This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

27/07/2023

Wine’s share of ecommerce sales continues to erode: how can it win back consumers?

IWSR analyses the shifts in alcohol ecommerce as beer and spirits players increasingly invest in the channel

Wine’s share of the global ecommerce market for beverage alcohol is set to shrink over the next few years, but opportunities remain for brand owners to target untapped markets and new consumers.

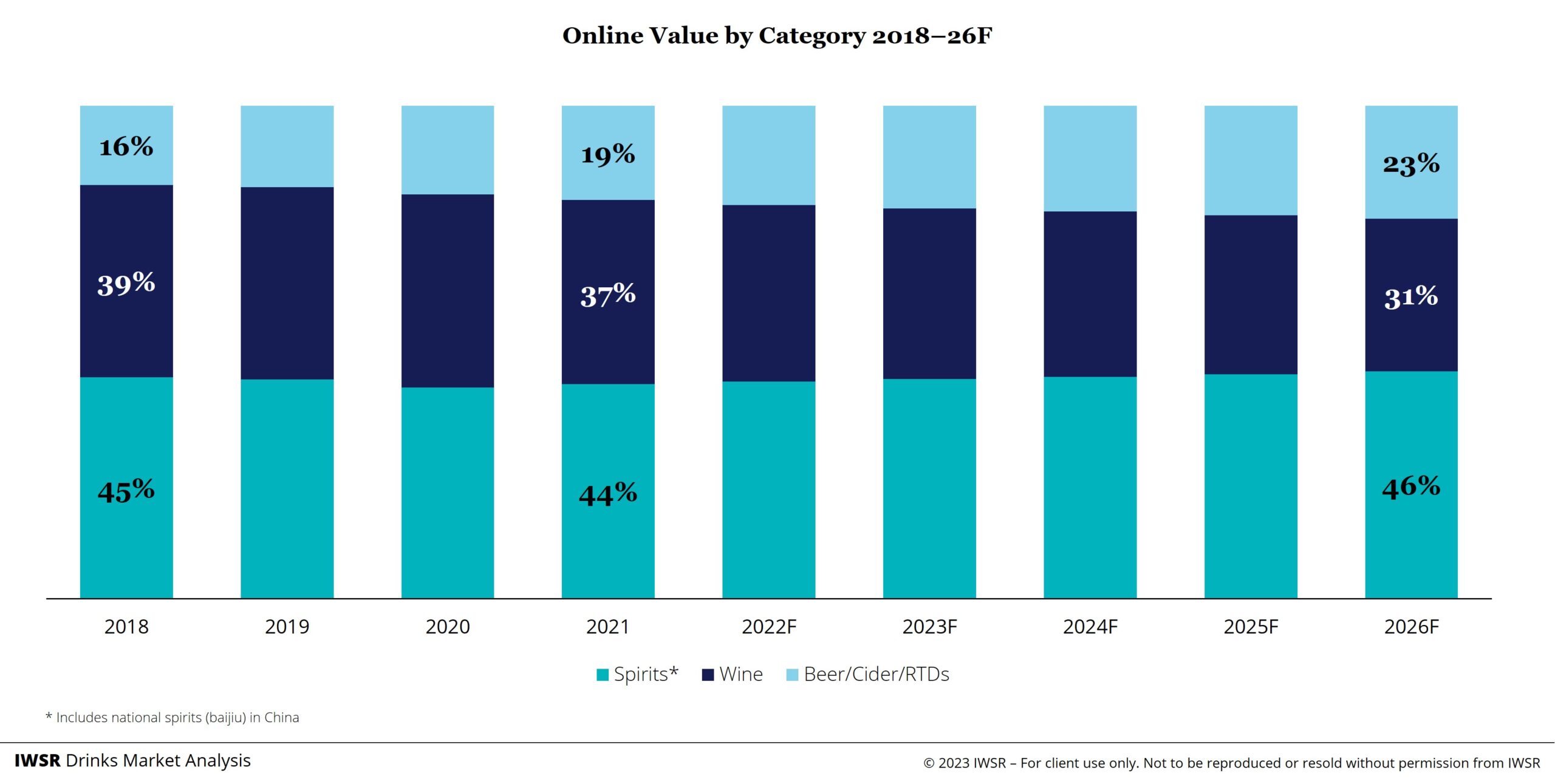

Beer/cider/RTDs and spirits are poised to make the strongest gains in the post-Covid ecommerce landscape, gradually eroding wine’s market share, according to IWSR forecasts.

“Ecommerce remains an important channel for wine, despite a post-pandemic plateau and challenges from other categories,” says Guy Wolfe, Head of Ecommerce Insights, IWSR. “Even with these challenges, there is still an opportunity to recruit new shoppers to the channel.”

Ecommerce across total global beverage alcohol grew strongly during the Covid-19 pandemic, with sales by value in the 16 largest global ecommerce markets rising at a compound annual growth rate (CAGR) of +30% between 2019 and 2021. This growth is expected to moderate in the years ahead, with value increasing at a CAGR of +6% between 2021 and 2026.

Competition intensifies from beer and spirits players

Wine will see its market share gradually reduce over the next few years in the face of strong value gains from beer/cider/RTDs and spirits: beer/cider/RTDs ecommerce sales are forecast to rise at a CAGR of +10% between 2021 and 2026 across the 16 markets, while the larger spirits category will add the most in absolute value terms, while growing at a CAGR of +7% over the same period.

As a result, wine’s share of online sales will decline from 37% in 2021 to 31% by 2026; over the same timescale, spirits’ share will rise from 44% to 46%, while beer/cider/RTDs will increase from 19% to 23%.

“Excluding baijiu in China, which dominates spirits growth, whisky and agave in the US will perform strongest,” explains Wolfe. “The rise of beer/cider/RTDs will be led by the US and China, with rapid expansion also in Brazil and Mexico.

“Having initially been relatively slow to react to the rise of ecommerce, the major brewers are now waking up to the potential of the channel and investing heavily in their online capabilities, helping to drive beer growth.”

However, there are still clear growth opportunities for wine in ecommerce, with IWSR forecasting that sales will grow at a CAGR of +2% between 2021 and 2026, adding more than US$1bn in the process.

Opportunities to recruit new wine consumers online

Globally, 31% of wine drinkers do not currently buy wine online, but would consider doing so in future.

“Consideration to buy wine online tends to be higher in markets with lower penetration such as the US and some European markets. In Portugal, for example, only 20% of regular wine drinkers buy wine online, but 49% would consider doing so in the future. In the US, the rates are 30% and 35% respectively,” says Richard Halstead, COO Consumer Insights, IWSR.

“However, markets with higher penetration are closer to reaching saturation point,” Halstead cautions. “In China, 78% of wine drinkers buy wine online, while only 11% are non-online buyers who would consider doing so in the future.” Wine ecommerce participation is also strong in Brazil, and is therefore expected to plateau in the near future as the number of online ‘considerers’ is relatively small.

Consumers choose online retailers based on a number of factors, the most significant being a wide range of available products, and the presence of promotions or special offers. Where the use of apps is more prominent, such as in Brazil and China, speed of delivery is more valued than elsewhere.

“Product range and promotions still drive online retailer choice, suggesting that these factors, alongside convenience, will be powerful tools for recruitment and retention in the years ahead,” says Halstead.

“There is still a divide between app-based and website-focused markets. Most purchases in Brazil and China are coming through apps, and app usage is growing in the US. App markets have distinctive purchasing behaviours, with people tending to buy smaller quantities of wine more often. With overall online purchase frequency slowing, converting consumers to become app shoppers could be a strategy to increase sales.”

A focus on package size and wine clubs

There are also opportunities for increased online spend in the US as the ecommerce marketplace there evolves. “The US is the market in which ecommerce alcohol shoppers are most likely to spend more online than in stores,” says Halstead. “This can partially be explained by bulk ordering, with 39% of people purchasing seven or more bottles in a typical order.

“However, the proportion making large bulk orders has declined since 2022, suggesting there is the potential for premiumisation, with wine buyers buying more expensive products online.”

Meanwhile, some uncertainty surrounds the future role and performance of wine clubs, which soared in popularity during Covid-19 lockdowns as consumers took the chance to explore the world of wine from their own homes.

In some markets, as restrictions eased, many cancelled their subscriptions, leading some wine clubs to offer deep discounts in an effort to attract new users, which in turn eroded their profitability, leading to job cuts and reductions in marketing spend.

“The focus is now on retention and greater discipline around the cost of new subscribers,” explains Wolfe. “As the bottles sold by wine clubs typically skew towards the premium segment, it remains to be seen how they will fare in future. Consumers may regard them as an affordable luxury in challenging economic times, or perhaps as an unnecessary expenditure.”

You may also be interested in reading:

Global beverage alcohol shows subdued growth 2022-2027, whilst value outlook is more positive

Consumer confidence in the US remains broadly positive

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Wine | MARKET: All | TREND: All, Digitalisation |