18/01/2024

Are RTDs in the US learning enough from craft beer?

IWSR analysis shows that consumers may be becoming immune to new RTD products or brands in a way reminiscent of the recent history of craft beer in the US

The dynamic and fast-moving RTD category in the US could risk the same challenges that faced craft beer, with an increasingly saturated market overwhelming consumers and leaving them confused about which product to choose.

IWSR data shows that the number of RTD brand lines available in the US has more than tripled between 2018 and 2022. Over the same timescale, the total RTD category in the US registered strong growth from 2018 to 2020 – volumes rose by double digits each year, 2018-2021 – before decelerating in 2022 (flat growth).

“There are signs that consumers may be becoming immune to new products or brands in a way reminiscent of the recent history of craft beer in the US,” says Marten Lodewijks, Consulting Director – North America, IWSR. “As the number of brands and new variants on the market increases, growth rates are tailing off.”

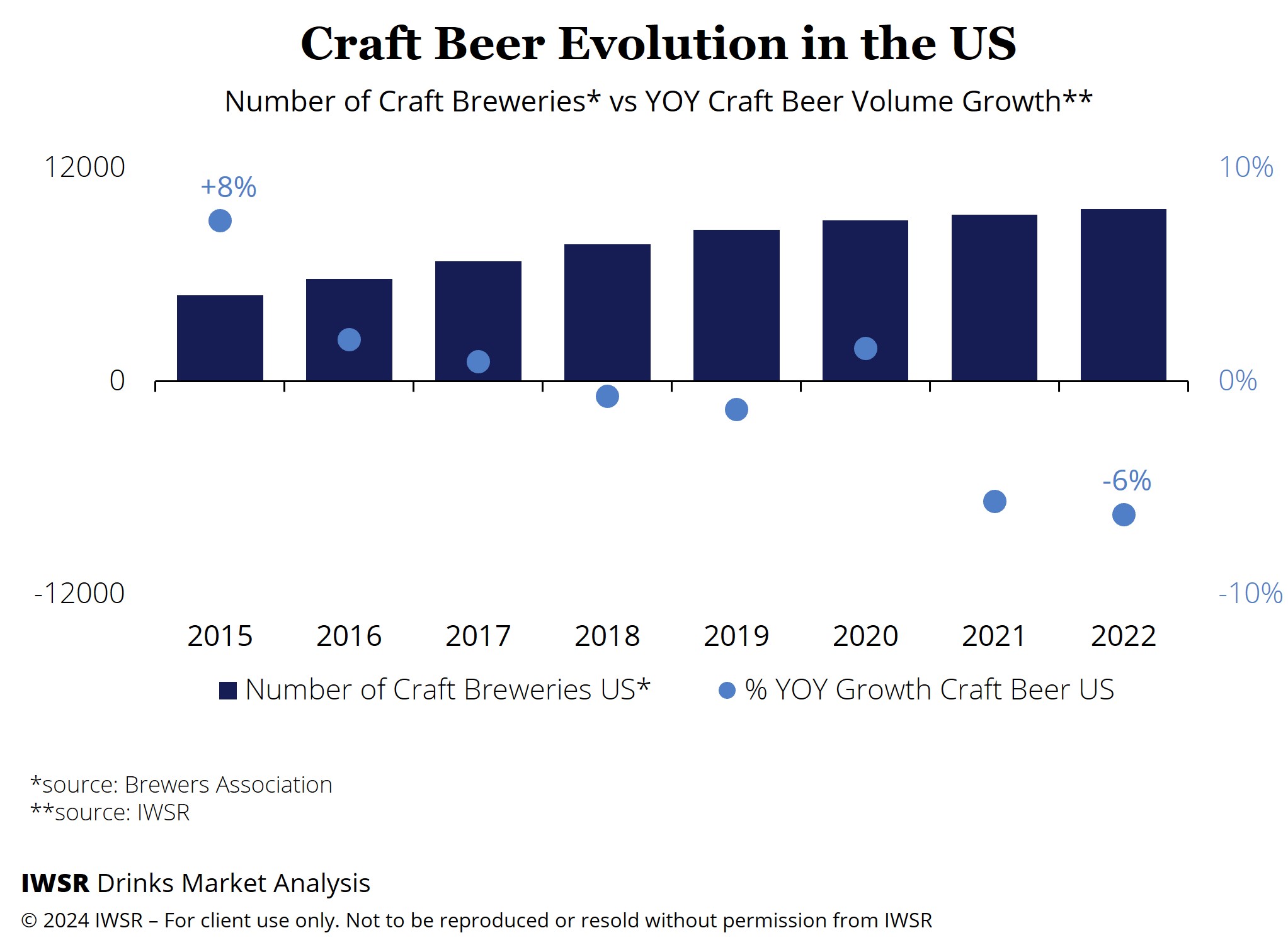

There are clear echoes of a similar recent trend in craft beer: the number of craft breweries in the US doubled between 2015 (4,847) and 2022 (9,709), according to Brewers Association figures.

However, IWSR data shows that the craft beer category’s strong volume growth at the beginning of the period (+8% in 2015) slowed and then headed to reverse, with volumes declining by -6% in both 2021 and 2022. Most volumes are now sold through taprooms and on-site, leaning into a sense of community for consumers.

“The glut of brands that emerged during the peak of the craft beer movement in the US essentially led to a ‘de-branding’ of the category,” explains Lodewijks. “Instead of buying based on brand, consumers instead started to focus on expressions and flavours of beer, due to the overwhelming number of breweries and brands.

“RTDs may now be moving in the same direction. The importance of ‘brand’ risks being overtaken by other attributes as consumers become overwhelmed.”

A tipping point in flavour expansion

According to IWSR consumer research, the influence of brand on purchasing decisions is declining. When asked in June 2023 of what helped them to select an RTD, consumers in the US mentioned flavour (53%), alcohol base (36%), type of cocktail/long drink (35%), and ABV (31%) ahead of well-known brand (27%).

“Consumers like trying new products,” says Susie Goldspink, Head of RTD Insights, IWSR. “In RTDs, this is mainly new flavours, but it also involves trying – for instance – a spirit-based hard seltzer versus a malt-based product.

“As the category initially grows and establishes itself, the more new options there are, the better. However, there comes a tipping-point where suddenly a brand owner launches six new flavours at once, and the calculus changes.

“Trying six new flavours is firstly expensive, and many of them may not be flavours of interest – so they end up choosing based on flavour they like, and often revert to the familiar products that they know and trust rather than exploring new innovations.”

Both industries, craft beer and RTDs, also have a history of piggy backing trends, shortening the trends lifecycle. This was seen with hard seltzers in the RTD space, and with Hazy IPAs for craft beer. This approach can saturate the market, reducing the ability for a brand to clearly stand out.

Nonetheless, a number of recent high-profile co-brand launches – examples including Jack Daniel’s & Coca-Cola, and Absolut Vodka & Sprite – could yet restore the importance of brand to the RTD category.

Familiarity with brand is still a strong driver of choice among US consumers – Boomers especially.

Balancing consumer exploration with brand building

Lodewijks also sees some important differences between RTDs and craft beer in terms of product/brand fatigue. “Craft beer became so cluttered with new brands (not just new products) that consumers had no idea of how to navigate the category, and had nothing to turn back to,” he explains.

“RTDs aren’t there yet, because they have a few strong anchor brands – but product proliferation could yet prove problematic if it continues unchecked.”

It’s important for the incumbents to show discipline while building the RTD category. They need to provide the consumer with a category structure that is understandable and navigable.

New entrants can, and should, explore the boundaries but should beware not to sow confusion by trying to do too much at once.

“Consumers love novelty and variety, but too much and we get decision paralysis, which will simply stall momentum,” Lodewijks notes. “Exploration needs to be tempered with brand building and if brands are constantly changing their offering, consumers won’t understand what your brand stands for.”

Note to readers: IWSR defines craft breweries as US operating breweries that are small (annual production of 6m barrels of beer or less) and traditional (a brewer that has a majority of its total beverage alcohol volume in beers whose flavour derives from traditional or innovative brewing ingredients and their fermentation). Note this definition differs from that used by the US Brewers Association.

You may also be interested in reading:

Growth drivers for the US ready-to-drink RTD market

Home consumption vs the on-trade: have pandemic behaviours become entrenched?

Has premiumisation stalled?

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Beer & Cider, RTDs | MARKET: All, North America | TREND: All, Convenience |