03/04/2024

How will the agave price crash impact tequila?

IWSR analyses the impact of the tequila boom on agave prices, and the implications for brand owners

As agave prices plummet and premium-and-above tequila demand moderates in the US market, brand owners have an opportunity to improve product quality at lower price points, make additional marketing investments – and divert extra supply to international markets with strong growth potential.

While a dramatic reduction in the cost of agave will also enable producers to fund discounts in order to build market share, IWSR believes that brand owners will be wary of sacrificing their recently acquired brand equity by slashing prices.

Agave price crash sparks panic sale

Agave prices in Mexico hit a record MXP32/kg only 18 months ago, but by February 2024 they had plunged to MXP5/kg. Price falls are set to continue thanks to the huge numbers of new plants that have gone into the ground in the past few years (up by more than 10% between 2021 and 2022 alone), and the fact that agave takes several years to reach maturity. According to industry reports, the number of registered agave growers has more than quadrupled since 2018 as well.

“The very large inventory of agave plants, coupled with slowing demand of premium tequila segments in the US after years of rapid growth, has sparked a panic sale among amateur agave growers who have recently joined the industry in a bid to cash in on the agave spirits boom,” explains Jose Luis Hermoso, IWSR Research Director for Central and South America.

“With such huge numbers of new plants going into the ground in 2021 and 2022, it’s entirely possible that pricing will not hit the bottom until 2026.”

The peak/trough cycle

Agave is similar to many long lead-time commodities in having an unbalanced production cycle: growers tend to overplant at times of high prices – as has been the case until very recently – which drives prices down as new plants come on stream. Lower prices then cause growers to underplant, diminishing supply and driving prices up again.

The cycle from peak to peak, or trough to trough, happens roughly every 10-15 years, or twice the agave maturity period. The last pricing trough occurred in 2007-10, when prices dropped as low as MXP2/kg.

At the same time, after several years of robust double-digit increases, overall tequila consumption volumes grew by only +4% in the US during the first half of 2023, according to IWSR data.

“Logically, we would expect to see an influx of cheaper 100% agave tequila into the market in the near future – so, potentially, a higher-quality product at a lower price, which might attract new consumers and/or encourage trade-down,” says Richard Halstead, IWSR COO for Consumer Research.

“The last time we saw a supply glut similar to this was around 2009/10, when numerous new brands came to the market using the 100% agave description, but at prices significantly lower than the majority of incumbent 100% agave brands.”

These launches increased the downward trajectory of mixto (51% agave) brands, which has continued since then – and could be exacerbated by the entry of new 100% agave brands offering a better price-to-quality ratio.

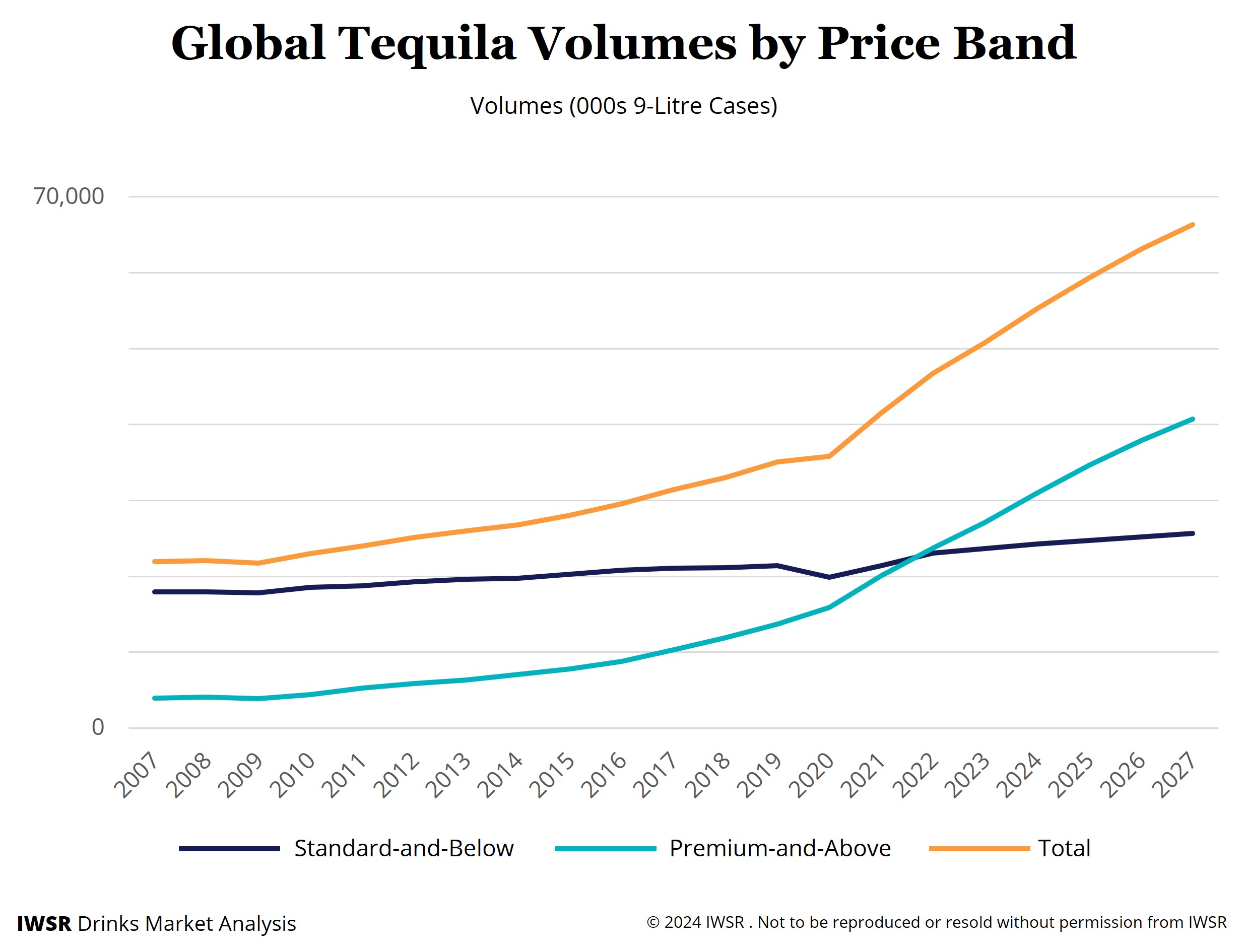

This need not signal the end of premiumisation for tequila. Longitudinal IWSR data covering the last agave pricing trough shows that, while global agave spirits volumes grew at a CAGR of +3% between 2006 and 2010, premium-plus volumes expanded at a CAGR of +7% over the same timescale – outstripping standard-and-below CAGR growth of +2%.

“Declining agave prices give leading brand owners the opportunity to improve their margins and/or increase promotional activity in order to build category share,” says Adam Rogers, Research Director for North America, IWSR. “But these experienced, marketing-led organisations will be wary of damaging their brand equity by widespread discounting.

“We do not foresee any race to the bottom in pricing terms, with premium-and-above products remaining dominant as the market leaders will be determined to preserve margin.”

Reinvesting into the category

Lower prices and increased supply will also allow brand owners to lay down more product for extended ageing – something that was previously difficult because of low supply levels and high input costs.

“Brand owners may also look to reinvest some of the margin windfall they have gained from lower agave prices into more aggressive awareness-building campaigns around the category, particularly in emerging growth markets across Asia Pacific, Eastern Europe, the Middle East, Africa and Latin America outside Mexico,” says Rogers.

While the US and Mexico continue to dominate global category volumes, agave spirits grew in 15 out of the world’s top 20 beverage alcohol markets in the first half of 2023, according to IWSR data, recording double-digit volume increases in 11 of them.

This category expansion is being driven by a number of factors, including the popularity of cocktails in Canada (where volumes rose by +14% in H1 2023); the reopening of the on-premise in China (+15%); and tequila’s improving quality image in Spain (+20%).

Meanwhile, tequila brand owners – many of them large multinationals – are working to create a more integrated production model from farm to bottle. Companies are expanding their own plantings and securing supply via long-term grower contracts – which should, in time, prevent or at least reduce supply and pricing volatility.

“While newer entrants are still falling into the approach of ‘buying at the peak/selling at the trough’, established players are trying to tame the cycle by underplanting during pricing peaks and overplanting during pricing troughs,” says Hermoso. “This can only be good for the agave spirits category in the longer term.”

You may also be interested in reading:

Is the US premium tequila boom over?

Does tequila’s growth mirror that of the gin boom?

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Spirits | MARKET: All, North America | TREND: All |