This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

09/09/2021

Alcohol ecommerce maturity in Asia Pacific

IWSR analyses the differences in alcohol ecommerce maturity and consumer behaviour across the APAC region

Compared to other global markets, Asia Pacific has a relatively mature alcohol ecommerce segment thanks to high penetration in China. However, growth opportunities remain, such as in up-and-coming alcohol ecommerce markets including Singapore and the Philippines.

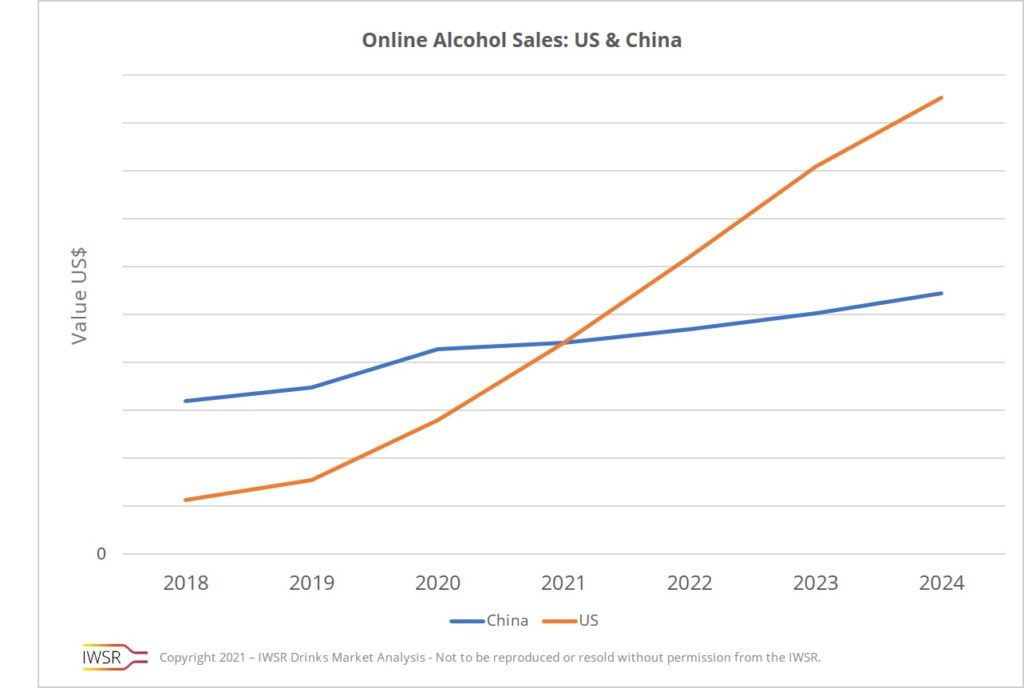

Asia Pacific’s alcohol ecommerce industry is led by China, the world’s largest market for online alcohol sales – although the value of the ecommerce channel in the US is expected to overtake that of China’s by end of 2021. Nevertheless, for the past three years, alcohol ecommerce in China has grown steadily at 10%-20% annually, driven by an increasingly affluent and connected middle class.

Across the globe, there has been a well-documented shift to buying alcohol online since the start of the pandemic. Online alcohol growth in China has been more subdued than in other markets such as the US, due to the existing high level of penetration. IWSR data shows that from 2019-2020, the value of China’s alcohol ecommerce sector grew by approximately 20%, compared to approximately 80% for the US, which has a far less developed alcohol ecommerce sector.

Growth has also been limited by the Chinese market’s reliance on the on-trade and baijiu – which, while the dominant ecommerce spirits category in China, has relatively low levels of penetration in the online sphere, with less than 5% of category value sales being registered digitally.

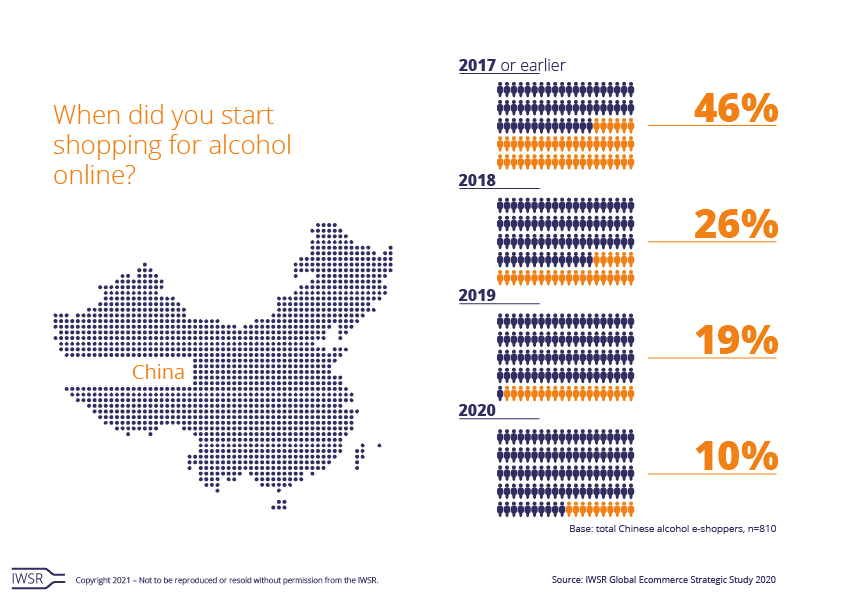

Nevertheless, the value of the online alcoholic drinks market in China is expected to see a temporary boost from the impact of Covid-19, and should then continue to grow steadily up to 2024. According to consumer research by IWSR, only 10% of Chinese alcohol shoppers started buying online in 2020, while 46% said they started in 2017 or earlier. As such, Chinese e-shoppers are generally quite experienced compared with those in other markets.

Looking to the future, while marketplaces dominate the alcohol ecommerce landscape, due to the strength of leading retailers such as JD.com and Tmall.com, investments from these same online powerhouses in ‘new retail’ chains are boosting the currently small omnichannel segment.

“China will continue to be a crucial market for online drinks sales, even if growth will not be as strong as in the US,” says Sarah Campbell, Research Director at IWSR. “While the key marketplaces such as JD.com and Tmall.com will remain dominant, brand owners should keep a close eye on the development of ‘new retail’ stores, as these have the backing of some of the largest ecommerce players in the market.”

Experienced e-shoppers in Japan

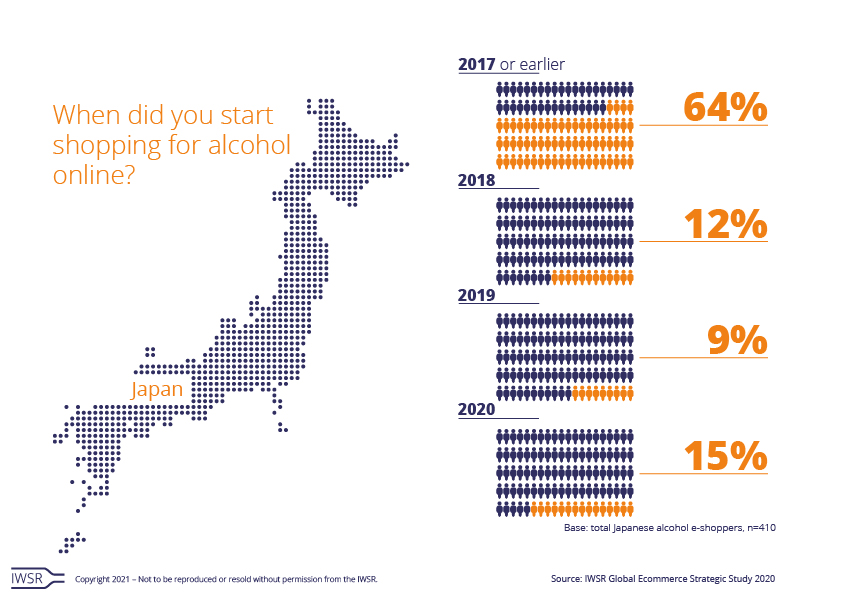

Likewise in Japan, many consumers were accustomed to buying alcohol online before the pandemic – 85% according to IWSR figures, with 64% claiming to have done so in 2017 or earlier. However, more consumers started to buy alcohol online in 2020 versus 2019 (15% versus 9%), which was not the case in China (10% versus 19%).

Online sales penetration rates remain moderate in Japan, at less than 5% of total sales, meaning there is still scope for further growth. Some behaviour developed during the pandemic will continue to influence buying trends, while others will diminish. For instance, Japan witnessed a divergence of consumer behaviour, with some shoppers becoming more adventurous and others more cautious. However, it appears that the conservative approach will prevail, with consumers stating they are more likely to buy trusted brands over experimentation, whilst shopping cheaper will be preferred over trading-up online.

Upswell in Australia

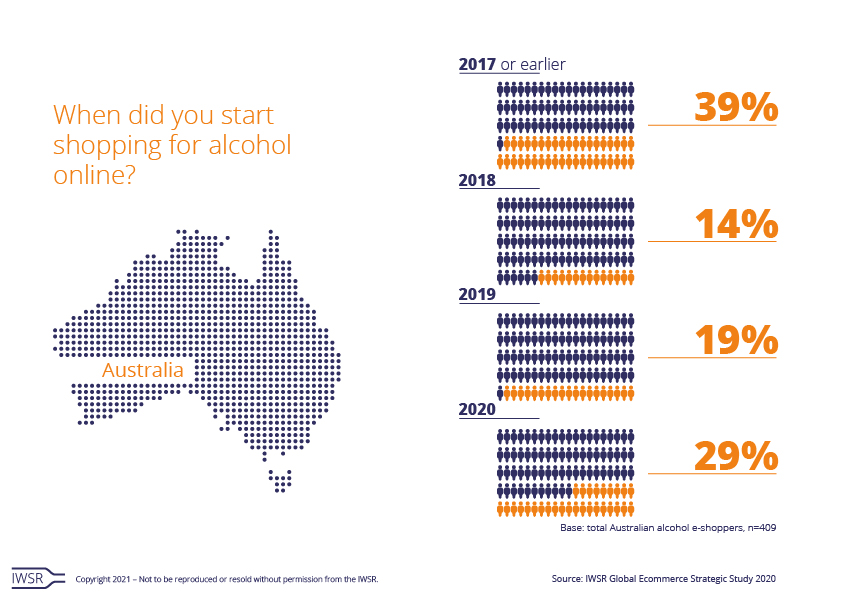

In contrast to both China and Japan, there has been a significant increase in the number of new alcohol ecommerce consumers in Australia, with 29% saying they started to buy alcohol online in 2020. Interestingly, alcohol shoppers who bought online for the first time in 2020 are likely to buy more frequently (32%) than experienced e-shoppers (17%); the latter group however tends to buy more consistently (49%).

During the first half of 2020, older consumers in Australia became more dependent on ecommerce than younger LDA consumers due to the pandemic circumstances. According to IWSR data, 20% of online alcohol shoppers claimed not to have bought any alcohol from a physical store in the first half of 2020, a move that was particularly prevalent among boomers.

The most commonly cited behaviour – mentioned by nearly 30% of survey participants – was buying drinks in larger quantities than usual during the first half of 2020. While this was likely a reaction to the uncertainty created by Covid-19, over half of respondents said they were likely to continue this behaviour in future as well.

APAC ecommerce markets to watch

In addition to the top 10 core alcohol ecommerce markets, determined by size, IWSR identifies 10 ‘markets to watch’, based on predicted growth rates. Within the 10 ‘markets to watch’ sit the Philippines and Singapore, which experienced pronounced alcohol ecommerce value growth in the 2019-2020 period.

All categories are growing quickly from a small base in the Philippines thanks to the rise of alcohol-focused online specialists. A benefit to the online channel in the Philippines is its strong emphasis on higher-end products, since ecommerce is most accessible to wealthier urbanites who have access to fast internet speeds, live within delivery range and are willing to pay for greater convenience and product choice.

Singapore, in addition to Nigeria and Mexico, has a premium-orientated ecommerce spirits market, though wine is the dominant alcohol ecommerce category here. The premium-and-above segment performs as well online as offline due to a tax structure that incentivises higher-end alcohol.

“There are vast differences in alcohol ecommerce maturity across the APAC region, and each country requires nuanced go-to-market strategies,” remarks Guy Wolfe, Strategic Insights Manager at IWSR. “Markets across the region have been boosted by the pandemic to varying degrees, with forecasts of future growth that offer opportunities for wine, spirits and beer brands to capitalise on.”

You may also be interested in reading:

The US and China offer resilience and opportunity for drinks groups

5 key trends that will shape the global beverage alcohol market in 2021

New technology drives ecommerce innovation in the US

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, Asia Pacific | TREND: All, Digitalisation |