03/06/2021

Global beverage alcohol expected to gain +3% volume in 2021

Resilience in key markets and brand owners’ swift response to changing market conditions leads IWSR to forecast alcohol consumption to grow by +1.5% CAGR 2021-2025

According to new forecasts from IWSR, global beverage alcohol is showing positive signs of recovery, and is projected to grow in volume by +2.9% by the end of 2021.

By 2023, IWSR expects total beverage alcohol consumption to return to pre-Covid levels, with consumption steadily increasing through to 2025. Recovery will be boosted by the industry pivoting rapidly in key markets, the momentum of ecommerce and RTDs, and increasing sophistication of the at-home occasion in many markets. The two fastest-growing categories, according to IWSR forecasts, are no-alcohol spirits and RTDs.

“In many global markets, Covid-19 accelerated the impact and growth of key industry drivers, such as the development of ecommerce, premiumisation, the rise of the ‘home premise,’ moderation, and the need for convenience in product formats,” says Mark Meek, CEO, IWSR. “These are the trends that will also underpin the industry’s resilience as it pivots to meet consumers where they are in the years to come. Additionally, across many markets, some segments of the population now have significantly more disposable income than they did in 2019, some of which will be spent on beverage alcohol products.”

Total beverage alcohol volume decreased by -6.2% globally in 2020, impacted by the near complete shutdown of bars and restaurants around the world. Though an unprecedented downturn, the -6.2% decline was less than previously forecast, as several factors ultimately helped the industry last year, such as: acceleration of ecommerce (up +45% from 2019, to reach US$29 billion in 2020), growth of RTDs, strong at-home consumption in key markets, and resilience and growth in the US and China.

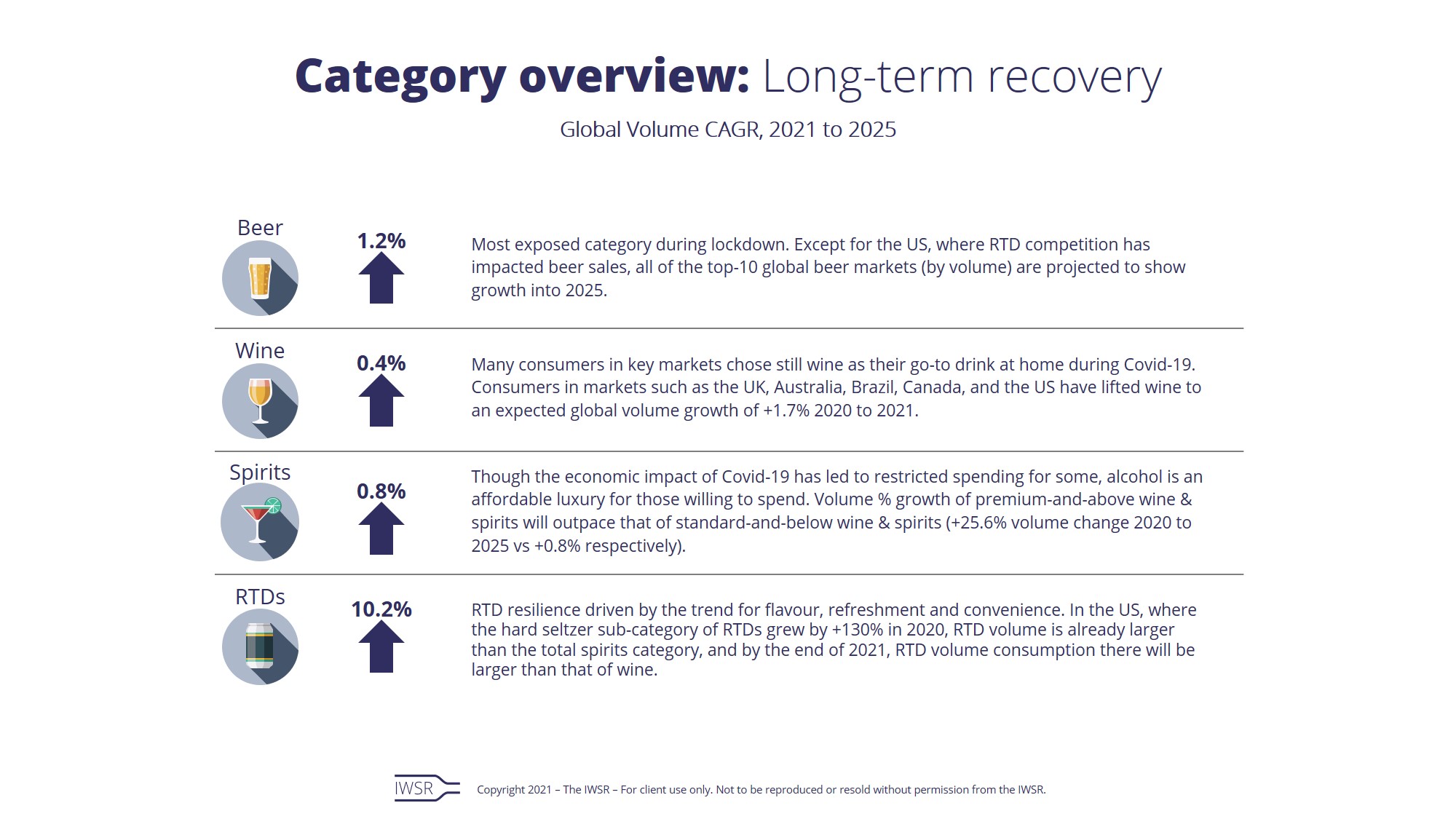

Another pre-Covid trend that will continue to accelerate beverage alcohol recovery is product premiumisation. Though the economic impact of Covid-19 has led to restricted spending for some, alcohol is an affordable luxury for those willing to spend. IWSR forecasts that premium-and-above wine and spirits will increase by +25.6% in total volume 2020-2025 (compared to +0.8% volume growth over the same period for brands in lower price tiers.)

IWSR’s analysis of the outlook of the global beverage alcohol market also shows:

Tequila overtakes rum to become the third-largest spirits category in the US

The global tequila category grew by +9.6% in 2020, driven especially by gains in the US (the world’s largest tequila market) where tequila is now the third-largest spirits category in the country (behind vodka and whisky). Also, thanks in large part to the success of tequila, consumer awareness and interest in mezcal has also lifted that category, and agave-based spirits overall are expected to grow +4.7% (volume CAGR 2021-2025).

Whisky sub-categories have been more impacted by Covid-19, but show long-term resilience

Global whisky experienced a -10.7% volume decline in 2020, but the category is forecasted to rebound in 2021 and continue on its growth path, bolstered by the US and India. Whiskies are among the fastest-growing sub-categories of spirits: Irish whiskey will be aided by the return of the on-trade and strength of new entrants; growth in Japanese whisky and US whiskey will mainly come from both of their respective home markets. Most of the growth for Scotch whisky will come from delayed recovery in the key market of India and eventual revival of global travel retail, especially for premium Scotch.

Gin grows, vodka remains flat

Gin is forecasted to increase +4.5% CAGR 2021-2025, driven notably by Brazil, South Africa, and Russia, and also by brands priced premium-and-above (with this segment projected to grow +11.4% CAGR 2021-2025). Global vodka volume was flat last year and is expected to remain so through to 2025. In Russia, the top global market for vodka, consumers are trading down from premium vodka as a result of the impact of Covid-19, however in the US (the second-largest market for the category), vodka is projected to grow. In total, spirits are expected to grow +0.6% globally this year, and +0.8% CAGR 2021-2025.

Many consumers in key markets chose still wine as their go-to drink at home during Covid-19

Though wine consumption has been in decline, consumers in markets such as the UK, Australia, Brazil, Canada, and the US have lifted wine volumes. In Brazil alone, still wine grew by +28% in 2020, driven by a rise in higher-quality imports and increasingly accessible prices. Conversely, imported wine in China has experienced a steep decline which will contribute to an expected decrease in wine volume in the country 2021-2025.

RTD volume projected to increase by almost +27% in volume this year

RTDs posted double-digit global growth in 2020, resonating with consumers across all demographics, and driven by the trend for convenience, refreshment, and flavour. IWSR projects that RTD volume will increase by +26.6% in 2021, and +10.2% CAGR 2021-2025, driven primarily by growth in the US and Japan, as well as Australia, Canada, and China. In the US, where the hard seltzer sub-category of RTDs grew by +130% in 2020, RTD volume is already larger than the total spirits category, and by the end of this year, RTD volume consumption there will be larger than that of wine.

Top beer markets forecasted for growth

Beer was the most exposed category during lockdown, losing -7.1% volume globally in 2020. However, beer volume is forecasted to grow by +2.5% in 2021, and continue on its growth path over the forecast period (2021-2025). Except for the US, where RTD competition has considerably impacted beer sales, all of the top-10 global beer markets (by volume) are projected to show growth into 2025.

To learn more about the data and trends outlined above:

- If your company subscribes to IWSR’s data, you can log into your account or register as a new user here. If you are unsure, please contact us: enquiries@theiwsr.com

- If you have a press or media enquiry, please email us at press@theiwsr.com

You may also be interested in reading:

The US and China offer resilience and opportunity for drinks groups

5 key trends that will shape the global beverage alcohol market in 2021

New technology drives ecommerce innovation in the US

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.