28/10/2021

Will social media increasingly impact alcohol choice?

As alcohol consumers increasingly move online, will they look to social media and other online sources for their alcohol choices and recommendations? Recent findings show that the trends are nuanced

As the use of social media spiked during Covid-19 lockdowns around the world, TikTok has emerged as a platform that has expanded and diversified its user base. The platform has taken off in markets such as Brazil, Japan and Spain – as well as continuing to grow in its heartland of China – and has started to attract more mainstream legal drinking age (LDA) alcohol consumers.

While the regular usage of TikTok among LDA+ alcohol drinkers increased across 10 key markets tracked by IWSR (Brazil, China, France, Germany, Italy, Japan, Russia, Spain, the UK and the US), only the US failed to register any significant rise. This is believed to be the result of negative publicity surrounding the Chinese-owned platform, with the Trump Administration threatening to ban it on national security grounds in 2020.

Across five of the markets surveyed (Brazil, Japan, Spain, the UK and France), IWSR estimates that, since August 2020, the platform has recruited around 37m new users from the legal-age alcohol-drinking population, with particularly pronounced increases in Brazil, Spain and Japan. In Brazil, for example, the TikTok user base has almost doubled to over half of the legal-age alcohol drinking population.

In all three countries, users are disproportionately likely to be younger LDA consumers – Gen-Z and millennials – and, although they have no significant income disparities versus the general drinking population, they are more likely to be high spenders on alcohol.

However, as the usage of TikTok becomes more mainstream within a society, the demographic distinctions of users are likely to become less pronounced. In China, where the proportion of alcohol consumers who regularly use Douyin (TikTok) reached 78% in June 2021 (up from 70% in August 2020), the increase is now not being driven by any one demographic. In Brazil, usage incidence among LDA Gen-Z and millennials almost doubled from 35% to 62%; among Gen X it increased by a similar function, 27% to 48%. By contrast, Spain’s growth is mainly among LDA Gen Z and millennial alcohol drinkers.

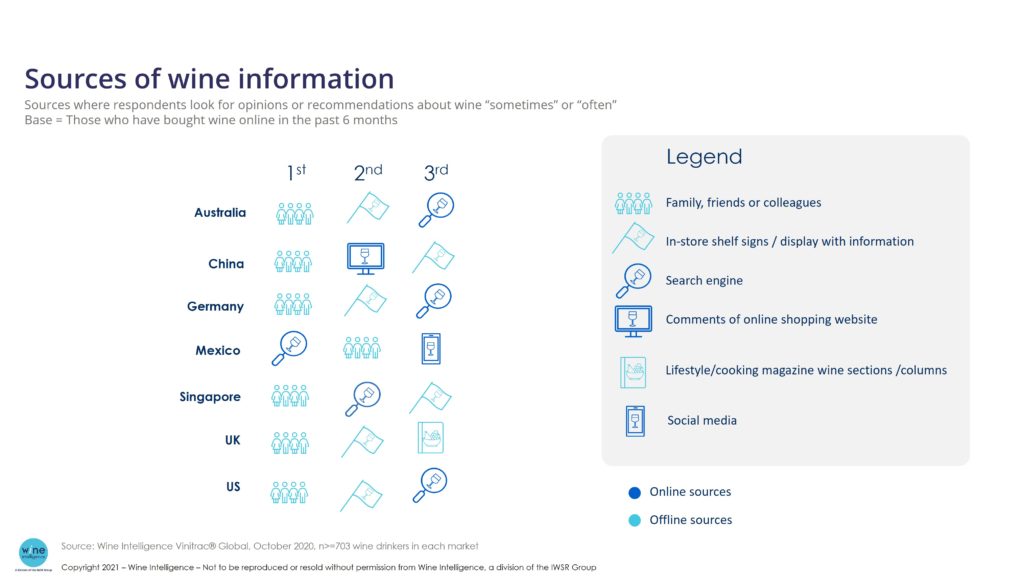

While increasing numbers of LDA beverage alcohol consumers are being attracted to TikTok and other social media platforms, many continue to rely on friends and family – rather than influencers and live streamers – as trusted sources of information and recommendations.

According to research conducted by Wine Intelligence, a division of the IWSR Group, 43% of regular wine drinkers in China named friends, family and colleagues as their most trusted source of wine information, narrowly ahead of brand websites, bloggers and comments on online shopping sites.

While the reach of live streamers in China can be substantial – Li Jiaqi, a lifestyle key opinion leader with more than 40M followers on TikTok/Douyin, for example, is reported to have sold 20,000 six-bottle cases of wine within 30 seconds during a livestream in 2019 – Wine Intelligence data shows that 34% of Chinese regular wine drinkers trust social media, a figure which rose to 39% among millennials (aged 25-29) – but fell to 27% for Gen-Z (20-24).

Friends and family are an even more vital source of trusted wine information for regular wine drinkers in the US, with 70% of those surveyed by Wine Intelligence turning to them for wine guidance and recommendations.

Meanwhile, 40% said they trusted social media, rising to 52% for younger LDA Gen-Z drinkers (21-24). However, millennials in the US are not significantly more influenced by social media, with 44% of this cohort trusting these sources for wine information and recommendations.

These findings reflect the experiences of David Choi, owner of Angel Falls Wines and Magna Carta Cellars in California’s Napa Valley, and a wine influencer with more than 220,000 followers on TikTok. He began posting in an effort to bridge what he calls the “big divide” between the wine industry and consumers, who he says can often be intimidated by the subject.

“We have found [our audience] to be everyday wine drinkers, and we see our audience on TikTok specifically to be the next generation of wine drinkers, at the beginning stages of their wine journey,” he says.

While younger LDA wine consumers in the US are increasingly paying attention to influencers and other online sources of information, the picture changes in the UK – where Wine Intelligence found that only 29% of regular wine drinkers trust social media. Furthermore, millennial and LDA Gen-Z consumers are not significantly more influenced by social media compared with other UK wine drinkers. Levels of trust in information given by a wine blogger or expert are higher at 40%, but friends, family and colleagues (75%) remain by far the most trusted sources of information.

The inference is that, while some social media platforms are inexorably growing in popularity among legal-drinking age beverage alcohol consumers, fragile levels of trust mean that the most effective marketing strategy for brand owners will remain a multi-channel approach, even for LDA Gen-Z and millennial drinkers.

You may also be interested in reading:

Consumer curiosity underpins ecommerce evolution

Alcohol ecommerce maturity in Asia Pacific

How has Covid-19 altered consumer attitudes in the US?

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Digitalisation |