27/07/2022

Can soju ride the Korean cultural wave to find success in global markets?

IWSR expects soju volumes to grow in a number of APAC markets over the next five years, as brand owners tap into K-pop and focus on flavour innovation

South Korea’s soju producers are targeting growth opportunities in markets across the Asia Pacific region, buoyed by the huge popularity of Korean culture, known as the ‘Hallyu’, including the highly influential K-pop scene.

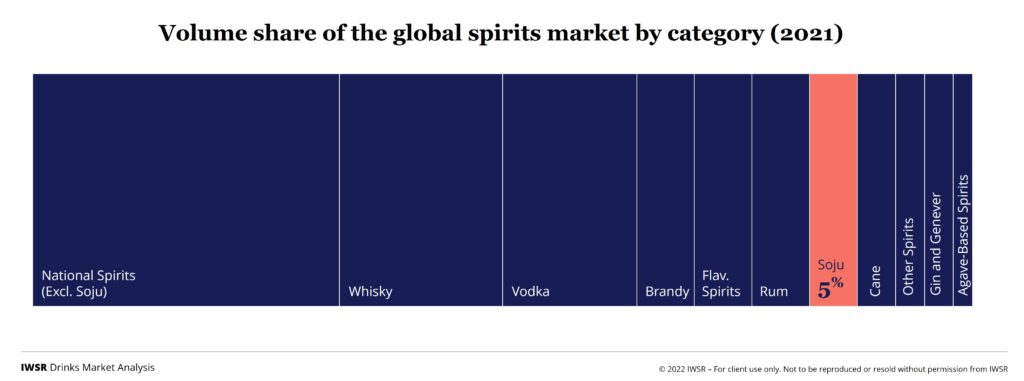

Soju holds a 5% volume share of the global spirits category, and IWSR expects soju volumes to grow in a number of markets across Southeast Asia over the next five years, although off a relatively small base. The category is also targeting Asian expats living in countries such as Australia and New Zealand.

These fresh avenues of growth should help to offset more lacklustre trends in the domestic South Korean market. Although soju will remain huge here, future expansion will be limited by factors including rising health consciousness and consumer migration into other drinks categories.

Growth markets

Historically, soju consumption has been almost exclusively confined to the South Korean market, which accounted for 97% of global volumes in 2021, but now a host of other APAC countries are witnessing rising soju volumes.

Between 2014 and 2019, IWSR data shows soju volumes rose at a CAGR of +80% in Indonesia, with Vietnam, the Philippines, Taiwan and New Zealand also witnessing increasing interest in the category, each with volume CAGR growth between 20-30% (2014-2019).

Soju consumption in Indonesia has seen “remarkable” growth recently, according to Jonathan Ho, market analyst at IWSR, largely due to the popularity of Korean culture, including K-pop songs, TV, and variety shows. “Younger legal-aged consumers find soju affordable and easy to drink, and there are now eight or nine locally bottled brands that account for more than half of total consumption,” Ho adds.

Some regional markets were negatively impacted during 2019-21 by the Covid-19 pandemic and on-premise closures, although Malaysia, Hong Kong, Cambodia and Taiwan all reported impressive growth, with volume CAGRs of between 20-30%, from 2019 to 2021.

Looking ahead, soju volumes are expected to grow in markets including Vietnam, the Philippines, Indonesia, Malaysia, Cambodia, New Zealand and Australia.

The influence of the Hallyu

To drive category growth, brand owners are engaging famous K-pop stars to boost awareness of soju products.

“LDA Gen Z and millennials usually have a great deal of interest in K-pop trends, which has allowed soju brand owners to establish a strong foothold across APAC,” explains Ho.

Companies have enlisted a number of K-pop stars to help promote their soju brands, including PSY, Bae Suzy, IU, Jennie (Blackpink), Irene (Red Velvet), Park Seo Joon and Gong Yoo. In Singapore, Chorong Chorong Soju has appointed Tasha Low, former lead singer of South Korean girl group Skarf, as the brand’s local ambassador. Meanwhile, earlier in 2022, K-pop star Jay Park launched his own premium brand, Won Soju.

Soju brands in Singapore and Malaysia have hired lifestyle influencers to raise awareness, posting recipes and cocktail photos that feature soju heavily, while leading producer Hite-Jinro has also engaged food influencers to promote its products.

In Japan, HiteJinro has focused on tapping into young adult consumers’ love of Korean TV shows by parodying a hit Korean drama in a television ad that has been viewed more than 3m times since its release in December 2021.

Flavour innovation

While leveraging this interest in Korean culture, producers are also now looking to adapt their offer to the demands of the local market, for instance by introducing fruit-flavoured sojus geared to the local palate, and lower-alcohol versions bottled at 8-12% ABV.

“Brand owners can reinvent soju to suit a particular country’s consumer tastes by learning about the local culture and what people like, while keeping some aspects of the Korean culture,” says Ho.

Examples of this can be found in Vietnam and Thailand, where fruit-flavoured sojus have found particular success, as well as in Japan, where the popularity of RTDs based on local shochu could give soju brand owners another consumption opportunity.

“Soju producers can also look to exploit the popularity of beer across Southeast Asia – soju is often mixed with beer to create the ‘Somaek’ mixed drink in Korea – as well as combinations with other beverages (Yakult is one popular option) and soju’s compatibility with Korean barbecue food,” notes Ho.

There are also signs that other Asian national spirits are becoming more sought-after, especially in the wake of soju’s growing popularity. In Australia, retail drinks and hospitality business Endeavour Group recently doubled its range of Asian beverages to meet growing demand among LDA Gen-Z and millennial consumers – including soju, but also Korean sparkling beverage makgeolli, as well as sake and shochu from Japan, plus shochu-based ‘chuhai’ RTDs.

Category outlook

There are some barriers and likely limitations to soju’s future overseas growth – most notably, pricing. The low costs associated with local production and a beneficial tax regime make soju highly affordable in South Korea at about US$1 for a 360ml bottle – but the same product costs US$10 or more in markets such as Singapore, Japan, and Indonesia. However, New Zealand is an exception – there, soju is taxed as a wine and, as a result, is proving to be a popular and cost-effective option for younger LDA consumers.

Soju’s growth potential could also be curtailed by the strength of other national spirits – for instance, shochu, sake and baijiu – in markets such as Japan and China. Strong associations with drinking soju alongside Korean food could also limit opportunities to target broader consumption occasions.

The pursuit of international growth for soju producers is increasingly important because of the limited opportunities offered by their domestic market in South Korea. While the country is set to continue its dominance of global soju consumption, its sheer scale makes meaningful gains unlikely in the coming years, with IWSR forecasting a 2021-26 CAGR of only +0.5%.

“Growing health consciousness and a steady decline in the after-work drinking culture will limit local consumption growth in South Korea,” explains Ho. “At the same time, many consumers, particularly LDA Gen Z and Millennials, are being exposed to different alcohol beverages, such as wine and other spirits.

“They tend to be willing to experiment with new types of drinks, and they were exposed to many different beverage alcohol brands during the Covid-19 pandemic as well. This may well lead to soju drinkers switching to other categories in the future.”

You may also be interested in reading:

Global beverage alcohol rebounds, with value reaching US$1.17 trillion

Key trends driving the global beverage alcohol drinks industry in 2022

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Spirits | MARKET: All, Asia Pacific | TREND: All |