23/01/2022

The growth of CBD and alcohol-adjacent drinks

New technology and the fast-growing no-alcohol segment are fuelling the rise of alcohol adjacencies in the US

The alcohol-adjacent category is emerging rapidly as more people become interested in moderation and avoiding the effects of alcohol. Alcohol adjacencies offer mood-enhancing or functional benefits, many employing ingredients such as CBD, nootropics and adaptogens. These products focus on how their ingredients will make consumers feel, and are seen as an alternative way to enjoy traditional alcohol occasions – thereby appealing to health-conscious (and stressed-out) consumers.

Alcohol-adjacent products include no-alcohol malt beverages; no-alcohol bitters; no-alcohol wine replacements (sparkling grape juice in mock sparkling wine packaging, for example); alcohol-free kombucha that targets alcohol or aperitif occasions; and no-alcohol nootropic and adaptogenic drinks, such as CBD beverages. IWSR’s definition of alcohol adjacencies excludes THC products.

While a relatively new segment, many products have already come to market, such as Recess, a sparkling water infused with hemp and adaptogens; Kin Euphorics which combines adaptogens, nootropics and botanicals, and is co-founded by supermodel Bella Hadid; and HOP WTR, a non-alcohol hop-filled sparkling water brewed with adaptogens and nootropics.

The mood-altering effects of these products varies based on the targeted occasion. Claims are made for feelings of uplifting, relaxing, concentrating, and being more sociable, for example.

The addressable market

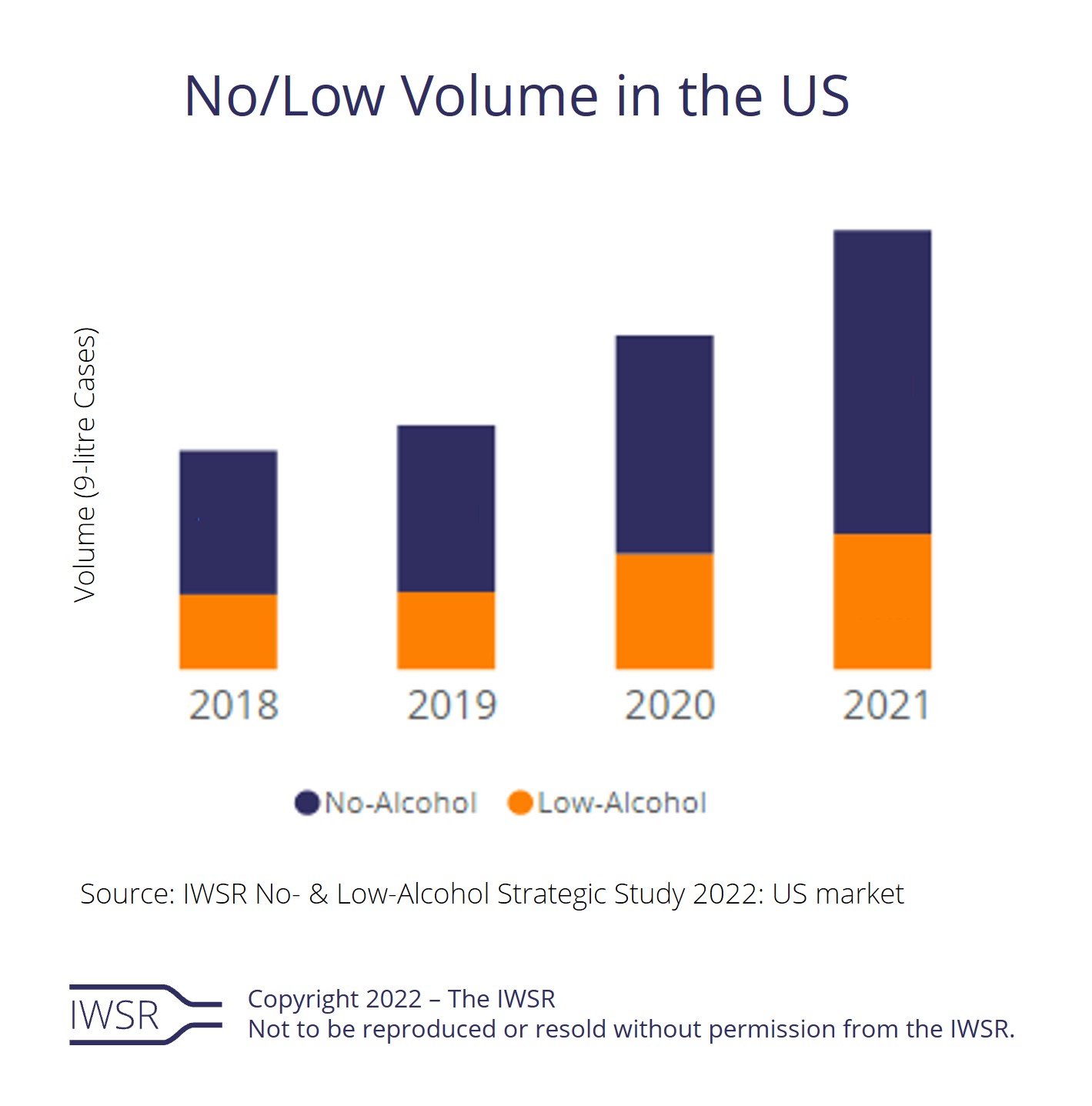

The total no/low alcohol segment in the US is currently valued at approximately $2.2bn, with volumes expected to continue to grow. While each no/low category in the US (across beer/cider, wine, spirits, RTDs, and alcohol adjacencies) has a different level of market maturity, no-alcohol products have, overall, commanded a greater share of the no/low segment in the US.

Within the no/low space, the alcohol-adjacent market is currently valued at around $98m in the US. The category is expected to keep growing, with IWSR forecasts indicating a +12% volume CAGR 2021-2025 in the US. As of 2021, 33% of the US adult population identify as no/low alcohol buyers. Of these, 30% are no-alcohol buyers, while 32% buy both no- and low-alcohol products, according to IWSR consumer research.

An evolving CBD segment

The CBD segment currently holds the largest volume share of the alcohol-adjacent market in the US.

The segment is developing rapidly, prompted by the Farm Bill that congress passed in 2018. While the Bill provides important agricultural and nutritional policy extensions for five years, the most interesting changes involve hemp. Hemp is defined in the legislation as the cannabis plant, with one key difference: it cannot contain more than 0.3% THC, the compound associated with being ‘high’.

The future of CBD-derived beverages and how they will be regulated, taxed and sold at both the federal and state levels (along with how they might fit into the current beverage alcohol three-tier system) remains complex. All the while, states are attempting to regulate and sell these products without the permission of the federal government, including the FDA.

Craft breweries were one of the first movers in the beverage space to tap into the CBD segment. Many breweries have come to market with alcohol-free CBD seltzers with varying flavours and CBD levels.

The future of the category

The rise of alcohol adjacencies is occurring at a time when beverage companies are becoming more agile and flexible in their approach to non-core product categories. The idea of innovating by entering previously alien segments is no longer such a disruptive business strategy, especially given the recent diversification of ‘pure play’ soft drinks or beer companies.

The functional or mood element is a new way of meeting the needs of stressed-out consumers – it’s about how beverages make you feel. These products are free of alcohol, but they target alcohol occasions.

Product innovation will be focused on discovering which naturally produced ingredients can be leveraged to produce mood-altering effects similar to alcohol, while still offering an appealing taste profile.

Consumer education around what these products are, the ingredients used and the mood-altering feelings that can be expected, will be key to category growth. Consumer understanding of alcohol adjacencies is currently low, but people are intrigued by this new proposition within the drinks space.

[table id=11 responsive=stack /]

You may also be interested in reading:

Drinks companies diversify as category lines blur

Key trends driving the global beverage alcohol drinks industry in 2022

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, No/Low-Alcohol | MARKET: All | TREND: All |