03/03/2022

The key drivers shaping no/low-alcohol go-to-market strategies

Many brand owners are taking a two-pronged approach to investing in the no/low-alcohol space

As the no/low beverage alcohol category continues to expand and diversify, many brand owners are taking a two-pronged approach to investing in the space: launching extensions of established brands, such as Gordon’s 0.0, and creating new-to-world (NTW) products, such as Seedlip or Ceder’s. Both approaches resonate for different reasons, and IWSR explores the drivers behind these go-to-market strategies.

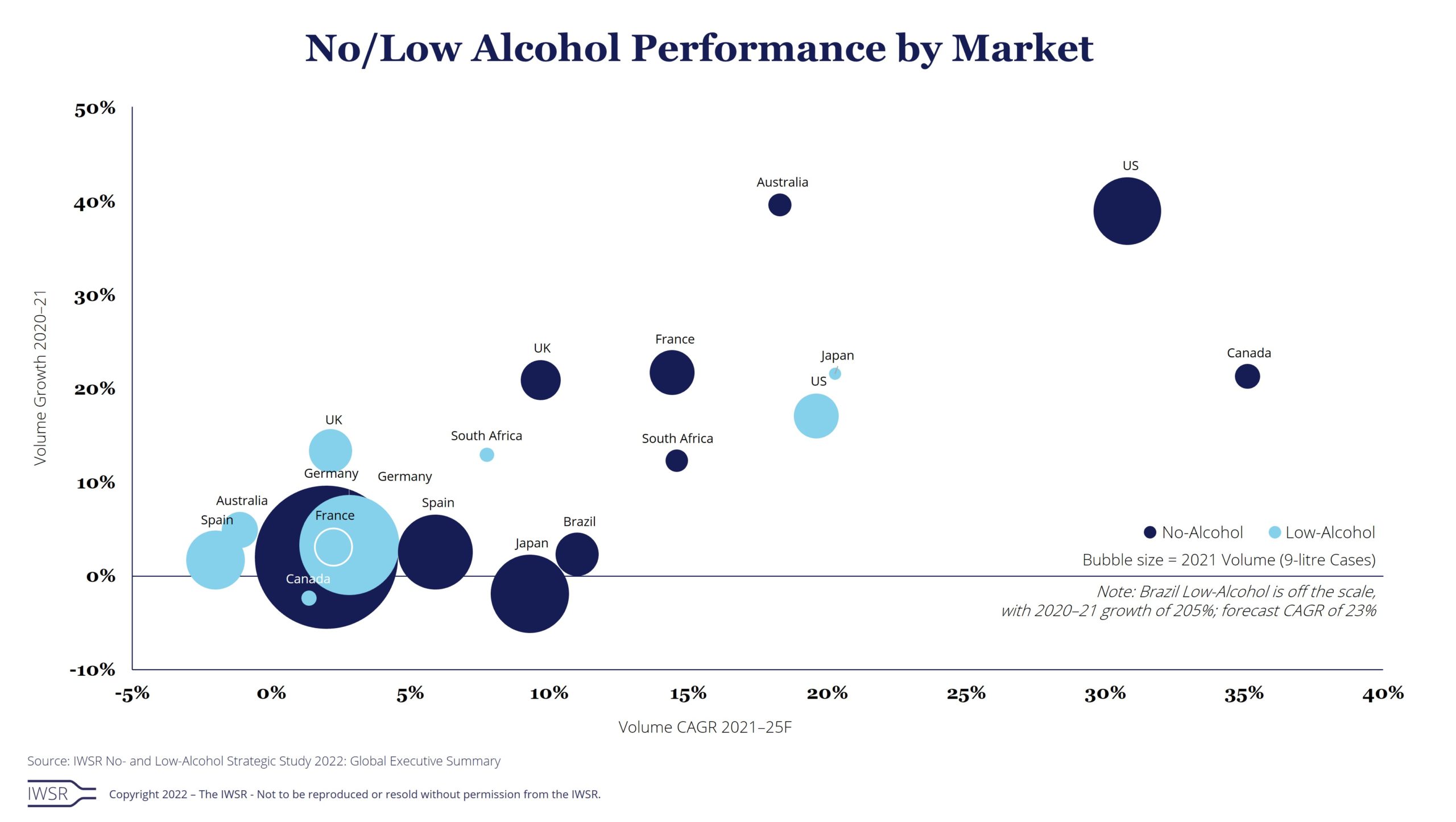

According to IWSR figures, no/low products accounted for a 3.5% volume share of beverage alcohol in 10 key markets (Australia, Brazil, Canada, France, Germany, Japan, South Africa, Spain, the UK and the US) in 2021, following a 6%-plus increase in consumption. No/low is now worth just under US$10bn, up from $7.8bn in 2018, across the focus markets.

IWSR forecasts suggest that the category will record a volume compound annual growth rate (CAGR) of +8% between 2021 and 2025.

As no/low evolves, there is a clear crossover between it and full-strength consumption: IWSR data shows that 43% of consumers are substituting no/low for full-strength alcohol on certain occasions – but fewer than one in five are avoiding alcohol altogether.

“While January has become a popular month for people to cut back or abstain from alcohol, interest in no- and low-alcohol drinks has increasingly become a year-round trend among consumers across the world,” says Emily Neill, COO of IWSR Drinks Market Analysis. “To meet that demand, beverage alcohol companies are investing heavily to introduce a number of innovative new products, and many established mainstream brands have recently crossed over to develop no/low alcohol versions of their popular beers and spirits.”

“These no/low products also generally have strong investment behind them, so they are helping to advertise and promote the broader category, and they are typically good-quality with plenty of R&D behind them,” adds Neill.

“The no-and-lower movement is complementary to the alcohol category,” says a Diageo spokesperson. “Social occasions are becoming increasingly diverse to cater for those who choose not to drink alcohol, as well as those who do.

“No/low drinks are for anybody. People may be choosing not to drink alcohol on a specific occasion or for a certain period, or they may even be blending no-and-lower products and alcoholic products on the same occasion.”

Simon de Beauregard, global director for Lillet, Ceder’s and French aperitifs at Pernod Ricard, agrees. “[The market] is all of us – alcohol drinkers that want to remain responsible,” he says. “As such, the base is the same base: the big non-alcohol markets are the alcohol markets – the UK, US, Benelux, Canada and France.”

Bacardi CFO Tony Latham highlights the examples of Martini Floreale and Vibrante – zero abv line extensions which he says “serve as a complement” to the core Martini vermouth brand. “The non-alcoholic Martini line saw the recruitment of more than 20m new consumers to the brand … and that’s great for the core brand,” he adds.

As no-and-low develops, extensions of established brands and “new-to-world” launches may begin to coexist and complement each other, Neill says. “Beer, for example, is more developed in no/low, and brand extensions and independent products are now working well together,” she adds.

“Extensions are investing heavily and performing well, but there is also a strong movement for independent no/low too (for instance, Big Drop and Lucky Saint). Brand extensions help to legitimise and promote the overall category. As the market becomes more mature, there is space for independents, who have improved the quality of their products and pressurised the big players to do the same.”

The long-term strategies of big operators reflect this two-pronged approach, combining new-to-world no/low brands with line extensions. “To me there are two approaches,” says de Beauregard. “One – no/low for what it is, and then no/low for what it is not.” de Beauregard highlights the example of Ceder’s, which offers “a beautifully distilled blend of botanicals”. On the other hand, some brands, he says, focus their marketing messaging on what they are not – they’ve removed something.

“At the moment, we are pushing both of these in a way – ‘we’ as a market. And they are not serving the same need. In many ways the question goes into complementarity.”

Bacardi has Martini Floreale and Vibrante as zero-abv extensions of an established brand – but also low-abv Plume & Petal in the US, and recently-launched zero-abv Palette in Europe. This raises another question – of whether zero-abv or low-abv products offer the most effective approach.

“We believe there is space for both,” says Latham. “Having a play in both no and low alcohol allows us to provide more options and connect on more occasions, and therefore more frequently, with consumers.”

“Strategies will differ based on the type of no/low-alcohol category – whether it is a beer, spirit or wine alternative,” says Neill. “For example, our data shows that in many markets, spirits performance is currently following more of an all-or-nothing trend in terms of ABV.”

The main barriers to increased consumer take-up of no/low products, according to IWSR research, are lack of choice, lack of availability and price. From a brand owner perspective, de Beauregard adds that trade caution is one of the main factors at play here. “There is clear demand from the consumer, and there are hundreds of [no/low] brands now,” he says. “In the middle, the trade is taking a bit more time to adjust, and that makes sense because economically it’s not a big category yet.”

In pricing terms, Ceder’s is line-priced with premium gin, he says, for three main reasons: because the company wants consumers to equate the experience of drinking it with drinking a full-strength product; because “from a production standpoint it’s at least as hard to make”; and in order to fund marketing investment. “We need to educate, do masterclasses and explain what it is,” he says.

While there is no sign of the number of no/low launches slowing down, Bacardi’s Latham argues that a scattergun approach will not be effective. “A lot of companies are throwing out zero percent extensions of brands,” he says. “We are not going to do that as an automatic play for every brand.

“We are paying close attention to where the opportunities are and, above all else, are ensuring any zero expression we create offers the same taste and quality that is expected from our brands.”

The overall picture, concludes Neill, is one of a fast-changing category where brand owners are still working out the most effective approach. “It is still early days for no and low, and many companies are still experimenting within the space,” she says.

“In many ways, they are hedging their bets with different options – testing the theory of brand extensions versus ‘new-to-world’ products, and observing how new brands from entrepreneurs, as well as how their own products, perform.”

[table id=11 responsive=stack /]

You may also be interested in reading:

How will activation strategies for no/low-alcohol spirits evolve?

Key trends driving the global beverage alcohol drinks industry in 2022

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, No/Low-Alcohol | MARKET: All | TREND: All, Moderation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.