20/05/2021

How might a Pernod Ricard & Brown-Forman merger shift the industry landscape?

IWSR looks at how the beverage alcohol industry landscape could change if Pernod Ricard and Brown-Forman were to merge

Amid speculation in the Financial Times that Pernod Ricard and Brown-Forman could engineer the spirits industry’s ‘only remaining mega-merger’, IWSR data makes it clear that a merger could have a material impact on beverage alcohol market share and the industry landscape.

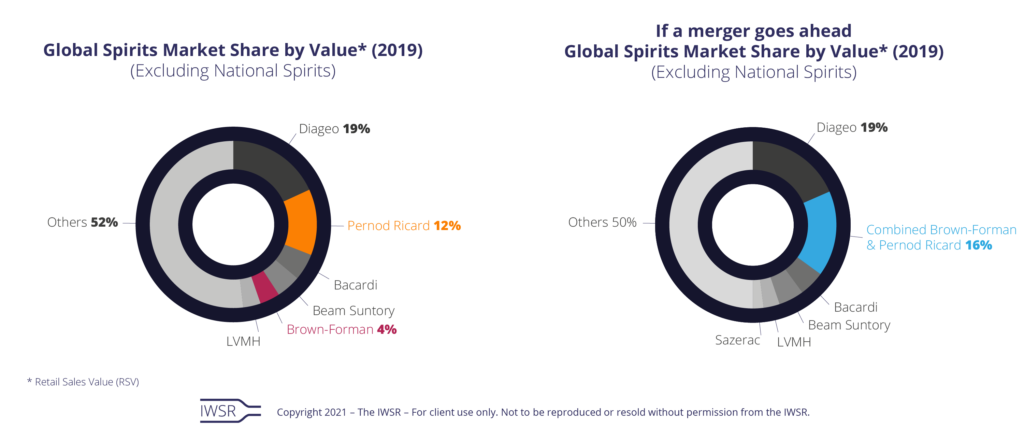

Global Spirits Market

A combined Pernod Ricard and Brown-Forman would rival Diageo’s supremacy in the global spirits market. Pernod Ricard is already a strong global number two behind Diageo in terms of value, and a merger with Brown-Forman would cement that position.

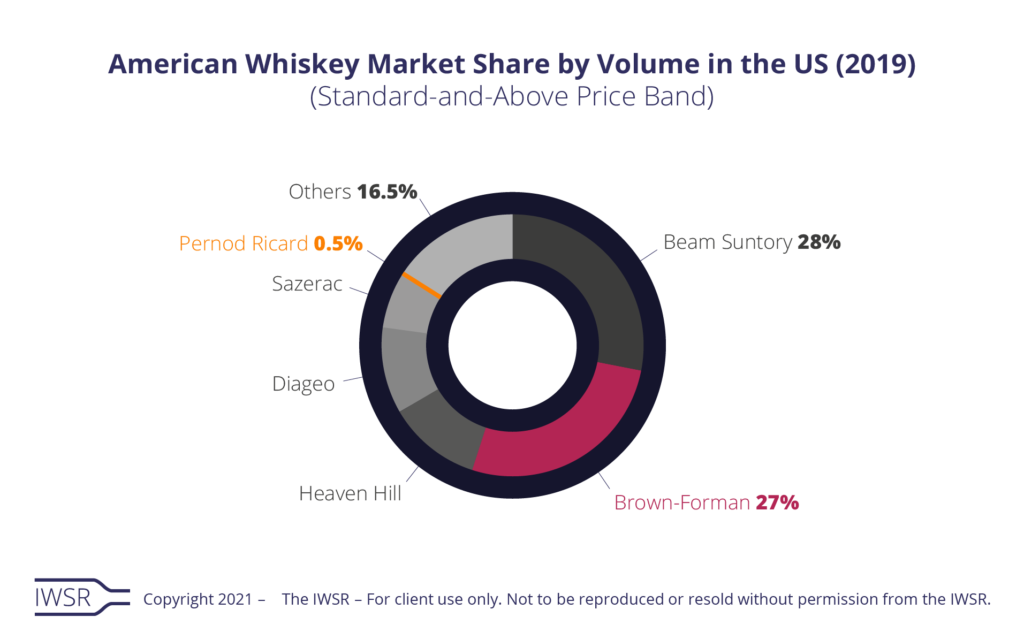

Whisky Market

Brown-Forman’s dominance of the American whiskey market in the US is driven by a portfolio of brands that includes Jack Daniel’s, Woodford Reserve and Old Forester.

Brown-Forman’s whiskey portfolio also gives it a dominant position in many international markets, including in the UK (70% category share by volume) and France (85%).

What is more, Pernod’s distribution network could help Brown-Forman to conquer new markets, such as India, where it currently has only a small presence. Pernod’s strong position in Indian whisky could provide Jack Daniel’s with a launchpad in what remains a difficult market to navigate.

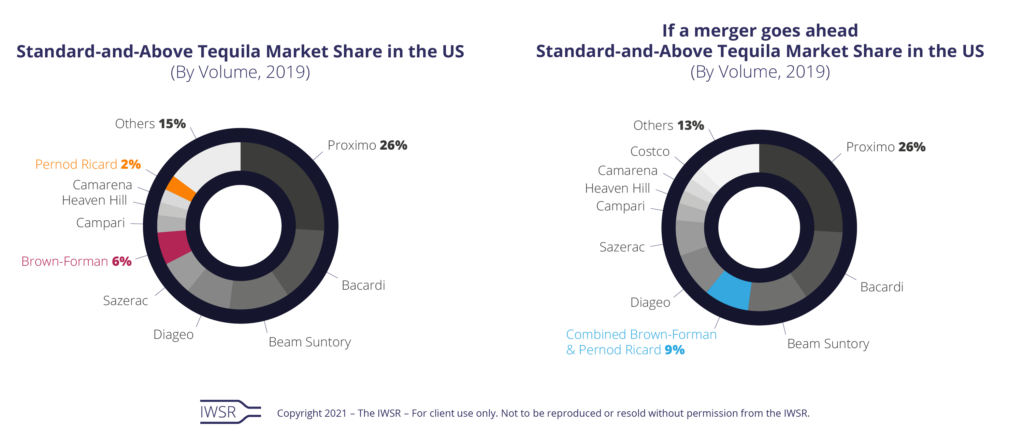

Tequila Market

A merger could elevate a combined tequila business into fourth rank in the crucial US market (driven by Brown-Forman’s investment in the tequila category), albeit with a market share still below 10%, and would create a strong number two in the UK.

There are other opportunities that could come out of a Brown-Forman and Pernod Ricard merger. For example, it could give the current Pernod Ricard portfolio increased access to the US market for the Cognac, wine and Scotch whisky categories. Conversely, a merger could strengthen Brown-Forman’s current position in the gin, vodka and Scotch whisky categories as well. The potential synergies are clear.

You may also be interested in reading:

The US and China offer resilience and opportunity for drinks groups

5 key trends that will shape the global beverage alcohol market in 2021

New technology drives ecommerce innovation in the US

The above analysis reflects IWSR data from the 2020 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.