25/04/2024

Why does China’s ecommerce growth continue to defy channel norms?

IWSR analyses the growth trajectory of alcohol ecommerce in China compared with other key markets

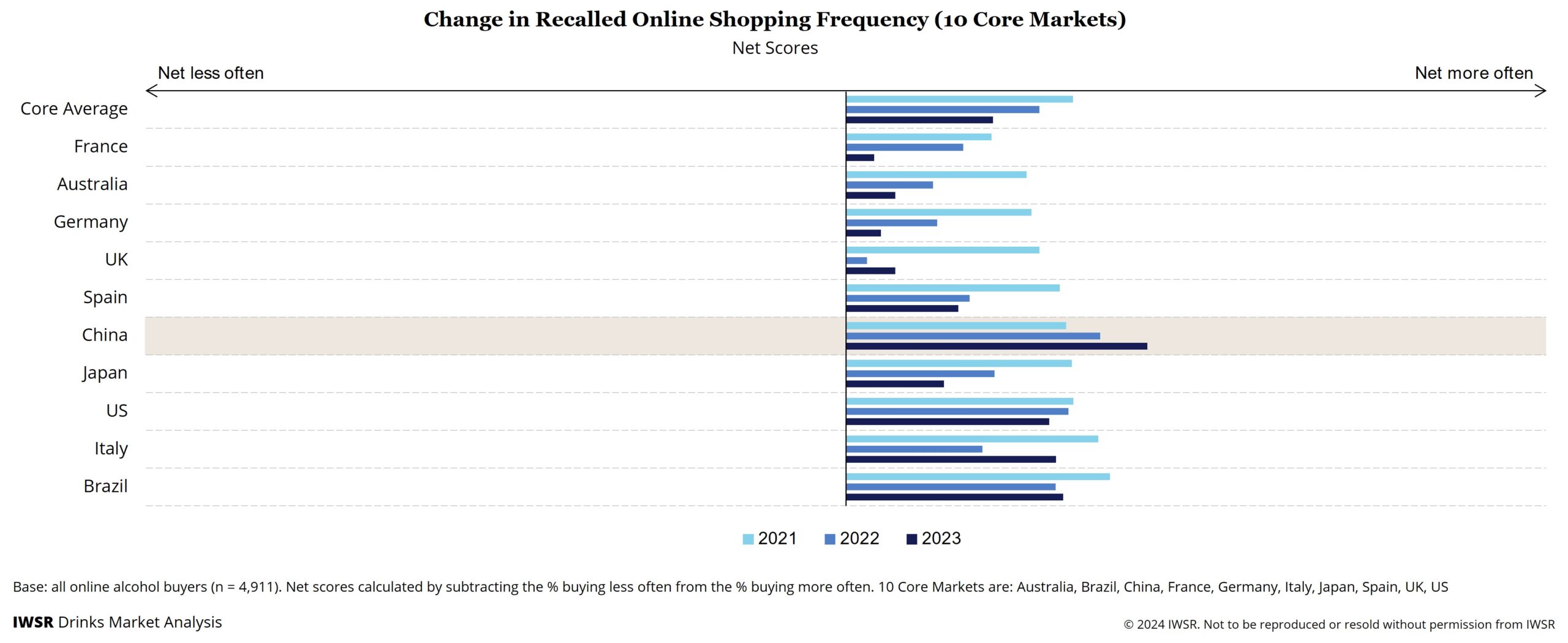

Of the world’s largest alcohol ecommerce markets, the only one in which ecommerce alcohol shopping frequency continues to reach new heights is China. The development of the D2C and on-demand channels have been key here, while the removal of Covid restrictions in late 2022 further boosted online sales.

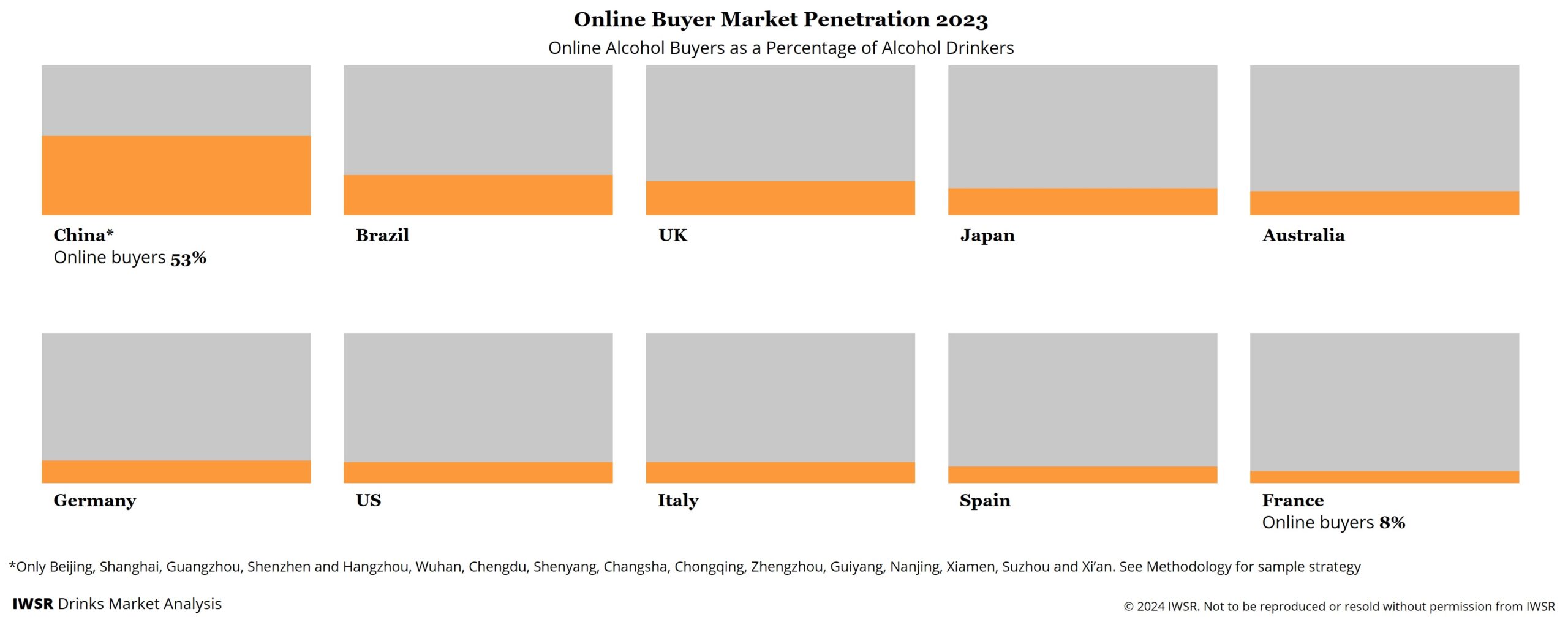

Growth has also been driven by China’s online buyer market penetration: more than half (53%) of all alcohol buyers shop online – almost double the incidence seen in any other major market. Additionally, IWSR data shows that 83% of non-users of the channel surveyed in 2023 said they were somewhat or very likely to buy alcohol online in the future, up from 71% in 2022.

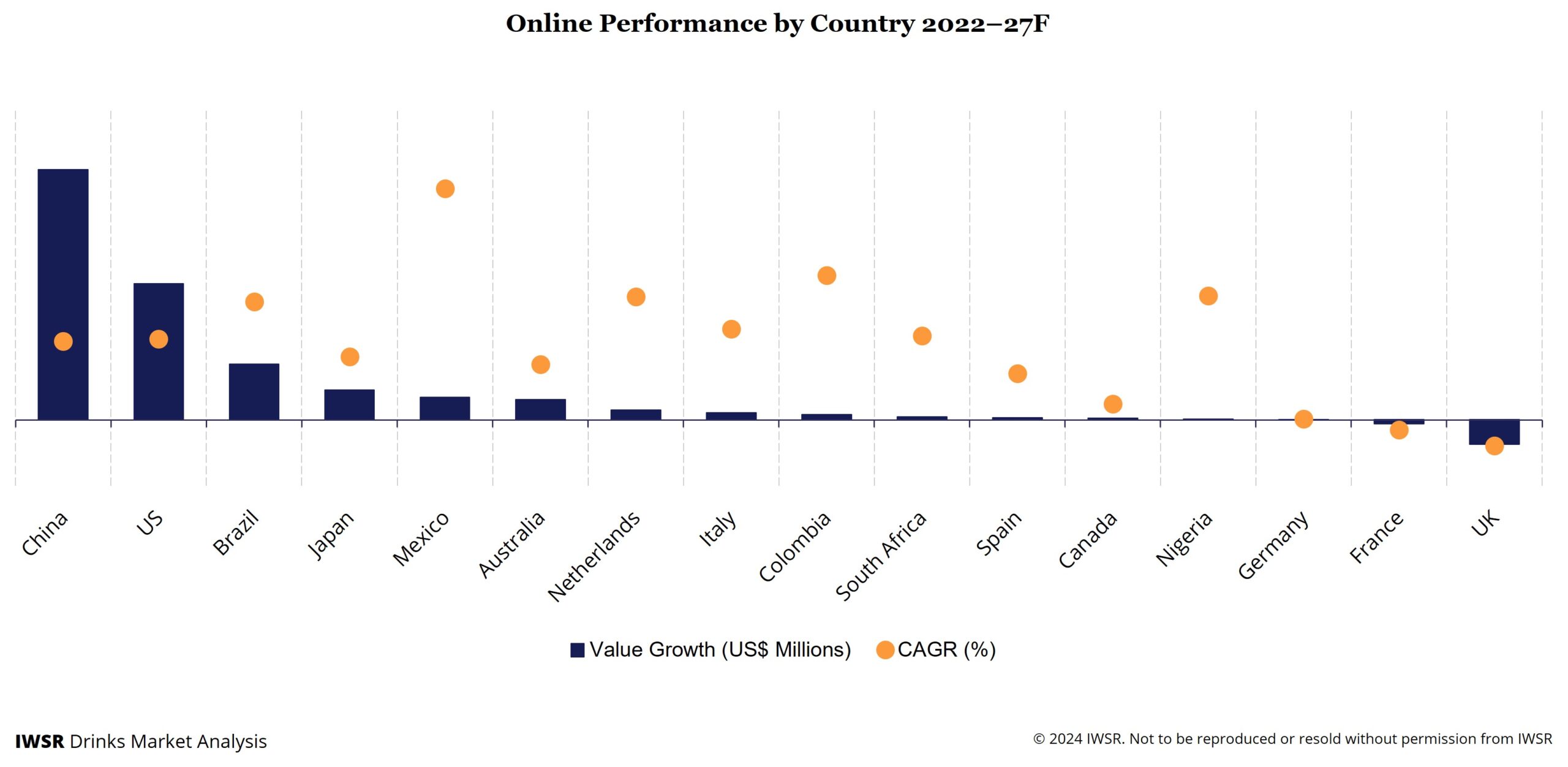

Compare this with the US, where the online buyer penetration is only 14%. Interestingly though, the US remains the second most valuable ecommerce market, and will continue to deliver some of the most growth globally, although at a lowered level due to a weak macro-economic environment and normalising consumer behaviours.

What, then, keeps China’s ecommerce channel growing at such a high rate?

Online alcohol sales in the country expanded at a value CAGR of +16% between 2018 and 2022, building a 39% share of global ecommerce sales; IWSR forecasts a 2022-27 CAGR of +6%, increasing the global share figure to 40%.

China’s forecast absolute value growth is well above that of any other market. This is partly due to consumers’ ongoing enthusiasm for the channel, which was not simply a Covid-induced anomaly as in some countries. In addition, ecommerce momentum is being sustained by considerable retailer innovation.

Consumer enthusiasm

Chinese consumers show high levels of commitment to and participation in alcohol ecommerce: IWSR data shows a consistent purchasing frequency, with most people saying they are buying more than they did previously.

Rising numbers are now buying alcohol online more than once a week – largely driven by the legal drinking aged Gen Z cohort. And almost half of online alcohol buyers surveyed in 2023 said they expected to increase their purchasing frequency in the next few months – a significant increase on previous years.

“At the same time, consumer behaviour is becoming more complex, so brands will need to have a deeper understanding of shoppers, and to meet their needs with the right products and propositions to win in the competitive online space,” says Guy Wolfe, Head of Alcohol Ecommerce Insights, IWSR.

All of the main beverage alcohol categories in China are poised for growth in ecommerce: IWSR forecasts show that online wine sales will increase at a value CAGR of +8% between 2022 and 2027, with spirits (+5%) and beer/cider/RTDs (+6%) also expanding.

Online wine sales significantly outperform the overall market, because wine’s core consumer base skews to younger LDA groups – Millennials especially – who are more likely to use ecommerce. According to IWSR data, wine has a 3% value share of total beverage alcohol (TBA) in China; in ecommerce, its share is 12%.

Ecommerce spirits didn’t see the same pandemic spike as in many other countries, but the recent D2C success of baijiu, and strong demand for key categories, has helped elevate online’s value share of total spirits sales from 2.5% in 2018 to 3.7% in 2022.

Ecommerce penetration in beer/cider/RTDs has picked up from a low base in recent years as consumers look for convenience via the omnichannel and on-demand channels. The category is dominated by beer – more than 90% of sales – but RTDs over-index online thanks to their relatively younger demographic.

“Online wine growth is predicted to pick up over the forecast period as the previously ailing category bottoms out and starts to recover,” says Shirley Zhu, Research Director for Greater China, IWSR. “In spirits, strong growth seen in 2022, due to the rise of D2C baijiu, will soften, but the category will continue to perform well. We expect baijiu companies to likely increase their investment in online channels, now that they’ve seen the results. Meanwhile, ecommerce share of beer is likely to rise as more consumers seek convenience.”

Channel innovation: the rise of on-demand and D2C

As momentum for traditional online marketplaces shows signs of slowing, there has been a rise of on-demand platforms, as well as the recent emergence of brand owner D2C [direct-to-consumer] apps such as iMoutai, which are helping to maintain consumer interest in the channel. Other baijiu players are now launching ventures of their own, at the same time boosting baijiu’s presence in ecommerce, where it is underrepresented.

This, along with the rise of ‘social commerce’ channels such as Douyin (TikTok) and Pinduoduo, show that there are new ways to sell within the relatively well-developed Chinese ecommerce space.

“Brand owners should not be shy about exploring new platforms in the search for growth, as they can rapidly become major drivers in a market where consumers are receptive to new concepts,” notes Wolfe.

IWSR forecasts suggest that on-demand and D2C will record the fastest growth in the years ahead, with 2022-27 value CAGRs of +13% and +9% respectively. Marketplaces are predicted to grow at a value CAGR of +4% over the same timescale, leading to a further erosion of their share of ecommerce to 69% by 2027 (versus 11% for D2C and 9% for on-demand).

You may also be interested in reading:

India’s growth potential in 2024 and beyond

How China’s tariffs on Australian wine changed the market landscape

From necessity to novelty, US beverage alcohol ecommerce is evolving

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, Asia Pacific | TREND: All, Digitalisation |