03/11/2021

How will activation strategies for no/low-alcohol spirits evolve?

IWSR analyses how channel distribution and marketing plans for no/low spirits may change as the on-premise returns in key markets

Brand launches in no/low-alcohol spirits successfully pivoted to target at-home consumption during Covid-19 lockdowns – and their growing presence in direct-to-consumer (D2C) and ecommerce channels is expected to continue in a post-pandemic world. However, brand owners will also increasingly focus on the reopening on-premise, targeting the bartenders whose recommendations are so crucial to driving consumer trial of this emerging category.

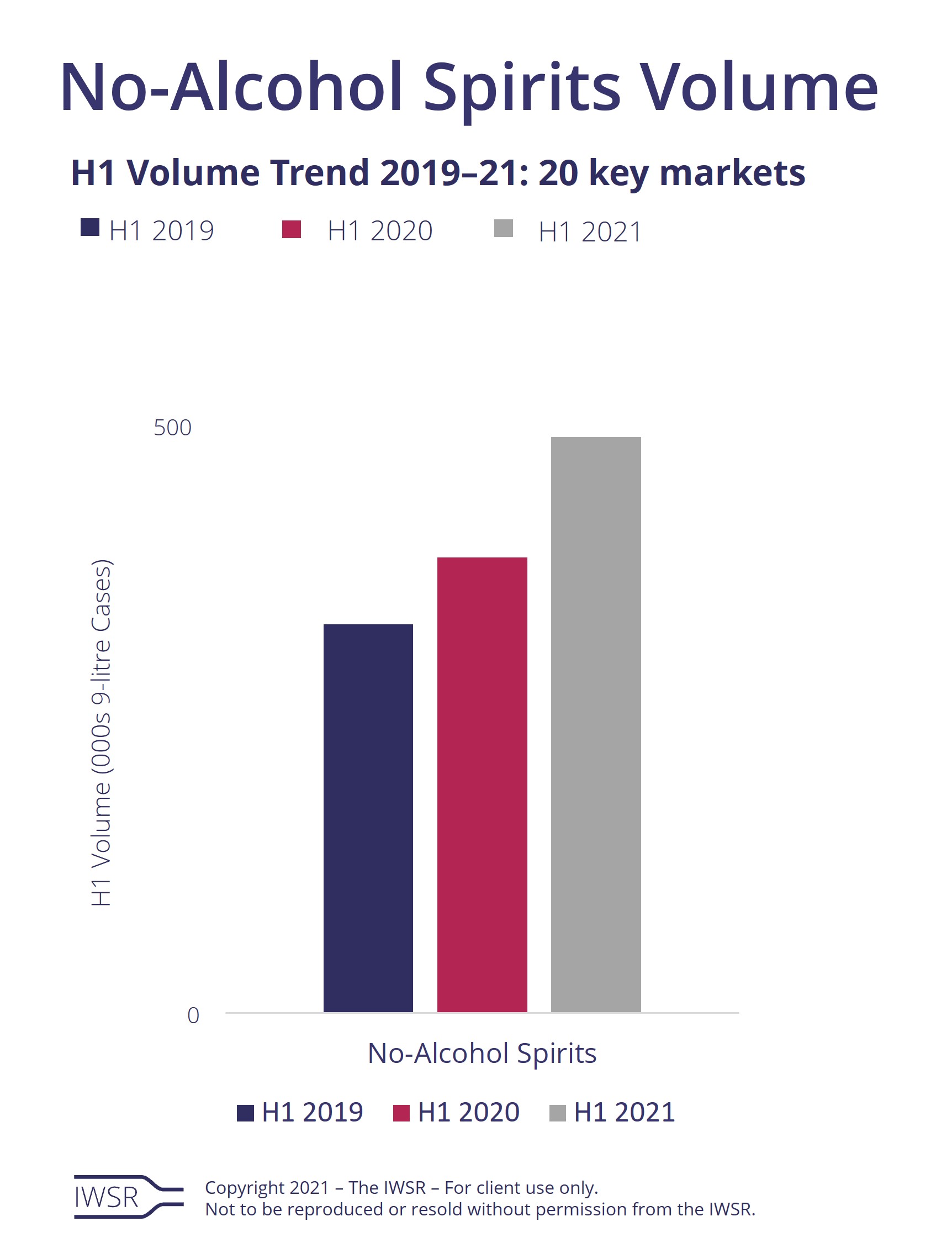

Through 2020 and 2021, the industry has seen a rush of no/low launches from marquee spirits brands, including Gordon’s, Ballantine’s and Sipsmith, as well as zero alcohol line extensions into RTD products (Seedlip, Lyres, Clean Liquor Co, Caleño) targeting the exponential increase in outdoor, on-the-go drinking occasions outside the on-trade. (click the image below to enlarge)

The enforced closure and restrictions on the on-premise also led to a democratisation of opportunity within no/low alcohol, as brands large and small used the same social media platforms and digital strategies to target consumers and to obtain more information and data about their customers. Smaller brands were able to enjoy the advantage of being more dynamic and faster to react to changing circumstances.

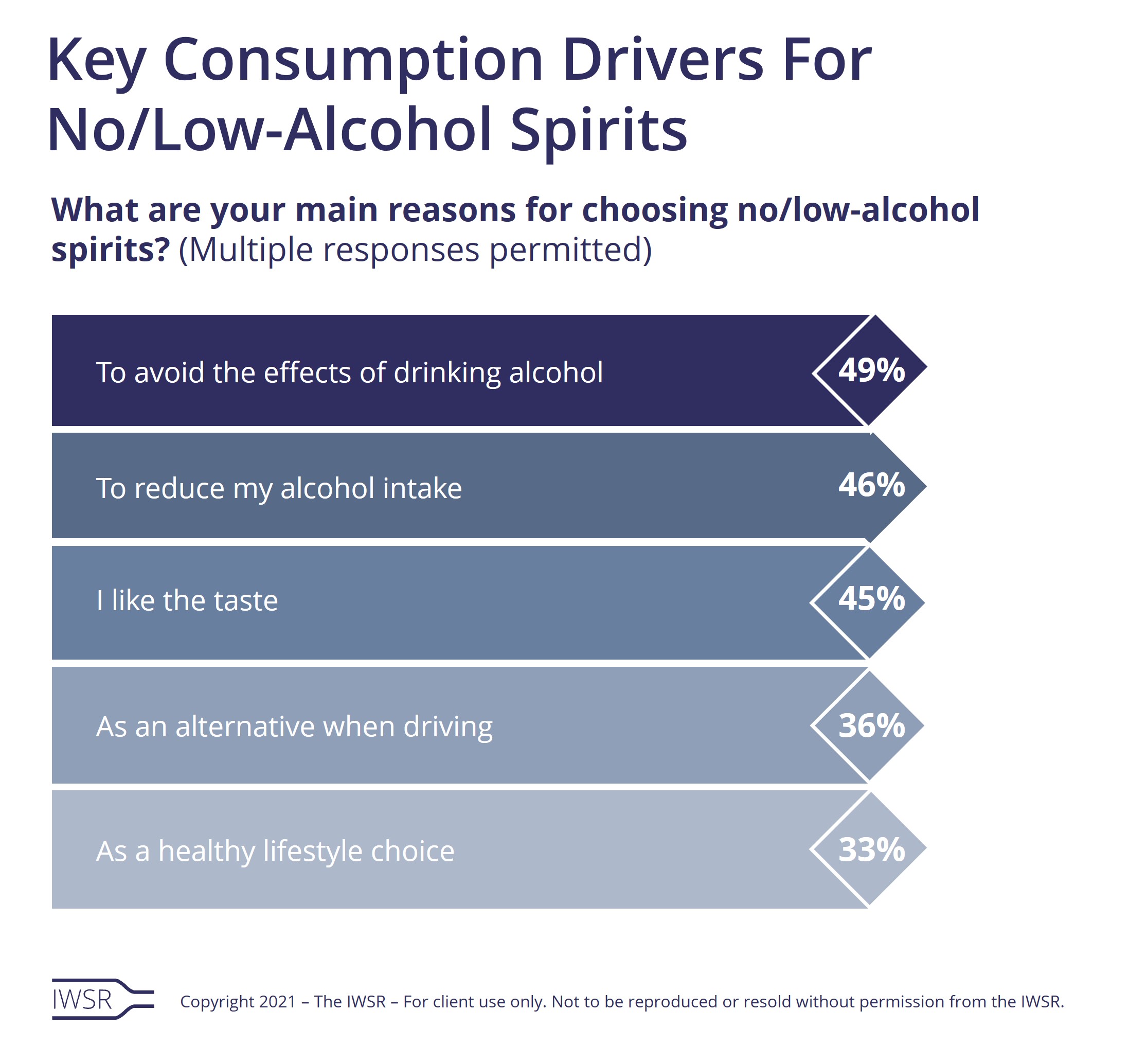

Such tactics helped newly launched no/low spirits brands to tap into growing consumer awareness around health and wellness, which was fuelled by the pandemic, says Emily Neill, COO research at IWSR. (click the image below to enlarge)

“Many established big brands, such as Gordon’s, Beefeater, Ballantine’s, Sipsmith and Tanqueray, have launched their own low or no versions over the past year, enabling them to capture more at-home drinking occasions,” she adds.

“In terms of activations, many tried to focus on events like Dry January to launch and to promote their appeal. There was much more activity on Instagram and other social media platforms than previously, including the promotion of moderation, flavour and botanical-focused language and posts, as well as brands promoting the ‘better for you, better for the world’ positioning.”

UK-based Illogical Drinks launched Mary, its 6% ABV, responsibly sourced ‘botanical blend’, at the height of the pandemic in summer 2020. “We had to focus on ecommerce and D2C, which accounted for 80% of sales as we neared 12 months from the launch,” says Illogical Drinks co-founder and MD Eric Sampers.

“The fact that most people were spending a lot of time at home on their devices … gave D2C brands the opportunity to engage with consumers, and we have registered more than 3,000 consumers through our website, have run some satisfaction surveys, promotions and email marketing. We have learned a lot.”

The enforced closure of pubs, bars and restaurants benefited small, start-up brands, says Neill. “The lack of an on-premise levelled the playing field between the big players, who can afford to ‘pay their way’ into the on-premise through menu listings, etc, and the small businesses who can’t,” she says.

“Instead, they all had the same social media platforms and tools to gain awareness, with small businesses also benefiting from the ‘buy local’ trend and the support for local businesses.”

Covid-19 also necessitated a change of approach for no/low brands that had recently entered the market, such as Elegantly Spirited-owned STRYYK, which had previously placed a strong emphasis on the on-premise to drive awareness of its range of zero-proof spirits, including Not G*n, Not R*m and Not V*dka.

“At the start of the pandemic, we had to pivot our sales strategy for STRYYK to survive,” says Alex Carlton, STRYYK founder and Elegantly Spirited CEO. “We put increased resource, focus and funds behind our D2C model and invested further in other e-comms partners, such as Tesco, Amazon and Ocado. We also sell via our own website.”

As well as securing retail listings with Tesco for Not G*n and Not R*m, the company has brought out a 0.5% ABV line of RTD products, including Not G*n & Tonic and Not R*m & Cola.

Carlton believes that the pandemic has transformed the business: “We had to adapt quickly and the new routes to market have allowed us to introduce STRYYK to new consumers, and also reach them in new ways,” he says.

“We are more analytical and data-driven. We are deep-diving into our customer profiles, looking for patterns, trends, habits to build lookalike audiences and help identify and target more efficiently.

“Growing our direct-to-consumer channel has helped us understand our customer better and given us insights which we can leverage for NPD and marketing. The diversification of channels and strategies also enables us to be nimble and flex to different scenarios.”

According to Neill, D2C and ecommerce are only going to grow in importance in a post-pandemic world. “The evolution of D2C and ecommerce was accelerated by Covid, but we believe that it will continue, not reverse,” she says.

“These trends and shifts in launches and engagement with consumers will continue, with further support from the on-premise ensuring continued category growth.”

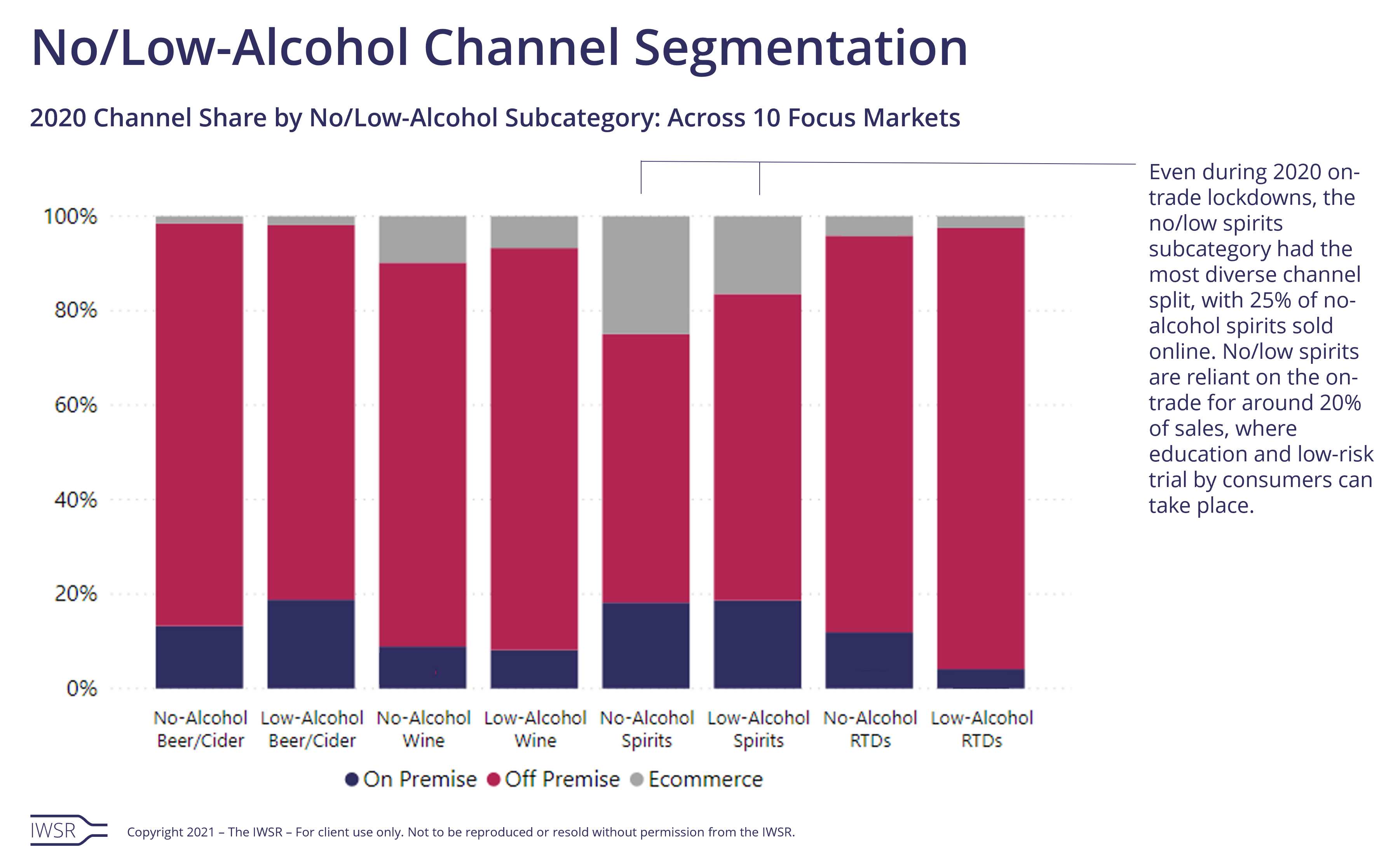

IWSR data shows that no/low-spirits rely on the on-premise for consumer education, and on ecommerce to access products. The on-trade accounts for around 20% of no/low spirits sales across 10 focus countries. In comparison, 80% of no/low-beer, RTD and wine products are purchased in the off-premise. (click the image below to enlarge)

These data trends reflect the experiences of brand owners as well. Seedlip, Gordon’s and Tanqueray owner Diageo sees “incremental opportunities” for its no/low brands in the reopening on-premise. “We are seeing increasing passion for the non-alc space in the on-trade, with for example non-alcoholic drinks appearing in many venues in London Cocktail Week,” says a company spokesperson.

“And we know that bartender recommendations are key to driving trial for consumers … Bartenders are therefore critical for overall category vibrancy and growth, and for driving individual brand reputation via word-of-mouth.”

Carlton agrees. “Assuming the status quo returns, I’m not sure product launches would look vastly different to pre-Covid,” he says. “We would look to seed within the on-trade, build stories and advocacy, look to collaborate with like-minded, similar-positioned partners, sample and get our liquid on lips to the widest possible audience.”

Meanwhile, product format is set to be increasingly important to brand owners in the post-Covid age. “The acceleration in RTD products in this category, and the rise of the RTD category generally, is projected to continue,” says Neill. “It also provides a more affordable trial price for new consumers to the category, where price may be a deterrent.”

She also expects to see increasing product diversity among no/low spirits products as the category moves beyond its current focus on gin-style drinks. “The no/low gin-inspired space is busy now,” Neill says. “So more innovation and NPD will take place in new categories and flavours inspired by, for instance, bitters and dark spirits.”

You may also be interested in reading:

Consumer curiosity underpins ecommerce evolution

RTD volume share expected to double in next five years in top markets

How has Covid-19 altered consumer attitudes in the US?

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, No/Low-Alcohol, Spirits | MARKET: All | TREND: All, Innovation, Moderation |