22/07/2021

Are hard kombuchas the next better-for-you hard seltzer?

While still a small category relative to hard seltzers, hard kombuchas tend to be positioned at a premium price-point, enhancing value for brand owners

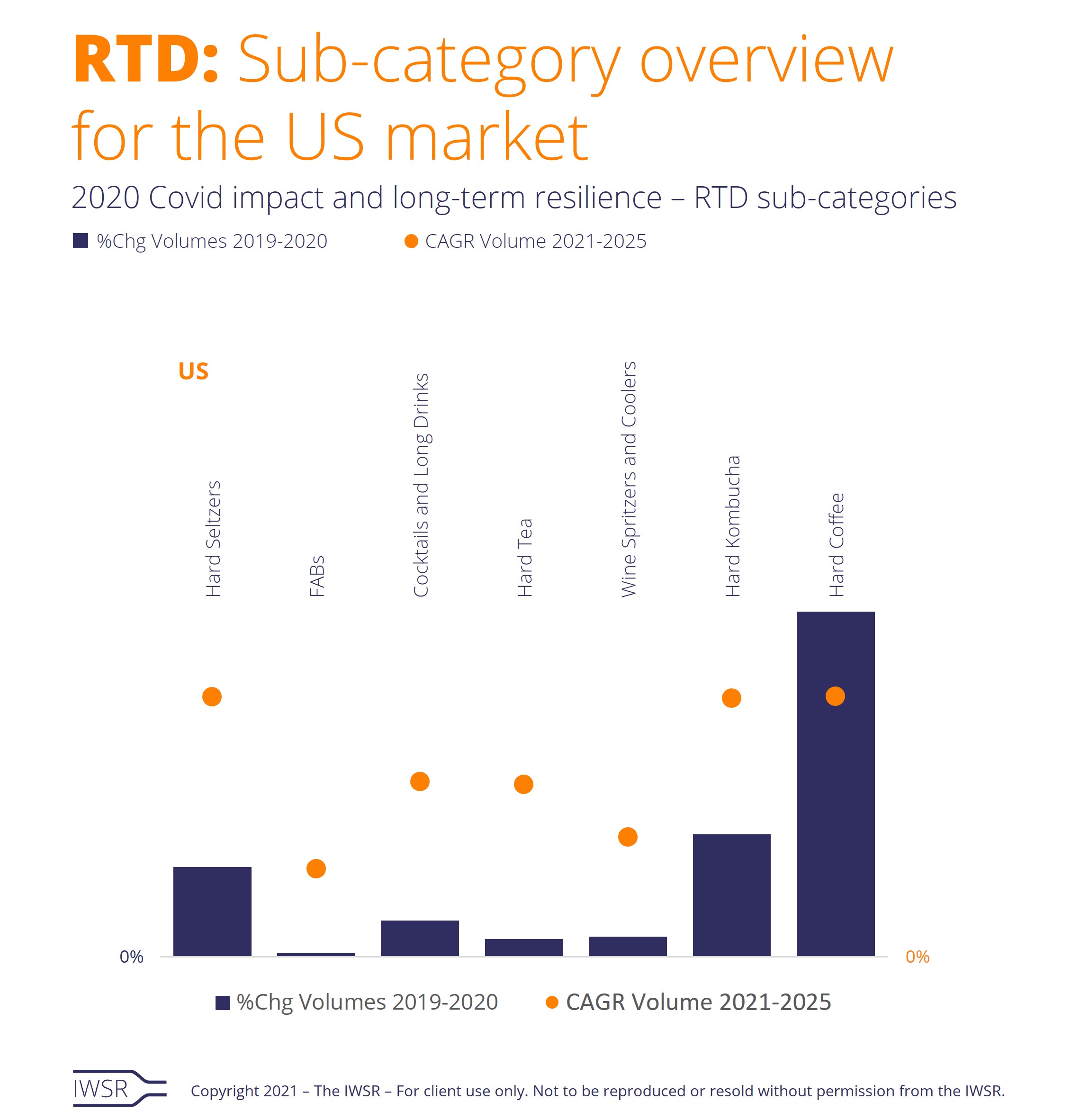

Hard kombucha RTDs are poised for growth in the years ahead, buoyed by the dynamic expansion of the adjacent hard seltzer category and consumer trends around health and wellness.

While the US is set to be the driving force for hard kombucha in the short to medium term, other markets, such as Australia and the UK, will provide pockets of growth as more brand owners, including a number of brewers, explore the category.

“These new entrants are driving the diversification of hard kombucha through innovative flavour combinations, differing levels of alcoholic strength and fresh packaging formats – from the slimline cans favoured by hard seltzers to regular cans and bottles traditionally used by beers,” remarks Brandy Rand, COO Americas at IWSR.

The first hard kombucha was launched in the US in 2010, but the category recorded exponential growth off a small base between 2017 and 2020 – and volumes are expected to more than double by 2023, driven predominantly by demand in the US. While still a small category relative to hard seltzers, hard kombuchas tend to be positioned at a premium price-point, enhancing value for brand owners.

As well as attracting pure players, hard kombuchas have piqued the interest of brewers across the US, who are drawn by both the potential of the category, and its proximity to hard seltzers. These include Anheuser-Busch InBev, which has backed the Kombrewcha brand through ZX Ventures, its incubator arm. Kombrewcha recently increased its ABV from 3.2% to 4.4%, placing it in the ‘sweet spot’ inhabited by many hard seltzer brands.

The hard kombucha trend has its roots in regular kombucha, a fermented soft drink made with sweetened black or green tea, often blended with fruit juice. Its probiotic properties, said to benefit the digestive system, have made it a favourite with consumers prioritising health and wellness.

“While hard kombuchas are alcoholic, they still benefit from the halo effect of these perceived health benefits – and many brands play upon this by highlighting their probiotic properties, as well as wellness-friendly ingredients such as enzymes, organic acids, vitamins and minerals,” adds Rand.

Some of these attributes are specific to hard kombucha, but these products share many characteristics with hard seltzers: they are typically low in calories, sugar and carbohydrates, as well as often being organic, non-GMO and gluten-free. Increasingly, producers are releasing products with fewer calories and lower carbs, allowing them to compete more directly and effectively with hard seltzers.

Many brand owners call attention to these properties by packaging their hard kombuchas in the slimline, single-serve aluminium cans that are already strongly associated with hard seltzers – although some brewers have preferred to use bottles or larger cans instead. However, the properties of hard kombucha – the use of fermentation, fruit flavours and carbonation – enable the category to align itself and compete with other alcoholic drinks, positioning it as a potential alternative to beer, wine, cider and cocktails.

This aspect is enhanced by the fact that, while many hard kombuchas are closely connected to hard seltzers, brand owners are increasingly exploring the fringes of the category with variations such as canned RTD cocktails, hard kombuchas fermented with Champagne yeast and hybrid products combining hard kombucha with beer.

This rising diversification of the hard kombucha category is also illustrated by the innovative use of unusual taste profiles, with brands rarely replicating each other’s flavours, but releasing unique combinations such as Huckleberry Basil (Luna Bay), Green Apple & Hemp (Brewhaha) and Watermelon Cucumber & Lime (Naughty Booch). Brand owners are also looking to varying levels of alcohol to provide them with a USP: as with RTDs in general and hard seltzers in particular, much activity is focused around the 4.1-5% ABV, but there has been a significant increase in launches of both lower- and higher-ABV products in recent months.

As more brands enter the market and look to carve out their own distinctive niche, this increasing diversification in terms of flavour, strength and packaging should serve to expand the appeal of premium-priced hard kombucha – predominantly in the US, but also in other global markets – in the years to come.

You may also be interested in reading:

The US and China offer resilience and opportunity for drinks groups

5 key trends that will shape the global beverage alcohol market in 2021

New technology drives ecommerce innovation in the US

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, RTDs | MARKET: All, North America | TREND: All, Convenience |