09/03/2022

Opportunities for no/low drinks beyond the traditional alcohol occasion

Key take-aways from IWSR's LinkedIn Live Briefing on the outlook of the no/low-alcohol market

Expanding beyond the typical beverage alcohol occasion is a key opportunity for the growth of the no- and low-alcohol category asserted Emily Neill, COO at IWSR, at a recent IWSR live briefing on the long-term opportunities for no- and low-alcohol, broadcast via LinkedIn and other IWSR social channels in March 2022.

During the briefing, Neill gave insight into the different types of no/low consumers and their behaviour preferences, as well as the short- and long-term growth trends of individual no/low categories across key markets.

Expanding outside the typical alcohol occasion

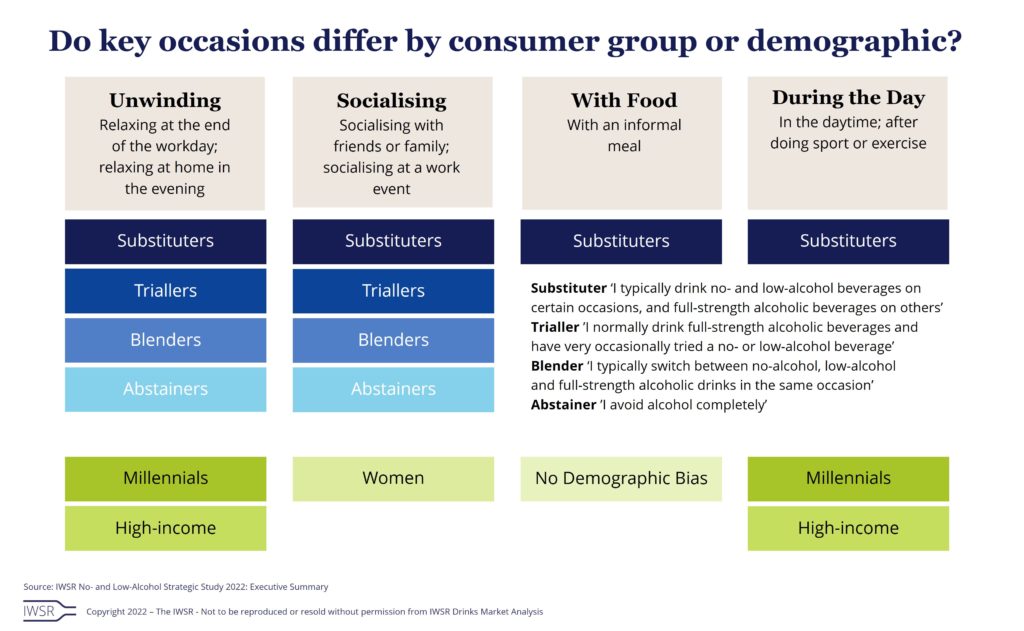

No- and low-alcohol beverages have an opportunity to break into occasions where alcoholic beverages are not typically consumed. “Many no/low beverages target specific alcohol occasions, such as unwinding and socialising at the end of the day,” commented Neill, “but no-alcohol beer, in particular, is able to stretch outside of these occasions.” Some no-alcohol beer brands have begun tapping into the sports and wellness space, such as UpFlow Brewing company in Australia, which has produced beers with added electrolytes for additional hydration.

“Currently, the percentage of no/low consumers who said they usually consume no/low beverages in wellness spaces such as gyms and health clubs, is low. At 13% on average across ten key markets, there could be potential to expand beyond the typical alcohol beverage occasion and location,” commented Neill.

Packaging innovation

Packaging innovation is another potential opportunity for attracting new consumers and enabling easier trial of new products. Large pack sizes, such the 75cl wine bottles or 70cl spirits bottles, can deter consumers from trialling new products due to a higher price tag. Using smaller pack sizes to enable and facilitate trial of the category can help break this barrier, especially for no-alcohol spirits.

Neill commented, “there has been a huge amount of innovation around the liquid of no- and low-alcohol, but there is still a lot that could be done in terms of packaging innovation to help make the category more accessible to consumers.”

“Some no-alcohol spirits brands have created RTD versions which enable consumers to trial product with a smaller outlay.”

On-premise serve

Another consideration is the serve and format in the on-premise. Draft beer in the on-premise is the last hurdle for the no/low beer category, which is the most dominant category in the no/low space, holding around 75% market share.

“In well-developed and mature no/low beer markets, such as Spain and Germany, draft no/low beer has been present in the on-premise for some time,” noted Neill. “Having a beer on tap gives a brand greater visibility on the bar as opposed to bottles in the chiller cabinets, and enables the customer to feel ‘part of the crowd’ drinking draft beer.”

Many brewers are seeing draft beer as a key factor for making their products as accessible as possible to consumers and for the long-term success of the category.

Route-to-market

“Lack of availability and choice is a key barrier to consumers buying more no- and low-alcohol products,” explained Neill. “There is work to be done in the off-trade bricks & mortar retail sector, where supporting retailers with shelf placement guidance and educating consumers is important.”

Choosing the right retail partners and right route to market is also key. “Ecommerce is helping to level the playing field for no/low brands, both smaller new-to-world brands as well as new-to-world and brand extensions from larger brand owners,” noted Neill.

Ecommerce activity accelerated during the pandemic, to overcome on-trade restrictions and lockdowns. “Ecommerce allows smaller brand owners to get greater visibility,” commented Neill. “Some brands sell exclusively online via ecommerce marketplaces and subscription services, as well as via dedicated no/low ecommerce outlets. Ecommerce can help consumers to navigate and explore the categories. Direct-to-consumer (DTC) ecommerce of individual brands is likely to continue to thrive and to be a key driver, especially for the no-alcohol categories.”

To stay up-to-date on IWSR’s Live Briefings, follow IWSR on LinkedIn

You may also be interested in reading:

How will activation strategies for no/low-alcohol spirits evolve?

The key drivers shaping no/low-alcohol go-to-market strategies

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, No/Low-Alcohol | MARKET: All | TREND: All, Moderation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.