30/05/2022

The Platinum Jubilee: What are Brits drinking in celebration, and how has this changed from past Jubilees?

IWSR analyses how alcohol consumption in the UK has changed between the Golden Jubilee year of 2002, the Diamond Jubilee of 2012, and this year’s Platinum Jubilee.

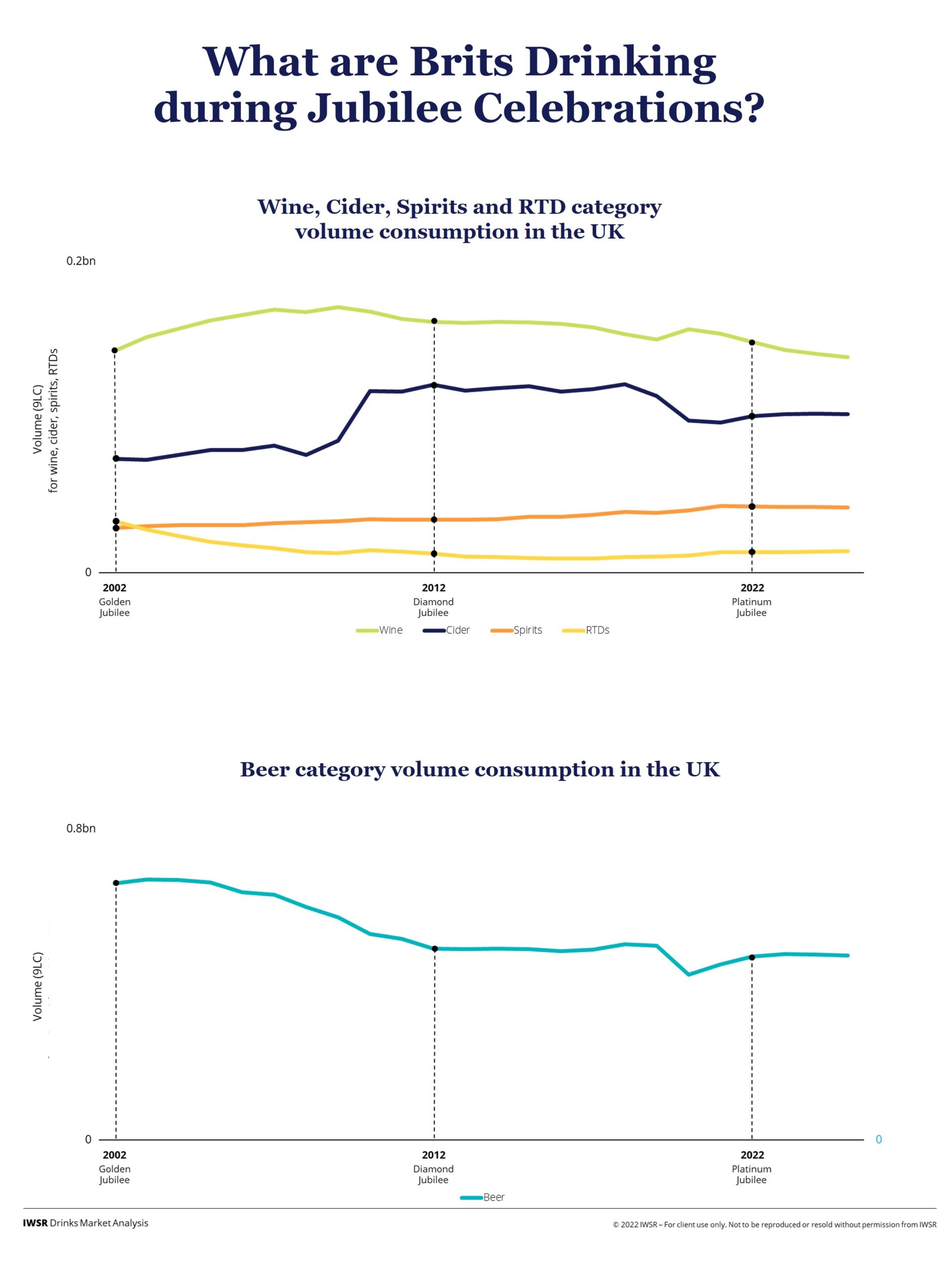

Overall, people in the UK are drinking less alcohol now than during the Diamond Jubilee year of 2012, and considerably less than during the time of the Golden Jubilee celebrations. This is mainly due to a gradual change in attitude towards alcohol and an increasing desire to drink better-quality products, combined with increasing drive towards moderation and the “better-for-me” lifestyle trend. Another key factor is that alcohol plays a less important role in young people’s lives today than it did 20 years ago.

Drinker’s choice has also significantly evolved since 2002, reflected in how category share of alcohol consumption has changed over the years:

- In 2002, beer represented over 70% of alcohol consumption in the UK; that figure is now closer to 60%

- Spirits has grown steadily from 3% in 2002 to 5% now

- Wine has gone up from less than 15% in 2002 to nearly 20% now

- RTDs account for 2% now, compared to 1% ten years ago and 3% twenty years ago

- Cider grew strongly from 7% in 2002 to 14% in 2012 and has fallen back to 12% now

The rise of cocktails and sparkling wine

The post Covid-19 drinker in 2022 is far more experimental than the pre-COVID drinker of 2002 and 2012, and this has helped to drive the demand for cocktails in the UK. One of the trendiest cocktails of the 2022 Jubilee celebrations will be the Pornstar Martini, which was invented in the same year as the Golden Jubilee. The surge in interest in cocktails has boosted the sales of spirits as well.

The Pornstar Martini is traditionally accompanied with a shot of Prosecco. In 2012 many drinkers would not even have heard of Prosecco, but since then, it has been one of the most high-profile forms of alcoholic refreshment. The competitive price of Prosecco has not just made it iconic, but it has enabled sparkling wine to be consumed as a regular treat. Twenty years ago, sparkling wine was very much reserved for special occasions. Consumers now, however, are keen to enjoy it across a broader range of occasions – from aperitif and brunch, to pre-night out and high energy nightlife. At street parties around the country, we can expect a lot of Prosecco to be enjoyed in celebration of the Platinum Jubilee.

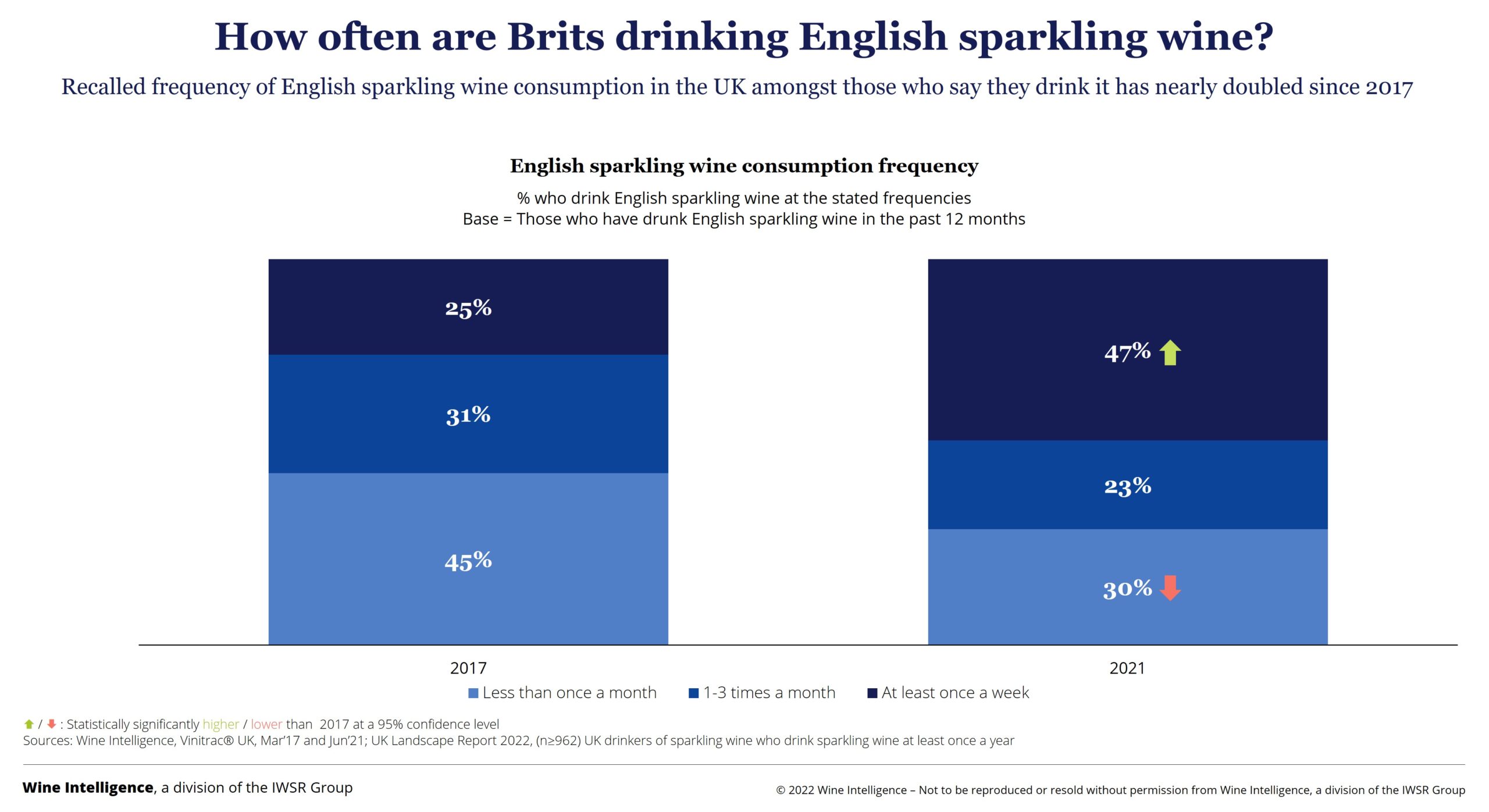

During the Golden and Diamond Jubilee years, English sparkling wine was barely on the radar, but the reputation of English sparkling wine has since flourished, winning over wine writers from around the world. This, coupled with the massive expansion in the acreage of vines being planted, will mean that many Brits will be raising a glass of English sparkling wine this Jubilee. English sparkling wine volume consumption in the UK has more than tripled since the Diamond Jubilee.

From whisky to vodka and gin

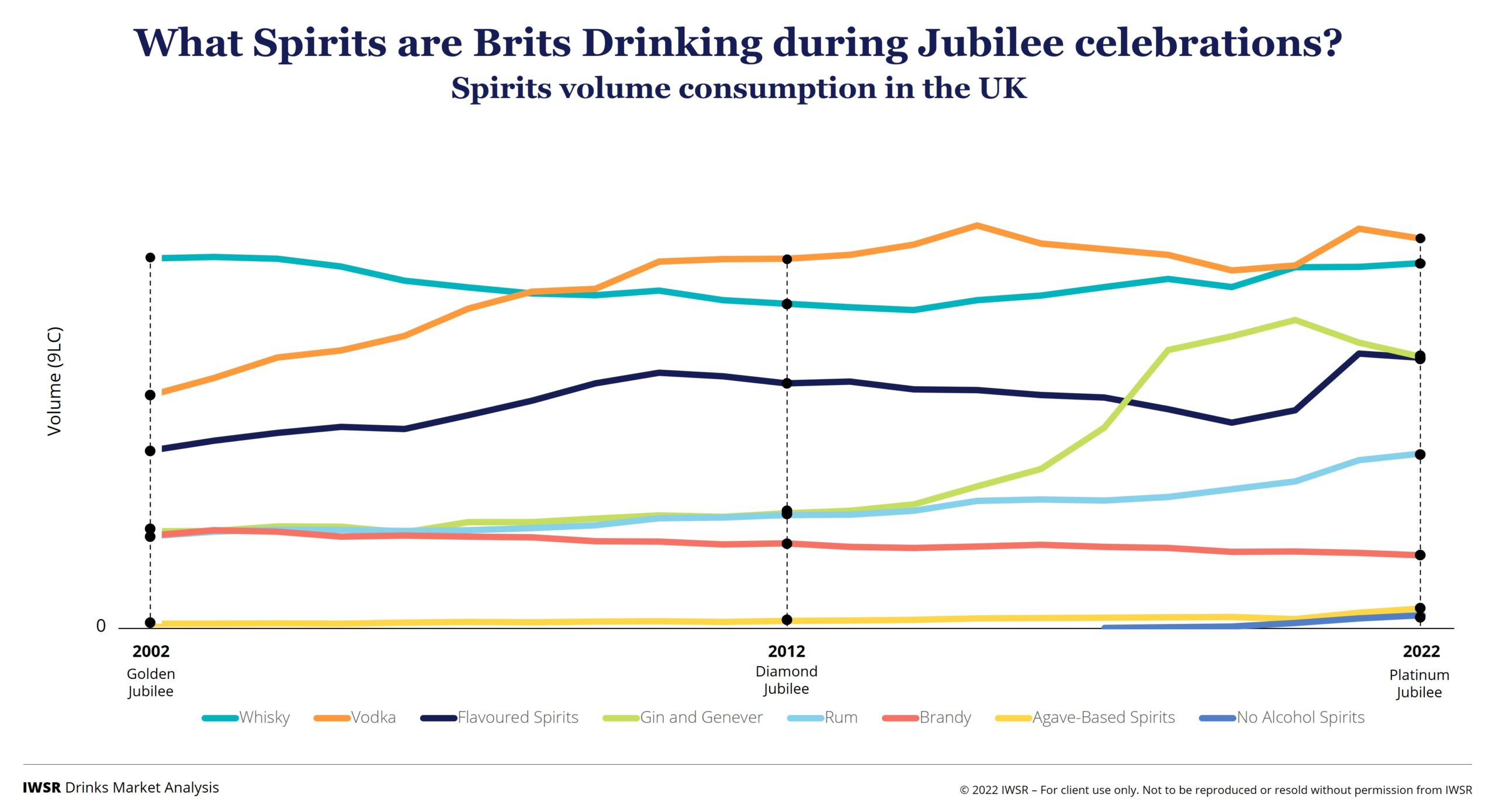

Spirits have become a much more central part of alcohol consumption in the UK over the years. The quality of the spirits people are drinking has also improved, as consumers have become more aware of what it takes to make high quality spirits and – as a result – have become more willing to pay for them.

Whisky was by far the dominant spirit category during the Golden Jubilee. However, it was in long-term gradual decline, and consumers began to transition from whisky to flavoured spirits and especially vodka. While whisky commanded over 30% share of spirits consumption during the Golden Jubilee year, its share is now closer to 20%.

Vodka became the fashionable spirit of choice during the Diamond Jubilee of 2012, before gin started to gain increasing traction, driven by both the gin-and-tonic and pink gin trends. While the rise of rosé may be one factor behind the gin boom’s peak in 2020, gin has been a key feature of the UK market over the past ten years, with growth now plateauing. Much of the gin enjoyed during this Jubilee will be flavoured, something that was very unusual until just a few years ago.

Rum has also gained increasing prominence, especially since the Diamond Jubilee, and has nearly doubled in volume in the past 20 years, driven by simple mixes and more complex cocktails.

The emergence of completely new categories

The gin boom spawned a plethora of craft style distillers, and this helped to drive interest in the overall craft segment. While specialist beer existed in the market, the concept of craft beer was unknown twenty years ago. The seeds of the mainstream craft concept were sown back in the Jubilee year of 2002, when the then Chancellor Gordon Brown introduced a progressive beer duty encouraging a wave of artisan brewers. The growth of craft beer since then has changed the face of the UK’s beer market, and today, there are well over 2000 brewers in the UK. The Jubilee celebrations will provide a considerable opportunity for them.

After facing years of negative consumer perception, the hot summer of 2006 saw an explosion in cider sales, triggered by Magners and the ‘Over Ice’ concept. Swedish ciders also gained traction, helping to establish the fruit cider segment in the UK, and with it, a surge in flavour innovation for UK cider brands. Flavoured ciders started to gain increasing momentum around ten years ago, and although ciders have waned in the last few years, it is now a far less regionalised and male dominated drink than it was during the 2002 Jubilee.

The re-emergence of cider since 2002 came at the expense of RTD products, which had decimated cider sales less than a decade earlier when they first hit the marketplace. The cycle has turned again though, and RTDs are now riding high. After RTD volumes declined by more than half between 2002 and 2012, RTD volumes in the UK have increased by 10% since the Diamond Jubilee.

The resurrection of the RTD category has been driven by the rapid development of higher ABV products, the convenience of canned RTD long drinks, and the emergence of a cocktail culture along with a demand for readymade cocktails. Hard seltzers as we know them today, as well as hard teas, coffees and kombuchas, weren’t even in existence twenty years ago.

No- and low-alcohol drinks also hardly existed during the time of the Golden Jubilee celebrations. No- and low-alcohol beer was a very niche pursuit in 2002, and limited to a few brands, such as Kaliber, the non-alcoholic pale lager from Guinness. The no/low category had not grown significantly by 2012, but now, these products are widely available in retail, and increasingly so in the on-premise too. Not only has the quality of these offerings improved enormously, but the perceived stigma associated with drinking no- and low-alcohol is now a thing of the past.

You may also be interested in reading:

Drinks companies diversify as category lines blur

Key trends driving the global beverage alcohol drinks industry in 2022

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, Europe | TREND: All |