08/05/2025

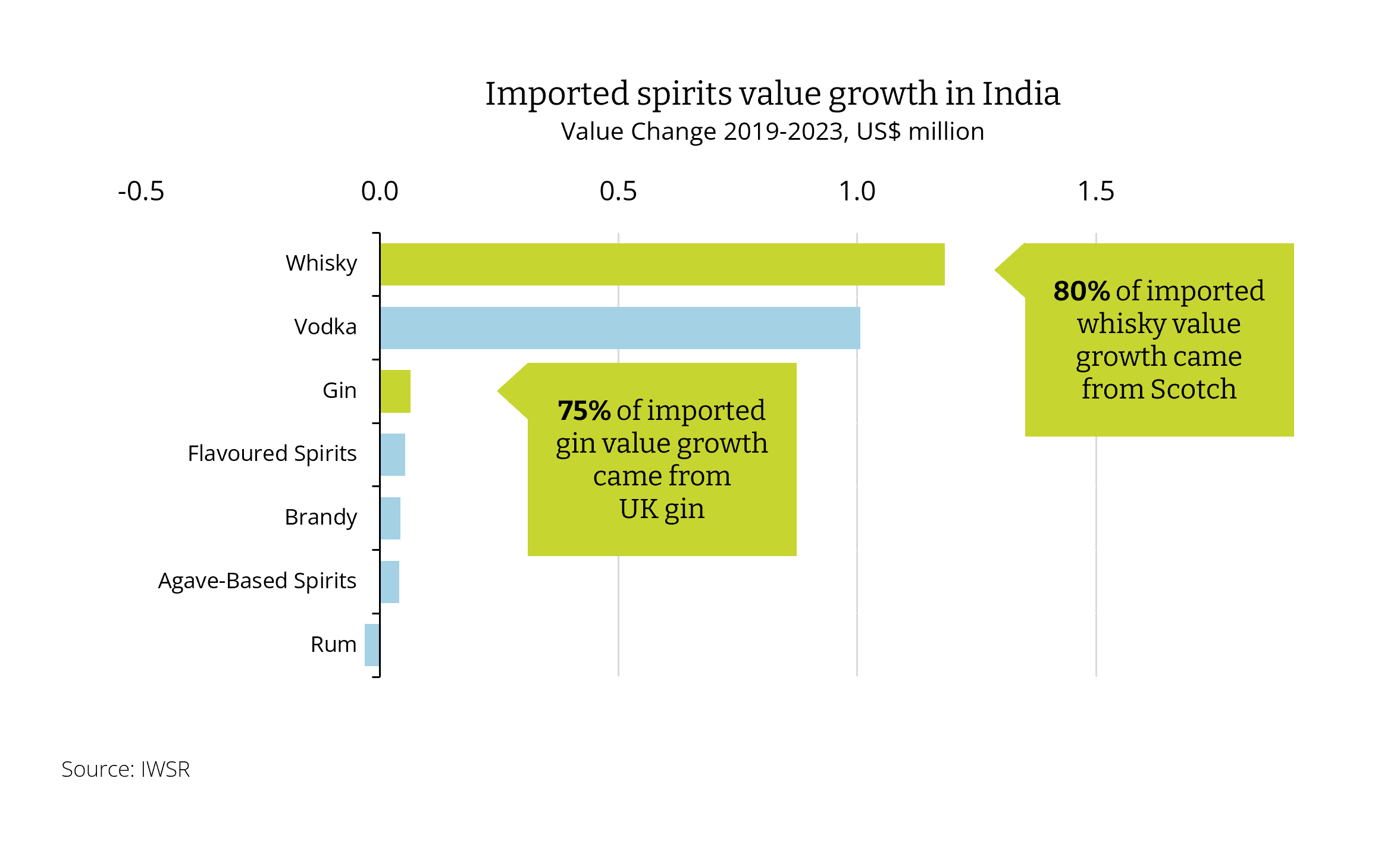

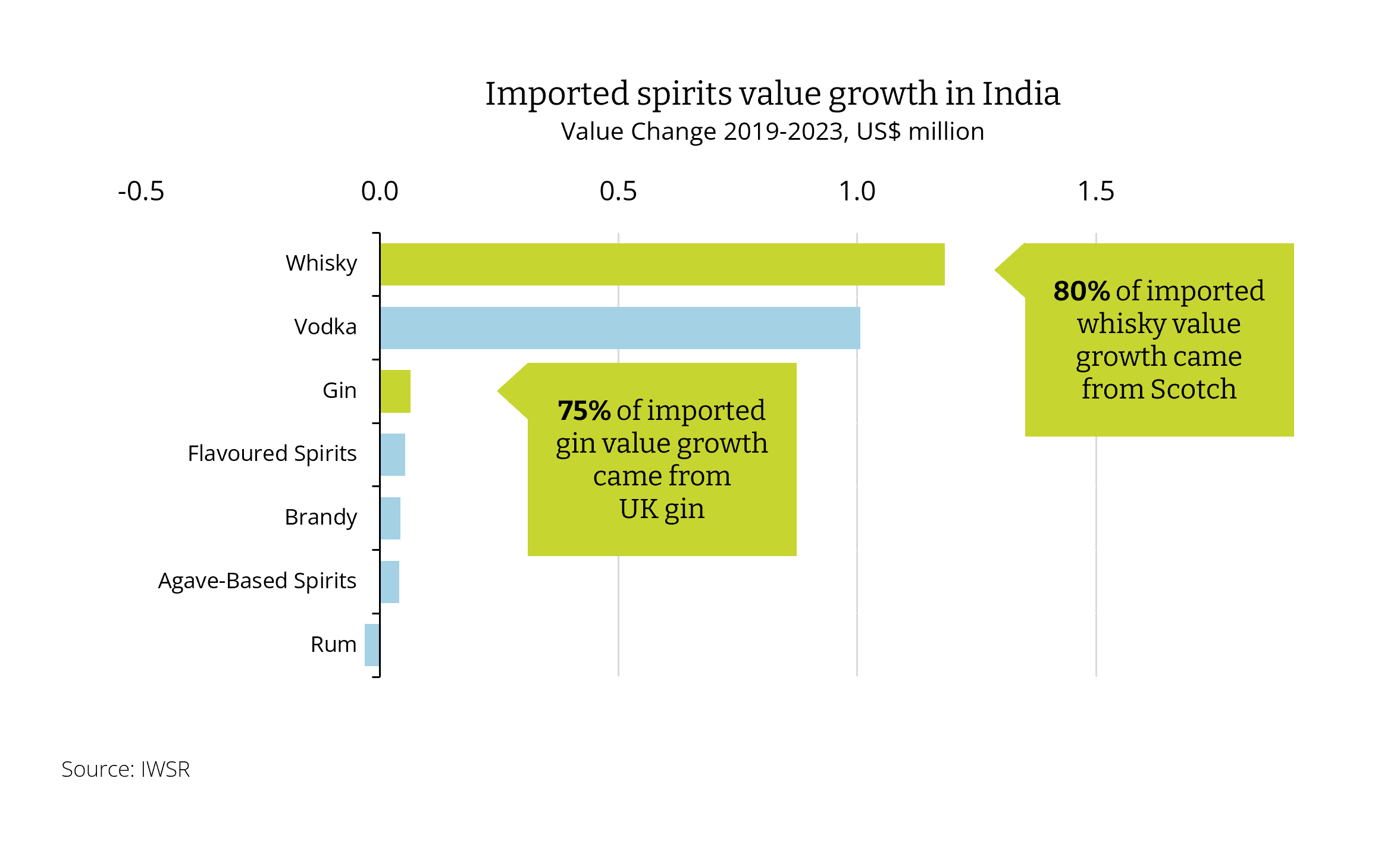

UK-India trade deal opens further opportunities for Scotch and gin

IWSR’s Jason Holway, Senior Research Consultant, analyses the potential implications and opportunities following the signing of the UK and India free trade agreement

After being signposted since the premiership of Boris Johnson, an India-UK free trade agreement (FTA) has finally been agreed. Amidst uncertainty following Trump’s tariffs it is all the more resonant as two of the world’s largest economies reinforce their commitment to free trade.

Additionally, the structure of this India-UK FTA may serve as a template for India-EU and India-US FTAs, which are also thought to be close to resolution, so the details, not yet fully known, will be even more important.

For the beverage alcohol industry, the key headline is the immediate halving of the whisky and gin tariff from 150% to 75%, with the intention for it to reduce to 40% within 10 years.

IWSR will be taking this change into consideration for the 5- and 10-year forecasts, which are due for release later this month.

It is unknown, as yet, whether two of the Indian industry’s concerns have been addressed: minimum import pricing (MIP) per case to prevent dumping and/or ‘predatory pricing’ and the removal of non-tariff barriers to help boost Indian export opportunities.

Initial analysis suggests an outbreak of predatory pricing or dumping, which would demand a response from the Indian Customs authorities, is unlikely, particularly when most players, domestic and imported alike, are premiumising portfolios so as to maximise margins. That said, a price war can’t be ruled out just yet.

As ever with alcohol and India, the impacts of this tariff reduction will be complex and vary state by state, category by category and price band by price band, reflecting the existing intricacy of the industry.

Tariff reduction beneficiaries

At a time when there is a consistent narrative of the Indian beverage alcohol industry lobbying states to increase retail sales prices (RSPs) to mitigate increased input costs, anything that helps to reduce those costs is seen as a positive.

Industry components set to benefit from this include:

- Bottled In Origin (BIO) Scotch: some industry commentators suggest that on shelf prices could reduce by up to 30%. More realistically, any saving is likely to be around 10%, not to be sniffed at but not a game-changer either. It is important to stress that any savings will not be apparent in all states and may not be passed on to the consumer, at least not in the short-term. For two reasons: brand owners were already invoicing at lower-than-ideal prices to compensate for the high duties: paradoxically, the states will be resistant to any price reductions, seeing only a loss of revenues.

- Smaller Scotch distillers and brands: 2024 was a year in which sales of Scotch single malts slowed as Indian consumers proudly embraced award-winning local malts. Blended Scotch, primarily from the larger brand owners, also had a strong year. If an FTA impact is to make premium-and-above blended Scotch and malt whisky more affordable, then it is certainly possible that smaller distillers will be prioritising the investigation of sub-continental opportunities. However, this FTA, as far as is presently known, does not remove any of the extensive red tape that characterises doing business in the Indian alcohol market: for instance, brands and labels will still need to register annually state by state, with licence fees paid. There are opportunities, but they will not necessarily be easier to access. Perseverance can bring rewards, but not overnight.

- Bottled in India (BII) Scotch: if the FTA will deliver an average saving of 10% in BIO pricing, the benefit for BII will be considerably less because any saving will only be on the liquid element – all other production and packing costs will be unchanged.

- Premium-priced local whiskies: commonly these brands use Scotch as a (bulk imported) ingredient and so will derive a similar marginal benefit as per BII Scotch.

Could cheap Scotch flood the market?

Throughout the FTA lobbying process, local distillers additionally sought to prevent cheap Scotch flooding the market via a Minimum Import Pricing (MIP) rule and wished for the removal of non-tariff barriers (essentially the EU-ratified requirement of all whisky to be matured for at least three years). It is unclear if or how these requests feature in the detail of the FTA, but we consider any MIP regulation to be unlikely and the second subject to possible workarounds.

If domestic brand owners need any further reassurance that things will not change dramatically, they need only look at the whisky category’s existing architecture and appreciate the pricing gaps.

Imported premium-priced blended Scotches such as Johnnie Walker Black Label and Chivas Regal average a retail price in the range INR 3,200 to INR 3,600. In terms of local competition, only Indian single malts sell at similar prices.

Standard-priced blended Scotches, either BII such as 100 Pipers and Teachers, or BIO imports such as Johnnie Walker Red Label, sell at around half that level in the range INR 1,400 to INR 1,600. There are a limited number of Indian blended whiskies at that price point – Royal Ranthambore (Radico Khaitan) and Rockford Reserve (Modi), each with a high Scotch content – and a couple more at closer to INR 1,000, but the great majority of local whisky sold in India is in the INR 500 to INR 800 price range.

So, standard-price blended Scotch is commonly double the price of the key domestic brands, with few products in the gap, while premium-priced blended Scotch is double again, with a similar absence of brands ‘in the gap’. There seems to be little incentive for Scotch producers to narrow such gaps if all they would be doing is, somewhat unnecessarily, giving away margin.

As to the prospect of dumping – it seems a little counterintuitive that, at a time when India is bulk Scotch’s biggest customer and an increasingly significant importer of bottled Scotch, exporters would choose to emphasise value over premiumisation and aspiration, would focus on low margin short-term gains rather than prioritising medium to long term upsides.

There may be those who can see a quick win in low value exporting, either opportunistic or through a desire to turn unsold stock into cash, but the output of the Scotch whisky industry is and always will be finite. Strategically, it is much more likely that the industry’s focus will be on guaranteeing consistent, matured supply.

Taking all these things into consideration, it is almost certain that the greatest part of whisky demand in India – small 180ml bottles of Indian whisky, known locally as nips, at the value/low-price end – will be untouched by these developments.

Gin market potential

Let’s not forget gin: the origins of the local craft wave in India were products priced closer to INR 1,000 than INR 2,000, with most imports sitting above INR 2,000. The pioneers successfully established the link between gin and Indian craft ingredients and, even if much subsequent new product development was concentrated north of INR 3,000, the centre of gravity of local supply still delivers a price advantage to imports. It will be interesting to see how, with prices potentially more equal, authentic Indian gins continue to play against traditional imported gins.

One development that the FTA may help to bring forward could be the import of more UK craft (gins) into India. The more enlightened domestic brand owners would welcome such developments: ethos rather than nationality – or, indeed, price point – could then provide a premiumising boost to the gin category.

Looking outwards, for both Indian whisky and gin, it is yet to be determined how the FTA will improve export access to the UK, but there will be opportunities.

Of course, the removal of protective tariffs will deliver a more challenging environment. Some will prosper, others may falter. But there is nothing pre-determined about the identity of those who will seize opportunities. This FTA creates better margins and supports premiumisation. Reaping the benefit is optional.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Spirits | MARKET: Asia Pacific, Europe |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.