11/11/2021

Should brand owners buy their way into ecommerce?

IWSR analyses the evolving ecommerce landscape as brand owners increasingly invest in the channel

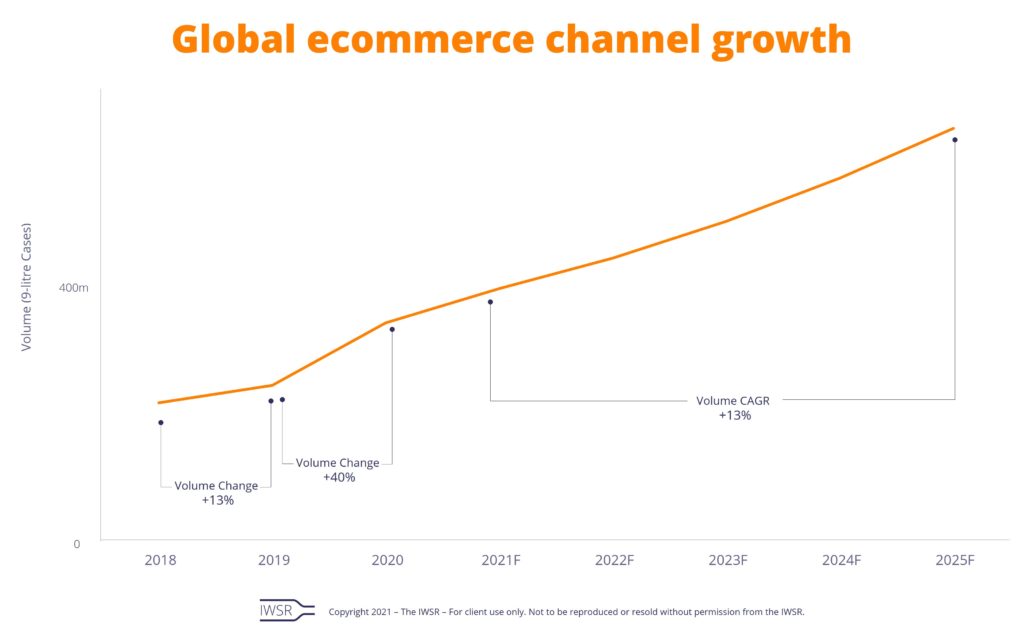

The global ecommerce channel saw online alcohol sales rise by almost +40% in the 2019-20 period, up from growth of +13% in 2018-19, according to IWSR analysis. This growth trajectory is expected to continue – IWSR data shows that global ecommerce will take increasing market share year-on-year, as consumers return to the on-premise, and the off-trade B&M gets squeezed. (click chart below to enlarge)

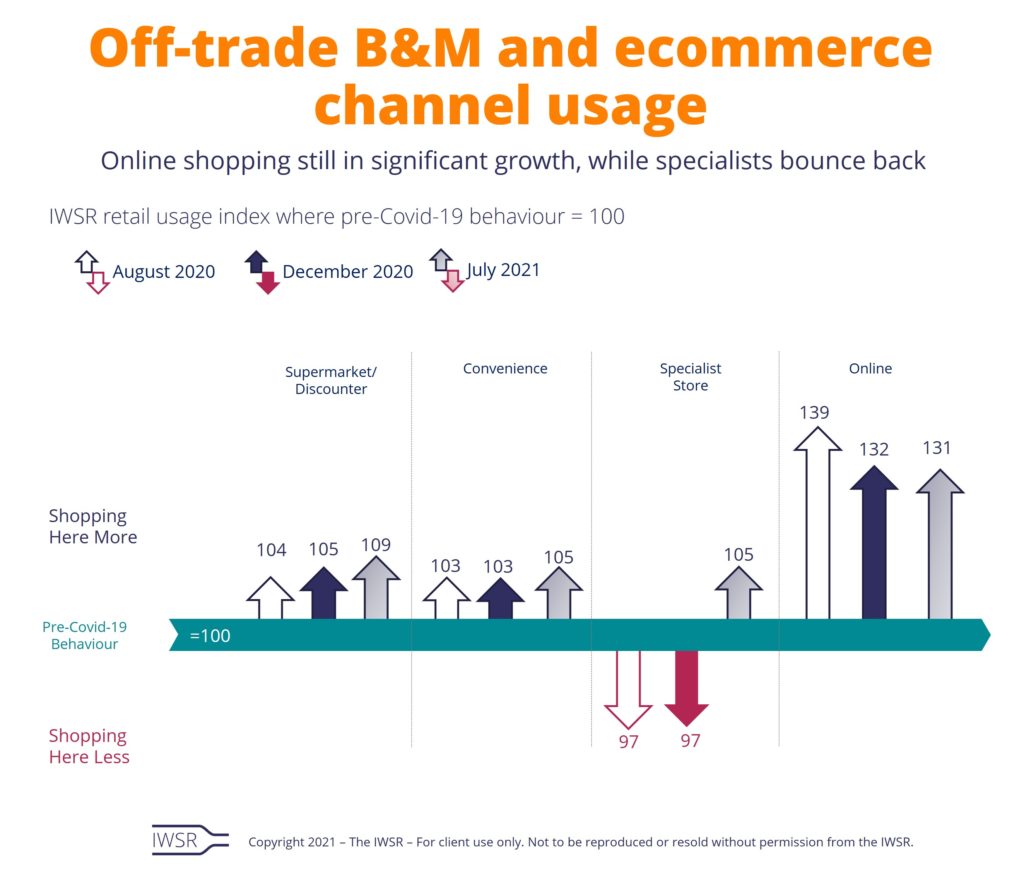

Led by evolving consumer behaviour (click chart below to enlarge), brand owners have been investing in their ecommerce strategies through acquiring ecommerce platforms, launching their own ecommerce sites (such as Heineken-owned Beerwulf), creating white-label storefronts (such as the online e-boutique launched by The Macallan), and/or ensuring their products are available on third party marketplaces or ecommerce sites.

The industry has seen a number of ecommerce acquisitions, such as AB InBev’s purchase of Master of Malt’s owner back in 2018. More recent acquisitions include Pernod Ricard’s purchase of UK-based The Whisky Exchange in 2021 and Campari Group buying a 49% stake in Italy’s Tannico in 2020 – a move which has since evolved into a joint venture with Moët Hennessy to develop a pan-European ecommerce platform.

“Buying into ecommerce allows brand owners to add to their overall ecommerce strategy – but it should not replace or define their full ecommerce investment,” says Thorsten Hartmann, director of custom analytics at the IWSR.

Pernod Ricard’s purchase of The Whisky Exchange follows the company’s earlier acquisitions of European drinks etailer Uvinum in 2018 – rebranded in 2020 as Drinks&Co – and of Spanish platform Bodeboca in 2019.

The long-term aim, according to Drinks&Co MD Louis de Fautereau, is for the platforms to give the consumer everything they need across beer, wine, spirits and soft drinks.

Ecommerce, he adds, can help to accelerate the introduction of new products to market. “If you have a robust platform, then increasing the number of brands you want to distribute is fairly easy, whether that’s 10, 20 or 100,” de Fautereau says.

Beyond offering a fresh distribution channel, owned ecommerce platforms give brand owners a valuable insight into their target consumers, adds Hartmann. “Buying into ecommerce allows brand owners to learn a lot about consumer behaviour, consumer profiling and the wider market,” he points out.

De Fautereau agrees. “We are able to understand how the consumer behaves, when they connect, how many times, their browsing journey, purchasing frequency, what place, what hour of the day,” he says.

“The big challenge is to be able to process and understand the data. Then we can increase the relevance of our communication to the consumer to make sure they get the right product at the right time – and at the right price.”

Such benefits offer a contrast with on-demand alcohol ecommerce delivery platforms – another growth area during the Covid-19 pandemic, with Uber acquiring Drizly in the US for US$1.1bn in February 2021, delivery site GoPuff buying retail chain BevMo! for $350m in 2020, and delivery app DoorDash announcing plans for alcohol delivery services in 20 US states, as well as in Australia and Canada.

“One of the challenges brand owners have with on-demand platforms is that they can’t access information about their consumers unless they buy the data back,” says Hartmann. “All brand owners can do is record their sales into the actual shops, but are unable to glean how much product is sold via B&M versus being picked up by delivery drivers to fulfil an online order.”

A consideration for brand owners acquiring an ecommerce platform is the need to maintain a comprehensive offer of products, many of which could be owned by rival companies. “Some brand owners get concerned their competitor, who now owns the ecommerce site, will receive advance notice of their special offers, product activations, discounts, and so on,” Hartmann notes.

Such concerns are, however, laid to rest by Campari Group CEO Bob Kunze-Concewitz. “When we bought the stake in Tannico, we clarified immediately that the company would remain independent, with its own management and business model,” he says, before adding: “Besides the fact that the management of the platform is independent and takes operational decisions autonomously, antitrust regulations prevent both Campari and Moët Hennessy from having access to specific commercial information pertaining to any competitor.”

In similar fashion, de Fautereau insists that nothing will change for suppliers to The Whisky Exchange post-acquisition. “You will get the same level of attention, service, the same capacity to sell and market your brands online through the platform,” he says. “Our duty as Pernod Ricard will be to demonstrate that you can still do business with us and be as happy as you were prior to the acquisition.”

Thanks to its earlier purchases of Uvinum and Bodeboca, Pernod Ricard already has experience of this. “The first reaction of some [suppliers] was to say we’ll stay and see what happens,” de Fautereau explains. “Some others said we will stop working with you because the shareholder is Pernod Ricard. The reality is that most of them have now come back to us.”

This objectivity is vital to the future of platforms like Drinks&Co and The Whisky Exchange (which will continue to operate independently post-acquisition), according to de Fautereau. “We have a different structure, which allows us to run the business in an independent way, respecting all suppliers, respecting the rules for business that make it fair for everyone,” he says.

“What really matters to us is the consumer, and we want to be fair to the consumer, offering them the products they’re looking for at the right price … Each decision is made from the consumer perspective, not from a company trade marketing perspective. That’s at the heart of those business models set up by these entrepreneurs. This is the best guarantee.”

Kunze-Concewitz echoes the point, while noting that Campari is happy to keep supplying its own brands to rival-owned ecommerce sites. “We believe in fair competition and do not have any concern with selling our brands on such platforms, which we actually do and similarly with many other ecommerce players,” he says.

Maintaining this model is key to the long-term success of beverage alcohol ecommerce platforms, as Kunze-Concewitz acknowledges.

“One of Tannico’s major strengths lies in its very broad offer to meet the needs of consumers who go online and want the widest possible choice,” he says. “Limiting this offer would mean losing this core advantage and the very source of Tannico’s success.”

[table id=11 responsive=stack /]

You may also be interested in reading:

Alcohol ecommerce maturity in Asia Pacific

Will the growth of ecommerce cannibalise sales or offer incremental value?

Consumer curiosity underpins ecommerce evolution

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Digitalisation |