06/05/2021

The US and China offer resilience and opportunity for drinks groups

Strong performances in China and the US have shielded multinational drinks companies from the fallout of Covid-19 in recent months. IWSR examines the reasons why.

The latest influx of financial results from the world’s biggest drinks firms have painted a similar picture: positive organic sales, with the US and China driving growth and mitigating losses incurred by the pandemic. Together, the markets account for a third of global alcohol volume and over 40% of global value, according to IWSR data.

Leading the charge in the results announcements were France’s top distillers. For the first nine months of its 2020/21 fiscal year, Pernod Ricard reported organic sales growth of 1.7%. In the US, the group registered mid-single-digit growth, while in China Pernod Ricard saw gains of 34%. For its full 2020/21 period, Rémy Cointreau witnessed organic sales growth of 1.8%, in large part thanks to “excellent momentum” in Cognac consumption in the US and China.

Moët Hennessy, meanwhile, announced a 36% uplift for wine and spirits in Q1 2021 compared to Q1 2020 and +17% versus Q1 2019 – showing strong growth even compared to pre-pandemic times. Regarding its latest results, the group highlighted a “strong rebound” in China and “robust demand” in the US. In its first quarter results, Moët Hennessy reported a 22% increase in Champagne volumes, driven by the US and Europe, and a 28% increase in Hennessy Cognac volumes, driven by China.

Since early 2020, IWSR has been tracking the on-going impact of the pandemic on the beverage alcohol industry and on shifts in consumer behaviour. Based on initial assessments of 1H 2020 performance combined with market forecasting, in October 2020, IWSR advised its clients of the growth opportunities and resilience likely to be provided by the US and Chinese beverage alcohol markets. IWSR insight shows that there are unique aspects of each market that are driving resilience, as well as some trends that both markets share.

China’s economy quickly bounced back from the crisis, experiencing a V-shaped recovery aided by increased demand from overseas markets for its domestically made physical goods, such as furniture and electronics. Furthermore, following a rapid suppression of the virus, everyday life in China has almost returned to normal.

Tommy Keeling, research director at IWSR, notes that most Chinese consumers are “perfectly comfortable going out and don’t mind the extra contact-tracing.” IWSR’s consumer sentiment tracking has shown that between August and December 2020, China was one of the few markets to show consistent increases in consumer willingness to visit the on-premise.

Not only are Chinese consumers more comfortable going out, but IWSR consumer research shows that they are also willing to spend more when they do. The loss of international travel means Chinese consumers are enhancing their domestic spend, some of which has filtered into drinks. Many consumers are also looking to vacation within the country, which is contributing to a boost in travel retail sales for destinations such as Hainan.

Last year, the Chinese government tripled Hainan’s duty-free allowances to CNY100,000, further driving growth. The destination is expected to become a key driver of global travel retail growth for high-end international brands, with a number of travel retailers and suppliers pouring investment into the area.

“Based on external forecasts, Hainan is expected to represent 18% of total global duty-free business before 2024, with China representing 30% on a similar time frame,” a Beam Suntory spokesperson tells IWSR.

There are also inherent characteristics of the US market that have contributed to its resilience. Around 80% of the market’s drinks consumption takes place in the off-trade, meaning the shift to at-home consumption was an easier transition for consumers during lockdowns.

Brandy Rand, IWSR’s COO of the Americas, also observes, “the dinner table experience at home was heightened during the pandemic, which led to people wanting to spend more or invest more time in making those moments and occasions special.”

Furthermore, the US’s developed ready-to-drink (RTD) category contributed to the resilience of its total drinks market over the course of the pandemic. Since they offer convenience and portability, RTDs were crucial in facilitating the transfer from on-trade to home consumption during lockdown. “RTDs are also more premium, and the big spend in spirits was a halo effect for more premium RTDs,” says Rand.

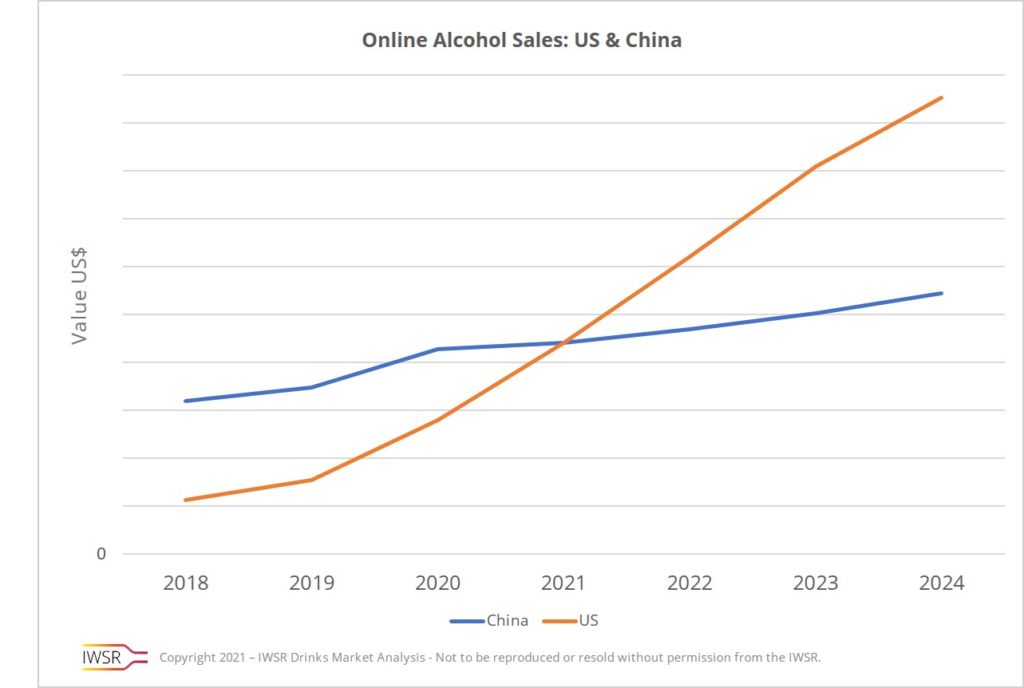

In terms of shared trends, both the US and China have seen a dramatic rise in ecommerce. IWSR research shows that in 2020, the value of beverage alcohol ecommerce across 10 key markets increased by 42%, driven largely by the US and China. China is the world’s largest alcohol ecommerce market, but it is set to be overtaken by the US by the end of 2021.

China has long had an established online market for alcohol drinks, and the channel massively accelerated in the US during the pandemic, likely altering consumer-purchasing habits in the long-term.

IWSR data indicates that in China, alcohol ecommerce value sales grew by around 20% in 2020, while in the US sales skyrocketed by 80%, aided by the (temporary) loosening of regulations. In the US, 44% of alcohol e-shoppers only started buying alcohol online in 2020, compared to 19% in 2019. In China, older millennials were shown to drive the most demand online, and with a population of almost 400 million millennials in China, the opportunity for further growth is ripe.

Online sales of beverage alcohol in China are expected to continue growing over the next five years, despite the market’s skew towards the on-trade. Combined, the US and China will make up approximately 70% of the global ecommerce alcohol market value by the end of 2024.

Another trait shared by the US and Chinese market is the increase in luxury spending among some segments of each nation’s population. With more disposable income saved up over the past year, some consumers now find themselves substantially wealthier than before the pandemic. As such, they are treating themselves to luxury purchases, which in turn is driving value growth in some alcoholic drinks segments, such as Champagne and Cognac.

With the trends that are currently driving the beverage alcohol industries in the US and China set to continue, the markets will provide growth opportunities for brand owners across beverage alcohol.

You may also be interested in reading:

How will the on-premise business model change post-Covid-19?

5 key trends that will shape the global beverage alcohol market in 2021

New technology drives ecommerce innovation in the US

The above analysis reflects IWSR data from the 2020 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, Asia Pacific, North America | TREND: All |