12/08/2022

Cocktail culture is driving the evolution of the spirit-based RTD segment in the US

As the RTD category in the US becomes more established, growth rates are moderating, and brand owners are increasingly focusing on premiumisation opportunities

Hard seltzers have made an important contribution to the rise of the RTD category in the US, which has seen RTD share of the US total beverage alcohol market expand from just 4% in 2017 to 11% in 2021. While hard seltzers make up over half of the volume share of the RTD category in the US, the fastest-growing RTD segment is RTD cocktails (from a smaller volume base). The increasing investment in RTD cocktails is contributing to the premiumisation of the overall RTD market, as well as the evolution of the spirit-based RTD segment in the US.

“Spirits and cocktail culture are extremely popular right now, and with consumers wanting more and more convenience, there is a clear opportunity for brands to fill the gap for high-quality canned and bottled cocktails,” notes Adam Rogers, North America research director at IWSR. “Many well-known brands have leveraged the opportunity to add another convenience-based consumption occasion to their portfolio, while raising overall brand awareness.”

“Alcohol under indexes in flavour options compared with other CPG categories. RTD cocktails help to fill that gap by offering more choice and variety, while still meeting the convenience needs of today’s consumer,” comments Brandy Rand, chief strategy officer, IWSR. “This is also reflected in findings from our consumer research: flavour is the number one reason people choose RTDs.”

The interest in RTD cocktails has prompted a shift from malt- to spirit-based RTD offerings. Favourable tax rates mean that malt-based products in the category still account for the bulk of volumes, but their share by the end of 2022 is expected to slip below 90%, while spirit-based products will likely climb from 5% to 7%. In a fast-growing market, that represents a notable uplift and in 2021 equated to 14 million extra 9 litre cases, a figure that is expected to accelerate further by the end of 2022.

IWSR consumer data shows that drinkers in the US perceive these spirit-based products to be more premium and this is borne out in the higher prices these products command on the shelves. Brands have consequently started to use their choice of spirit base as a point of difference to indicate quality. A number of premium spirit brands have been crossing over to RTDs, contributing to the premiumisation of the overall category as well.

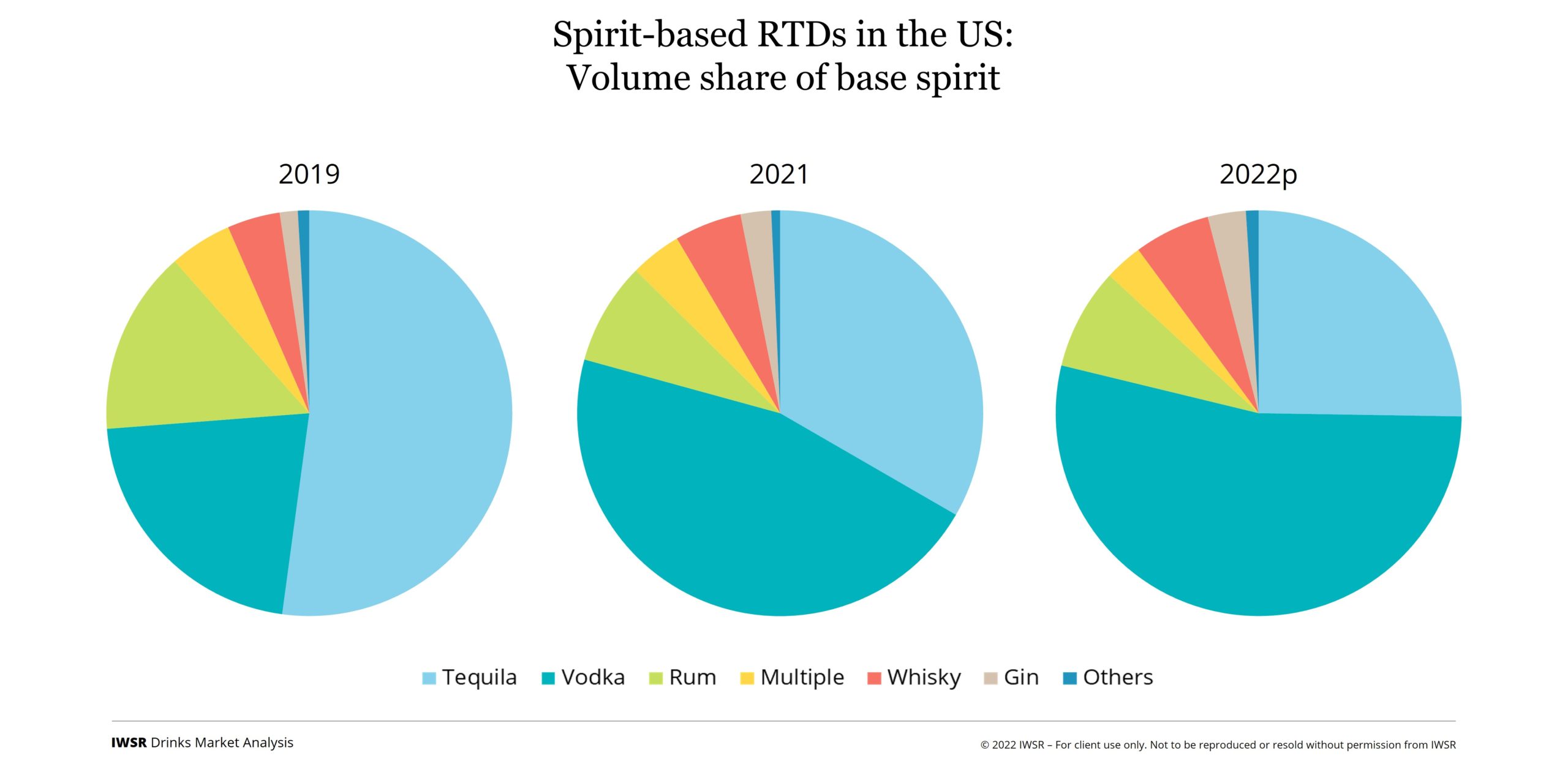

Vodka overtook tequila as the leading RTD spirit base in 2021, bolstered by the fact that around half of the most popular cocktails in the US are vodka based. In 2019, vodka had a share of just over a fifth of the spirit-based RTD segment, by 2020 this had surged to more than a third, and this is projected to reach approximately 50% by the end of 2022. Vodka-based RTDs also offer a trade-up alternative to malt-based hard seltzers.

Competition within the vodka-based RTD segment has increased significantly as large well-known brands, as well as new market entrants, launch new offerings. Brands that have recently entered the vodka-based RTD market include brands established within the vodka category, such as Deep Eddy, Ciroc and New Amsterdam, as well as RTD-focused brands, such as Spirit Fruit and NUTRL. In August 2022, Tito’s announced the launch of a vodka RTD “minus the drink” – a DIY spin-off to the canned cocktail.

Tequila is also an important ingredient in some of the most recognised cocktails, including the Margarita and the Tequila Sunrise. Margaritas in a 1.75 litre format are relatively long established and this can be accredited to the high share that tequila traditionally held as a spirit base. The 1.75 litre format, though, has seen its share diluted as more premium and fashionable smaller-format canned RTD vodka drinks emerged. In 2021, the 1.75L format claimed 57% of all spirit-based RTDs, down from the 70% share just two years prior. During the same timeframe, canned 355ml offerings increased share from 7% in 2019 to 31% in 2021.

IWSR are, however, expecting the erosion of tequila’s share of spirit-based RTDs to slow. The increasing popularity of tequila in general, is creating a halo effect for the RTD segment. Volume consumption of tequila grew 17% in the US in 2021, bolstered by increased celebrity investment. Consumers are increasingly embracing the new tequila-based Ranch Water, Paloma, and various new canned Margarita offerings that are entering the market.

Vodka and tequila’s dominance within the RTD category also relies on the fact that they are relatively more mixable than other spirit bases, such as whisky, which makes up just over 5% of spirit-based RTDs. With use in very specific cocktails, such as the Old Fashioned and Manhattan, whisky-based RTDs tend to over-index against all other RTD types in terms of pricing. However, consumer demand for more premium offerings will help, and whisky’s share of the RTD spirit-based market is expected to increase.

It is this constant innovation and a consumer demand for drinking ‘less, but better’, that is underpinning the evolution of the RTD category in the US. “The market landscape will continue to see more entrants carve a niche for themselves, for example, through new start-up launches, brand line extensions, co-brand partnerships, or influencer investment,” comments Rand. “Unlike spirits portfolios, a single RTD product doesn’t fill a brand’s portfolio gap. Because there are so many types of RTDs and constant evolution of the category, having a wide RTD portfolio can be advantageous.”

You may also be interested in reading:

Sources of RTD innovation

Why have Brown-Forman and Coca-Cola chosen Mexico for their RTD collaboration debut?

RTD volume share expected to double in next five years in top markets

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, RTDs | MARKET: All, North America | TREND: All, Convenience, Innovation, Premiumisation |