30/11/2023

Is the US premium tequila boom over?

IWSR data shows that tequila's expansion at the top end is slowing, as declines at the bottom end have turned around into growth

The era of rapid growth for high-end tequila in the US could be at an end after a dramatic slowing of growth for premium-and-above products during the first half of 2023.

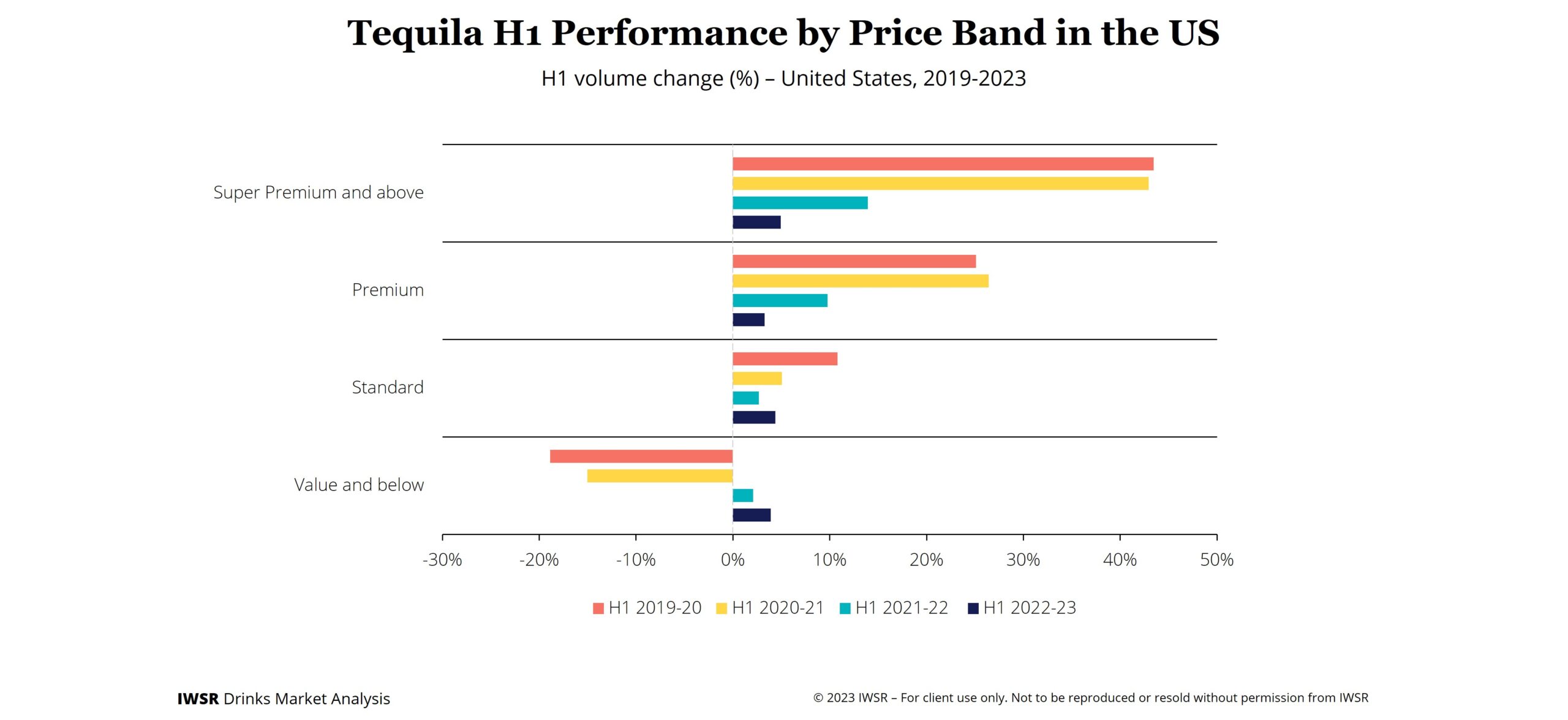

While volumes of agave-based spirits continued to expand in the US in H1 2023, lower price segments – standard, value and below – are now growing at a similar pace as premium-plus, reversing previous declines (see chart below). After several years of strong double-digit increases, volumes of premium-plus tequila in the US rose by +4% in the first six months of 2023, versus the same period in 2022.

Meanwhile, the category is expanding strongly in a host of markets outside North America, but off a much smaller volume base.

“As economic pressures mount and the novelty of the category wanes, the age of rapid premiumisation for agave in the US appears to be over,” says Marten Lodewijks, Consulting Director – US, IWSR. “Expansion at the top end is slowing and decline at the bottom end has turned around into growth.”

This phenomenon is underpinned by improvements in product quality and commercial profitability, notes Lodewijks. “As the tequila category becomes more mature and the number of brands grows, overall product quality improves, and this improvement is seen across all price tiers, justifying trade down,” he says.

The high-volume growth occurring through expanded distribution, especially from celebrity-backed brands, has normalised. Due to the influx of new brands, saturation is beginning to occur, making it more difficult for brands to differentiate themselves in the eyes of consumers.

With agave prices normalising after being elevated for many years, manufacturers are better able to maintain margins, even through lower-priced products.

The current trend of trading down mirrors the vodka category’s post-2008 recession era. “Consumers sought products with a favourable price-to-quality ratio and, upon discovering options that exceeded their quality expectations, remained within the lower-priced segment,” comments Adam Rogers, Research Director – US, IWSR. Unlike vodka, which is limited as an unaged product, tequila presents more opportunities for consumers to trade up.

“As economic conditions improve, it is anticipated that consumers will return to higher price points within the tequila category albeit the rate of return is yet to be determined,” notes Rogers.

The current slow down should not hide the extraordinary run tequila has had in the US market, especially at the very high end. The premium+ tequila segment is now significantly larger than in the past and therefore more difficult to expand.

Only ten years ago, the tequila category represented less than 10% of the US status spirit market (spirits in the ultra-premium+ price segment) by volume. In 2022, nearly one in every three bottles of luxury spirits in the US were agave-based (largely tequila).

Growth prospects outside of the US and Mexico

As demand for premium agave spirits shows signs of moderation in the US, overall sales are declining in the category’s other major market, Mexico, with volumes slipping by -4% in the first half of 2023.

Meanwhile, agave is beginning to take off in a number of markets outside North America – albeit off a much smaller base.

In the first half of 2023, agave grew in 15 out of the world’s top 20 beverage alcohol markets (including the US) – and recorded double-digit volume growth in 11 of them.

Category expansion was driven by a number of factors, including the reopening of the on-trade in China and growing appreciation of tequila as a quality spirit in Spain.

In India, volumes more than doubled in H1 2023 vs 2022 (off a small base) partly thanks to growing consumer acceptance of locally-grown agave, which has helped to soften the impact of supply constraints.

And in the UK, the -4% volume decline recorded in H1 2023 masks the changing image of agave in the country: as traditional tequila shot consumption in the on-trade declines, the higher end is enjoying growth, particularly in the home premise.

“Strong interest in agave outside the US has been boosted by growing interest in Mexican culture, celebrity influence and the popularity of cocktails,” says Jose Luis Hermoso, Research Director, IWSR. “The category is also continuing to gain traction thanks to the increasing appreciation of tequila as a quality spirit, a revival of the on-trade and tourism in Asia, and the recovery of the Duty-Free channel post-pandemic.

“Strong performance in the US has meant some brands were on strict quotas in secondary markets, with many of these undersupplied for years as allocations could not fulfil existing demand.”

Premium tequila under-indexes in ROW markets

The disparity between markets in the Americas and the rest of the world means that luxury tequila has huge growth potential. Currently, the US and Mexico sell about 25 times as much ultra-premium-plus tequila as a group of nine ROW markets (the UK, Spain, Australia, China, France, Japan, Italy, Germany and Poland).

For other spirits categories, such as Cognac/brandy and whisky, the differential in ultra-premium-plus volumes is less than two to one.

“The ultra-premium space for agave-based spirits under-indexes outside the US and Mexico, compared with other spirits categories,” says Hermoso. “Potentially, this gives high-end tequila enormous headway for future growth, if brand owners can continue to successfully promote its quality credentials with consumers.”

In the short to medium term, the US (and, to a lesser extent, Mexico) will continue to be by far the most important priorities for agave brand owners – simply because they account for more than 85% of category volumes, and an even larger proportion in the higher price tiers.

But, if demand continues to moderate in the US, and volumes keep declining in Mexico, companies may have to rethink their global brand strategies – and look to a larger and more diverse group of markets around the world to fuel future category growth.

You may also be interested in reading:

Home consumption vs the on-trade: have pandemic behaviours become entrenched?

Does tequila’s growth mirror that of the gin boom?

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Spirits | MARKET: All, North America | TREND: All, Premiumisation |