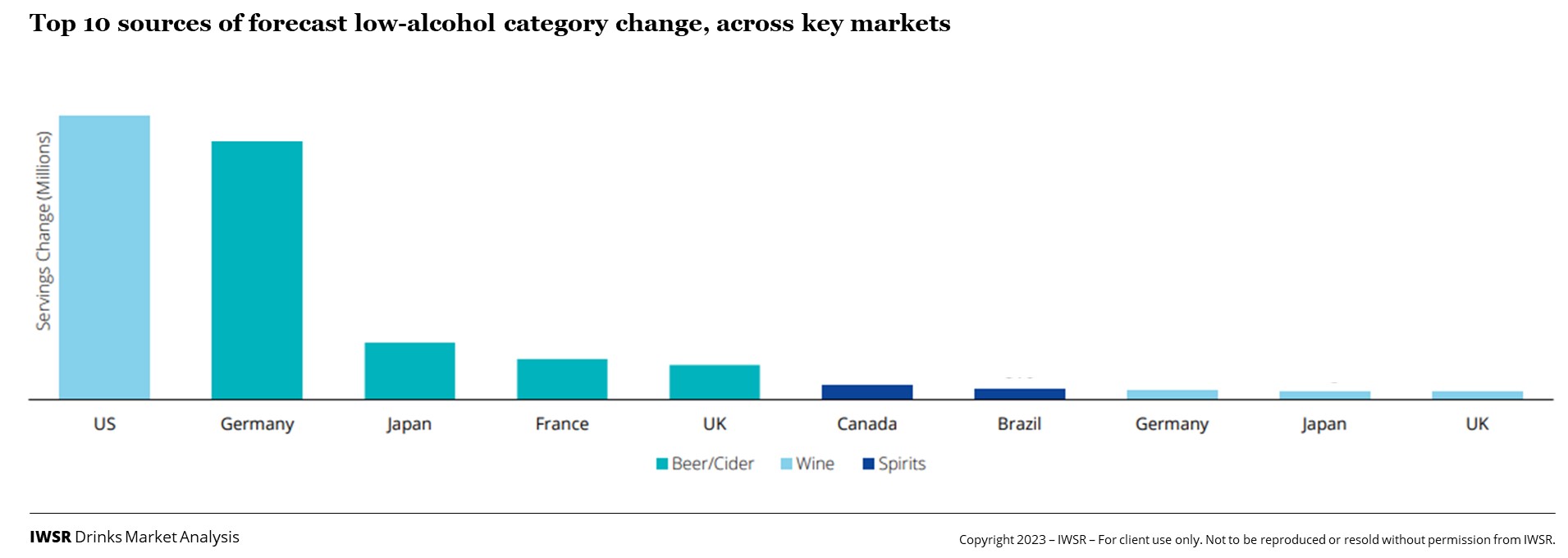

One of the biggest global trends in the drinks sector is moderation. Amongst wine drinkers specifically, moderation rates are highest among younger LDA wine consumers, with regular wine drinkers aged LDA−34 significantly more likely than other age groups to reduce their alcohol consumption in some way.

While no-alcohol wine struggles to gain acceptance in many markets, new technology is helping to improve taste and quality. Low-alcohol wine, however, is a key driver within the no/low space in markets such as the US, Germany, Japan, and the UK.

The ‘less but better’ trend is established – and alternative wines could capitalise on it

Premium wines are performing significantly better than their lower-priced counterparts and this should continue over the coming years. Premiumisation may be most evident in the sparkling sector, where premium wines are showing strong growth, but it is also true for still wines, albeit at reduced levels.

At just under 1% growth in H1 2022 vs H1 2021, the global volume growth of premium-and-above still wines is fragile, but it is, nonetheless, a clear bucking of the downwards trend of the category as a whole. With most consumers saying they would now rather drink more expensive wines less often, it is a trend that is expected to continue.

If so, this could drive growth for alternative wines. Consumer positivity towards organic, natural and sustainably-produced wines has grown significantly, even in the last two years. And though they are seen as more expensive, they fit with the ‘less but better’ trend, as well as resonating with the health and environmental concerns of Gen Y and Gen Z adults. These alternative wines look well-placed to leverage the shift towards premiumisation, and could be a way for wine to pull in younger LDA demographics.

It’s important to note though, that although recalled spend is up, it is being outpaced by inflation, meaning that genuine trading up is increasingly being replaced by spending more for the same product.

Wine is vulnerable to the uncertain economic outlook

A key challenge for the coming year will be consumer confidence in the context of a global economic downturn. IWSR data shows that the majority of wine drinkers are still confident in their ability to handle their personal finances. However, many of them are doing this by cutting back how much they spend on wine.

Europeans are particularly gloomy, expecting to buy less wine and cheaper wine in the near future. But most consumers – even those in the otherwise bullish US – are expecting to go out less in the coming 12 months.

Chinese consumers are an outlier in this regard, though their optimism may well be skewed by the fact that they are only now coming out of a particularly severe long-term lockdown.

Consumer sentiment points to a global wine-drinking population that is long-term optimistic, but – particularly in Europe – short-term cautious, and having thrown itself back into socialising after Covid, is now eyeing a period of retrenchment.

You may also be interested in reading:

The paradox of the US wine industry: falling volumes, yet more regular drinkers

Consumers choose to drink less to save more

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Wine | MARKET: All | TREND: All |