01/12/2021

Drinks companies diversify as category lines blur

Drinks companies are responding to evolving consumer behaviours by moving into previously unexplored categories to diversify their portfolio and mitigate risk

The beverage industry is entering a new era of category convergence as previously ‘pure’ beer, wine, spirits and soft drinks players adopt a more holistic approach to target a wider range of consumer preferences and occasions.

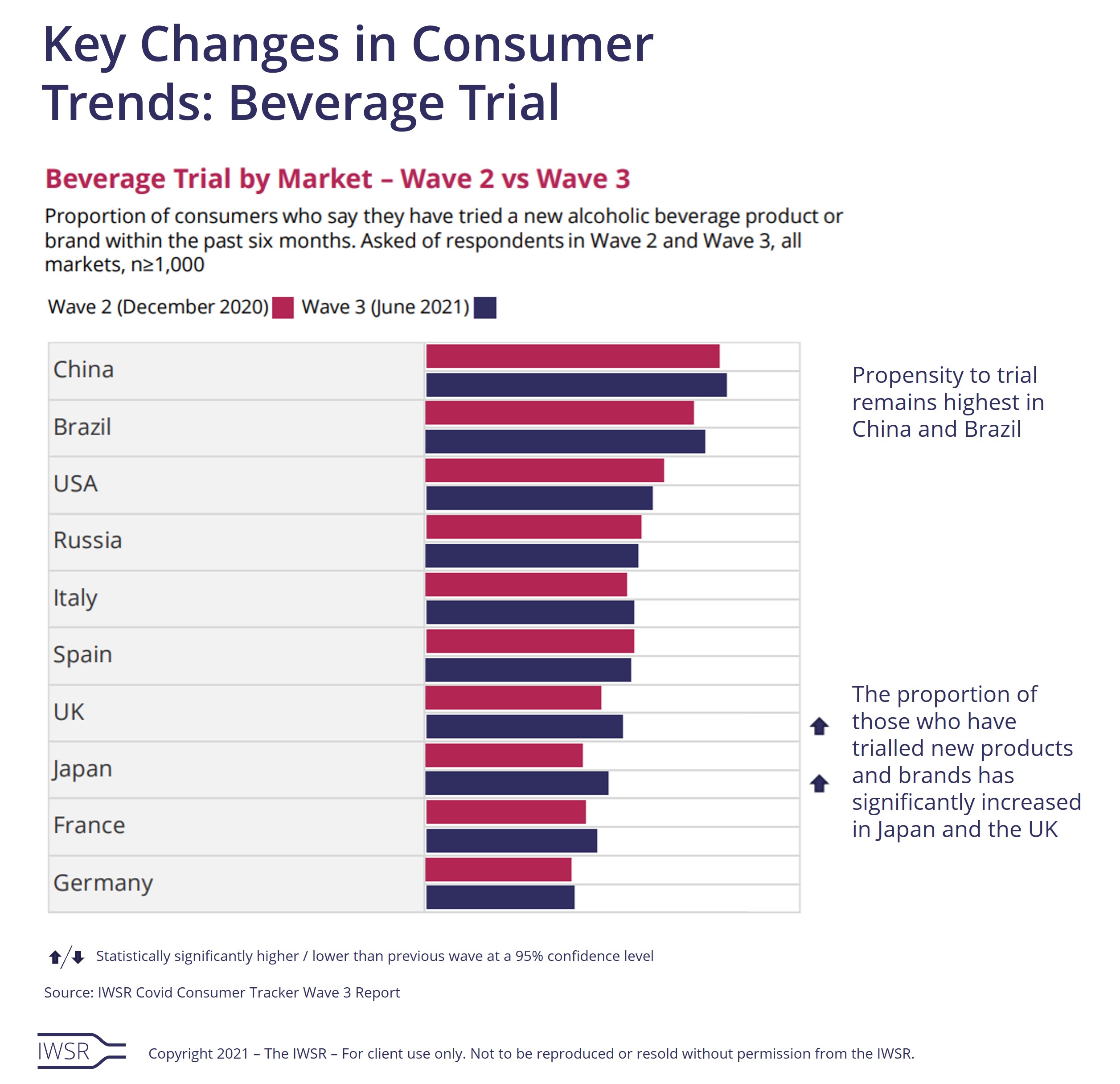

Consumer research from IWSR shows that people are switching with increasing frequency between beverage options or trialling new beverages altogether. In first half of 2021 alone, craft beer and beer have proven to be strong categories for new product trial among consumers in 10 key beverage alcohol markets. Hard seltzers, wine and Japanese whisky have also shown strong consumer product trial interest, signalling a wide repertoire across category trial.

Drinks companies are responding to this evolving consumer behaviour by moving into previously unexplored categories to diversify their portfolio and in some cases, proactively plan for the softening or decline of existing core brands and/or categories. Diversification also better positions beverage alcohol categories to address changing consumer tastes and the blurring of lines between traditional soft drinks and alcohol, or alcohol adjacent products, which can include CBD and other enhancements.

This shift is illustrated by Dutch brewer Heineken’s recent acquisition of a majority stake in South Africa-based total beverage alcohol operation Distell, and in the speculation over a potential merger between soft drinks business Monster Beverage Corp and Constellation Brands.

But this blurring of the lines between rival beverage categories has been occurring for some years. AB InBev recognised this shift in 2016 when they announced increased investment in their Beyond Beer portfolio which the company said contributed to $1.2b in revenue in 2020. This suite of beverages consists of products such as canned wine, hard seltzers, prepared cocktails and FMBs.

Molson Coors Beverage Company (formerly Molson Coors) changed the longstanding company name to represent a shift toward a wider beverage portfolio outside of just beer. The company has also invested in non-alcoholic beverage categories such as Zoa Energy, an energy drink created by a team that includes Dwayne “The Rock” Johnson, and VYNE botanical hop infused sparkling water.

Other examples include E&J Gallo, which owns High Noon, the top-selling vodka-based hard seltzer in the US, and has recently acquired RumChata, a cream liqueur. The company’s New Amsterdam vodka line is also performing well and future forays in the spirits space are part of the growth strategy.

Boston Beer and Beam Suntory announced a strategic partnership in 2021 – initially developing RTDs for Beam’s Sauza Tequila, and a spirits line for Boston’s Truly hard seltzer – and Boston Beer has also developed the Hard Mtn Dew FMB range in collaboration with Mountain Dew owner PepsiCo.

Meanwhile, The Coca-Cola Company has made an additional move into the beverage alcohol space, launching Topo Chico hard seltzer – based on the namesake mineral water brand – in the US, in partnership with Molson Coors. The company’s first alcoholic product was a chuhai (type of RTD) called Lemon-Do that launched in Japan in 2018.

There are multiple reasons for brand owners to diversify their product portfolio, including a desire to spread the risk of category decline. Molson Coors, for example, made the first large-scale move to focus more on streamlining and premiumising their portfolio by discontinuing 11 beer brands that make up 100 SKUs.

Strengthening the growth profile for a company and mitigating risk are important factors. For example, major US brewers want to reduce their exposure to mainstream lager, which is in long-term decline. In order to achieve this, they need to take positions in categories that show healthier growth trends.

Some drinks companies may also be targeting higher-margin growth opportunities – for instance, by moving from beer or wine into spirits – but such motivations should not be overstated, says IWSR director Thorsten Hartmann.

He explains: “There is also a proactive element at play, where brand owners have simply learnt that today’s consumers – and certainly today’s younger LDA consumers – have become more adventurous than the brand owners are necessarily used to.

“Shifting sands of consumer occasion and their beverage pairings, therefore, need to be addressed both in terms of available portfolio and how this portfolio is brought to market.”

The impact of the Covid-19 pandemic has also influenced industry boardrooms in this area, says Hartmann. “The year 2020 has been an unprecedented social experiment, and beverage brand owners have sought to really understand their consumers, and what these consumers may be missing from their current portfolio.”

So far, category convergence has not been truly transformative, in that the companies embarking upon it remain largely reliant on their core categories for the vast majority of their revenues and profits – but there may also be less tangible benefits attached to the change in strategy.

“Part of the motivation is to better understand the adjacent and competing categories to their core sectors, and to use small-scale investments to learn more about these adjacent products,” says Emily Neill, COO Research, IWSR. “There’s also an element of experimentation and innovation at play.”

Hartmann echoes this point. “Any activity outside their core expertise helps brand owners to understand consumers and relevant occasions better,” he says. “There are also obvious synergies: for example, Coca-Cola bottling partners have been active in third-party beverage alcohol distribution for some time, before The Coca-Cola Company itself entered into alcohol brand ownership.”

As a result of this broader philosophical shift for beverage companies, future cross-category M&A activity is a distinct possibility, especially as brand owners try to identify alternative growth opportunities and make efficiency gains in the face of inflationary pressures and rising input costs.

“What we are seeing is a new school of thought in the beverage industry,” says Neill. “Companies are no longer selling products to groups of consumers, but are selling products that fit particular consumption occasions. Having a wider portfolio allows them to be more exhaustive in their approach – and, while this desire brings with it route-to-market and merchandising considerations, formal co-operation or M&A can help with these issues.”

Consumer research insights from Wine Intelligence, a division of the IWSR Group, further highlights the shift in consumer attitudes towards consumption occasions. In markets such as the US, UK and Canada, for example, although sparkling wine is still not the primary drink of choice for informal occasions, there has been a significant increase in the proportion of consumers enjoying it at both informal meal and non-meal occasions – not just at larger scale or celebratory occasions.

Another sign of traditional beverage alcohol companies expanding their scope is the recent wave of senior management appointments from outside the immediate beverage alcohol world. This is sure to inject more proactive thinking from beyond the beverage alcohol realm, with brand owners becoming more adept as consumption occasion-centric CPG [consumer packaged goods] companies.

[table id=11 responsive=stack /]

You may also be interested in reading:

Brewers turn to product diversification to secure long-term growth in the US

Should spirits companies adopt FMCG strategies to win in hard seltzer space?

Should brand owners buy their way into ecommerce?

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All |