This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

06/07/2022

Sources of RTD innovation

New RTD products are increasingly driven by sustainability, flavour and premiumisation trends

IWSR’s innovation tracking data shows that RTD product launches are increasingly leaning into super-premium pricing, packaging with less plastic, fewer direct health claims and greater diversity of alcohol content. This is true across the key RTD markets – Australia, Brazil, Canada, China, Germany, Japan, Mexico, South Africa, the UK and the US – which represent 85% of global consumption of RTDs.

“The ability to respond to consumer needs goes some way to explaining the rapid rise of RTDs,” says Brandy Rand, COO Americas at IWSR. The category is growing quickly in countries like China, Canada and the US, which is the world’s largest RTD market.

Packaging trends

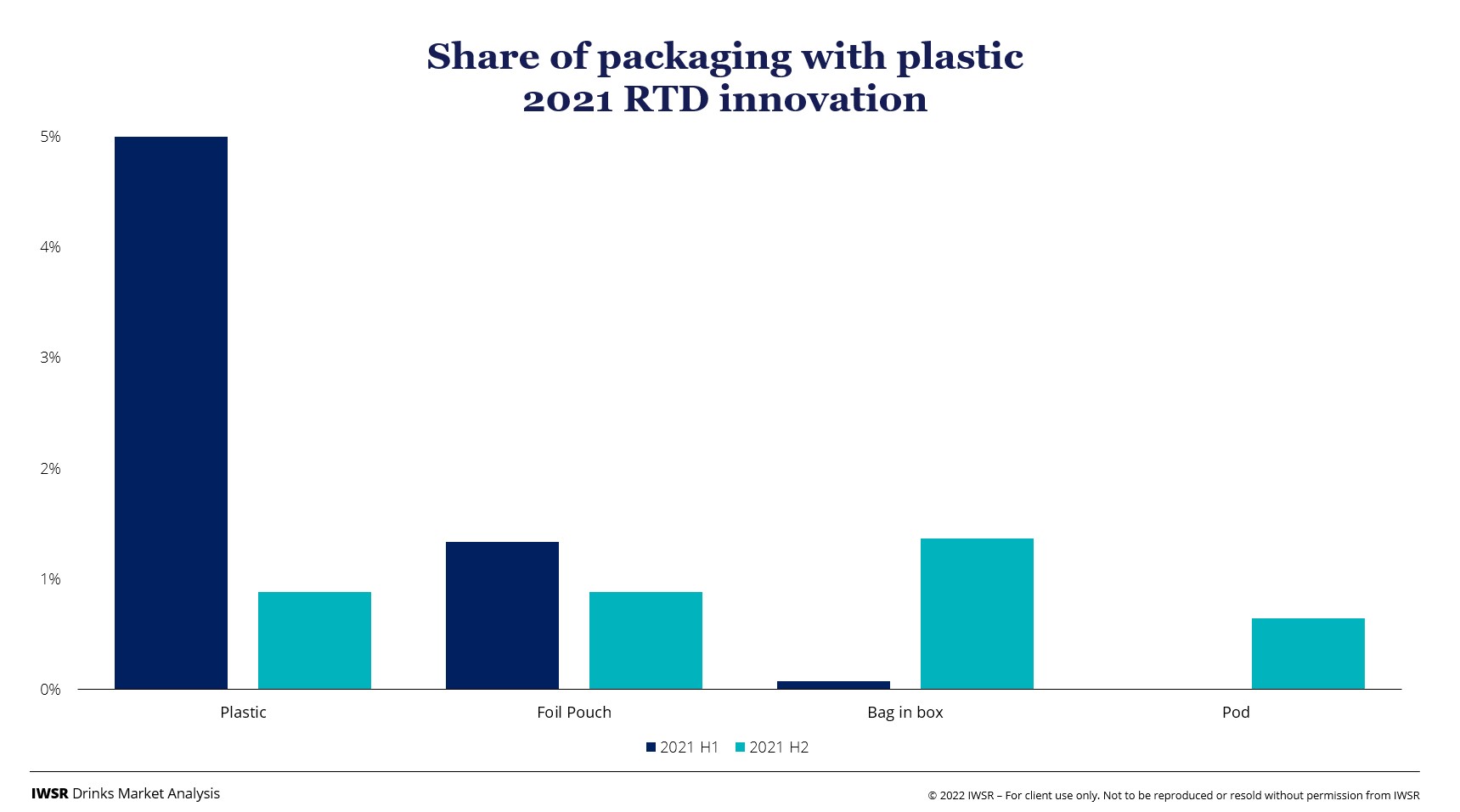

The number of RTD products using plastic-only packaging is reducing. IWSR data shows that just 1% of new RTD products used plastic-only packaging in the second half of 2021, down from 5% in the first half of the year.

Environmentally-focused packaging cues are increasingly important to consumers. In the US, for example, IWSR research shows that 44% of alcohol drinkers feel that their purchasing decisions are positively influenced by businesses with an active environmental or sustainability agenda. Some markets are moving away from plastic more quickly than others. In Germany, Japan and South Africa, no new products used plastic alone last year. On the other hand, Brazil and Mexico are progressing away from plastic but still have some way to go.

Flavour profiles and ABV

As reported previously, IWSR has been tracking an evolution in flavour profiles for RTD products, especially for spirit-based RTDs in the US, with two distinct flavour profiles coming to market. IWSR has defined these as “complex” and “simple” flavour products.

“Complex flavour” drinks are those that contain full amounts of sugar, calories, and ingredients. They provide the full-flavour taste profile of an alcohol drink and tend not to be carbonated. In contrast, “simple flavour” drinks have lower sugar and calorie contents. They tend to be lighter and clear, based on seltzer or soda, and therefore are generally more refreshing in character. The two groups aren’t completely distinctive, however, and already show some overlap. For example, Spa Girl cocktails are low in sugar and carbs, and at 11.5-16.5% ABV, they contain 3.4 times more alcohol per serving than the average spirit-based RTD.

As an extension of evolving flavours, new RTD brand owners, as well as established producers, are increasingly introducing products with higher ABV rather than focusing on the more traditional 3-5% range. Around half of all new RTDs launched in the second half of 2021 had an alcohol content of 5% or higher. This trend has been led by China, the US, and Australia, but is not universal. Other countries such as Germany and Japan are seeing a decrease in new innovations with higher ABVs.

Branding

The number of health claims associated with new RTD products is decreasing. The share of launches that included messages about low calories, sugars, carbs, or gluten dropped from 38% in the first half of 2021 to 29% in the second half of the year.

“Despite knowing that dietary needs are indirect motivators to product selection, producers are opting to highlight natural ingredients instead. This movement is likely linked to premiumisation in the category,” says Rand. She adds that, in a sense, natural ingredients might be seen as healthier than substituting certain ingredients such as sugar.

With RTDs shifting towards more premium, sustainable examples with fewer direct health claims and a greater diversity of alcohol levels, consumers have a broad and varied range of options in this fast-growing category.

You may also be interested in reading:

Premiumisation and the rise of RTDs drive shifts in category share

Why have Brown-Forman and Coca-Cola chosen Mexico for their RTD collaboration debut?

RTD volume share expected to double in next five years in top markets

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, RTDs | MARKET: All | TREND: All, Convenience, Innovation |