15/06/2022

Why have Brown-Forman and Coca-Cola chosen Mexico for their RTD collaboration debut?

IWSR analyses the RTD opportunity and market landscape

This week, The Coca-Cola Company and Brown-Forman announced plans to debut a Jack Daniel’s and Coca-Cola co-branded canned cocktail in Mexico in late 2022. Earlier this month, The Coca-Cola Company’s chairman and CEO also mentioned that the company is planning to release further RTD cocktail lines in Brazil, in addition to their Topo Chico and Schweppes products that were launched in 2020. IWSR analyses why these two countries – Mexico and Brazil – are attracting RTD activity.

The RTD opportunity

Mexico and Brazil are the two largest beverage alcohol markets, as well as the two largest RTD markets, in Latin America. However, cost of entry into the RTD category is high, and local distribution and logistical networks are critical to benefit from consumer interest in RTDs. For Brown-Forman and The Coca-Cola Company, established local bottling, logistics and distribution networks work in their favour.

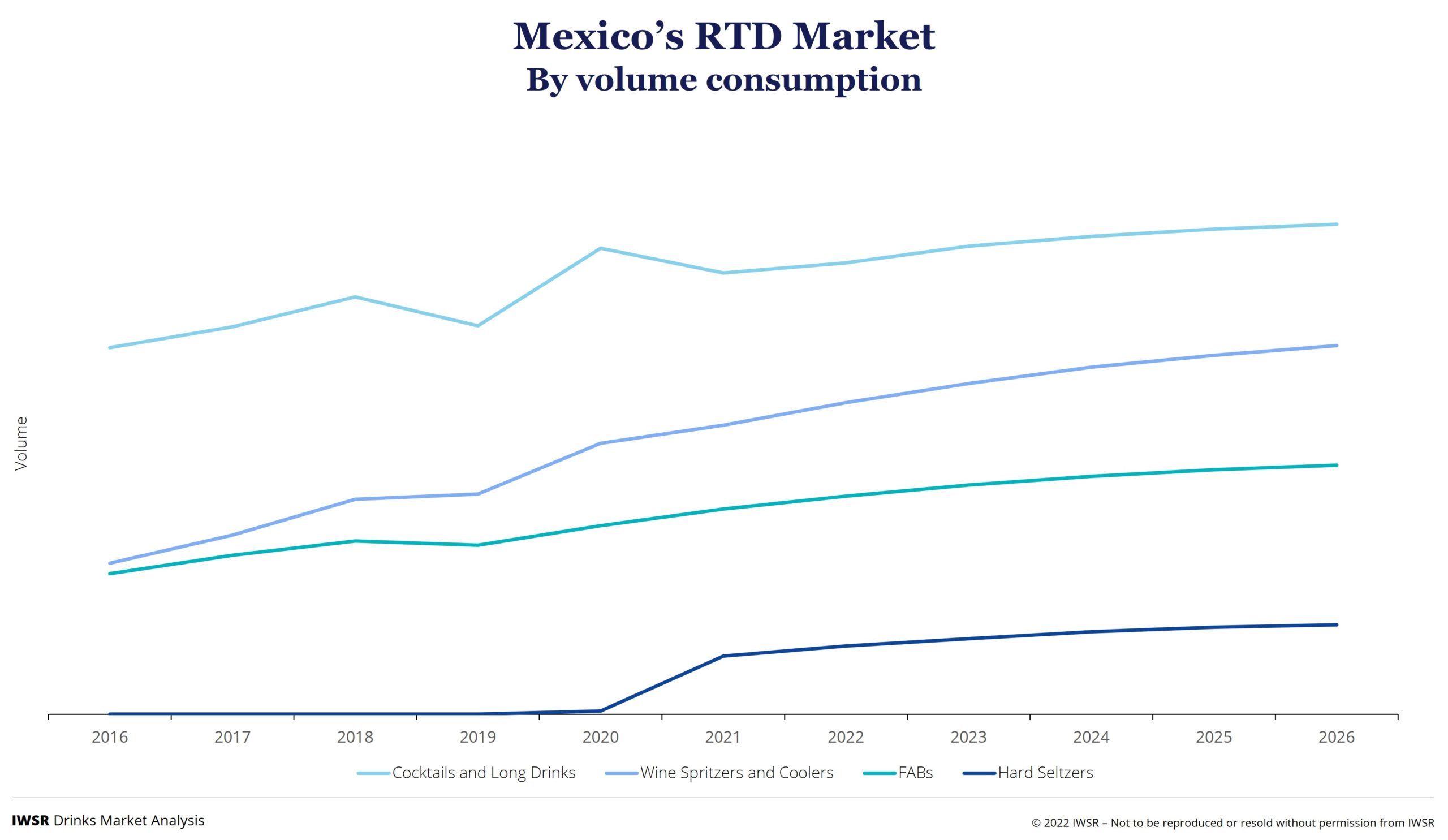

While the RTD category in Brazil and Mexico has been around for decades, product quality, as well as product choice, has improved over time. In Brazil, the RTD market is dominated by FABs, while in Mexico, cocktails and long drinks hold the largest share. In both Brazil and Mexico, as well as in other parts of the region, hard seltzers have yet to gain real traction with consumers.

Demographic factors in Brazil and Mexico are also advantageous for RTD products, with both markets having sizeable legal drinking age (LDA) populations, and relatively large proportions of younger LDA consumers, who are typically attracted to the new flavours and convenience offered by RTDs.

The local market landscape: Brazil and Mexico

In Mexico, RTD growth has coincided with the strong development of the country’s convenience store retail channel over the past decade, and consumer demand – along with industry investment in the category – has remained robust. RTDs have been a permanent feature in Mexico for the past thirty years. The size of the RTD market has nearly trebled in the last twenty years, and doubled in the last ten.

Cost of entry into the category is high, and with local production essential to compete in price, strong established players dominate the market. RTDs were given an artificial boost in 2020 when the Mexican government banned beer production for two months.

Hard seltzers also entered the market in the second half of 2021 and brought with them new entrants to the RTD competitive landscape, such as Heineken, AB InBev, as well as The Coca-Cola Company. Hard seltzers have injected fresh interest into the RTD category – although question marks remain over their longevity and the extent of their future growth. Most hard seltzers in Mexico sell along the Mexico/US border and Mexico City, where US influences and exchanges are stronger.

Cocktails and long drinks account for roughly 50% of RTD volumes in Mexico. The segment saw sales volumes decline during 2021 (but is expected to recover this year), while volumes for wine spritzers & coolers, FABs and the nascent hard seltzer segments all grew.

“RTDs have been growing for years in Mexico, and consumers are still seeking local flavours for refreshing alternatives to beer,” says Jose Luis Hermoso, Research Director at IWSR. “They are proving popular with Mexican drinkers when relaxing during the day and are also strongly associated with online socialising.

“Home-based socialising, including virtual get-togethers, is expected to remain popular among Mexicans as the worst effects of the Covid-19 pandemic recede and the on-trade recovers.”

RTDs are expected to continue developing in Mexico, competing directly with beer. Favourable demographics, such as a growing young LDA population and increasing participation of women, are expected to benefit the category, as will global trends towards healthier lifestyles, local flavours and cocktails. Increasing costs and shortages of glass and aluminium will moderate growth however, in what is a very price sensitive category.

Beer dominates beverage alcohol in Mexico, accounting for 94% of total volumes in 2021, compared to a 2% share for RTDs, according to IWSR data. However, the growth rate of RTDs between 2021 and 2026 is expected to be double that of beer over the same period (2% volume CAGR for beer in Mexico 2021 – 2026; 4% for RTDs).

Similar to Mexico, RTDs have a long history in the Brazilian market. RTDs have been sold in Brazil for more than twenty years, but – after the category had a difficult time in the early months of the Covid-19 pandemic due to on-premise closures – they have been reinvigorated over the past 18 months or so by a fresh wave of innovation, including diversification, premiumisation and the entry of hard seltzers.

Now RTDs are the fastest-growing category in the Brazilian market – a position they are expected to maintain in the medium term – albeit from a low base. RTDs are attracting consumers from most rival alcohol categories, but especially from the hugely dominant beer sector.

A number of factors are driving this development, according to Luciano Anavi, Research Analyst at IWSR. “RTDs usually compete with beer for share of throat, so Brazil being the largest beer market in South America provides an opportunity for RTD brand owners,” he says. “Brazil is also the largest economy and most populous country in the region. Distribution muscle is definitely another key factor in this market.”

Over the past year and a half, the cocktails/long drinks segment within RTDs has been transformed by the introduction of premixed gin and tonics, many of them from marquee international brands. Meanwhile, some larger-volume brands have seen considerable declines, leading to an overall volume fall for cocktails and long drinks, with the nascent hard seltzer segment yet to capture the imagination of consumers.

Nonetheless, demographic factors are helping to make Brazil an attractive market for RTD innovations: the country has a large legal-drinking-age population, and IWSR research shows that younger LDA consumers in Brazil are disproportionately attracted to the convenience, portability and fresh flavours offered by RTDs. IWSR consumer research also shows that, across 10 focus markets (China, Brazil, US, Russia, Italy, Spain, UK, Japan, France and Germany) propensity to trial new alcohol beverage products is highest in Brazil and China.

This is fast turning Brazil into a proving ground for RTD innovation where almost anything goes in flavour terms, with big international companies joined in the marketplace by a number of local operators.

“There is strong demand for refreshing drinking options as an alternative to beer,” says Anavi. “And young LDA consumers in Brazil are eager to try new proposals. However, local flavours are important in Brazil, and global propositions may not work as effectively in this market, unless they are adapted to the local palate.”

Beer continues to dominate the beverage alcohol marketplace in Brazil – the category had a share of 90% of the total beverage alcohol market in Brazil in 2021, while RTDs held a 1% share. Between 2021 and 2026, RTDs are forecast IWSR to grow at a volume CAGR of +6%, versus +2% for beer.

With such a large population and a huge disparity in terms of disposable wealth, there are opportunities for growth across all RTD price segments in Brazil, although low-priced products will continue to dominate volumes for the foreseeable future.

However, premiumisation will make the higher price segments a vital battleground for innovation among international brands especially, with cocktails and long drinks likely to prove most popular among consumers in Brazil.

You may also be interested in reading:

Premiumisation and the rise of RTDs drive shifts in category share

Tequila and vodka are the most popular bases for spirit-based RTDs in the US

RTD volume share expected to double in next five years in top markets

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, RTDs | MARKET: All, Latin America | TREND: All, Convenience, Innovation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.