31/05/2023

Sustainability concerns drive interest in organic, natural and alternative wines

Latest findings from IWSR’s ongoing tracking of consumer interest in and attitudes towards alternative wines

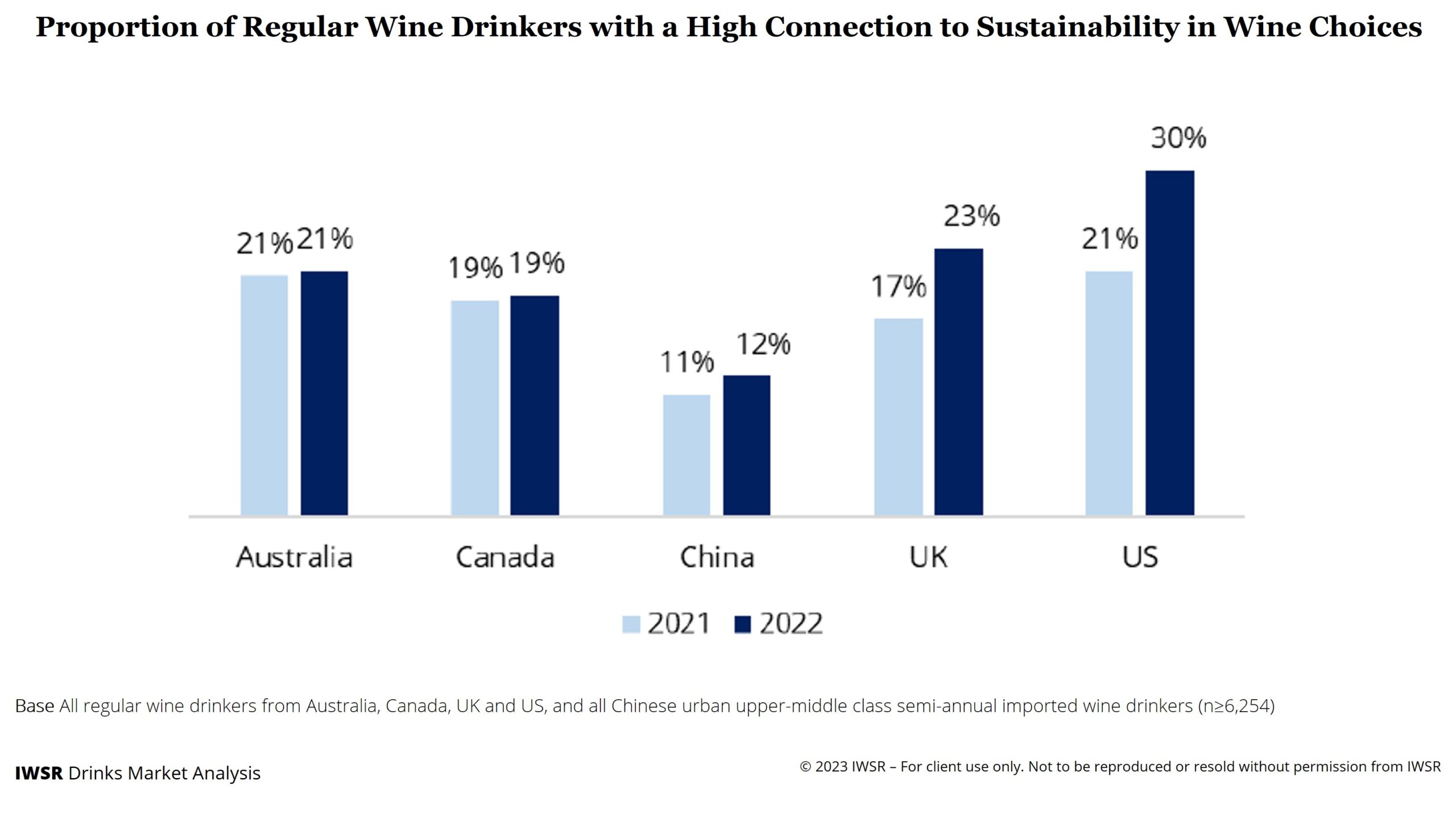

Sustainability concerns have generally become more elevated amongst wine drinkers over the past year, which has translated into a growing consumer interest in alternative wines, especially in the US and UK.

Latest findings from IWSR’s ongoing tracking for consumer interest in and attitudes towards organic, natural, and other alternative wines (such as Fairtrade, biodynamic, carbon-neutral, sulphate-free, and cannabis-infused) show that natural wine offers some of the biggest opportunities for wine producers – though the meaning of “natural” varies amongst consumers.

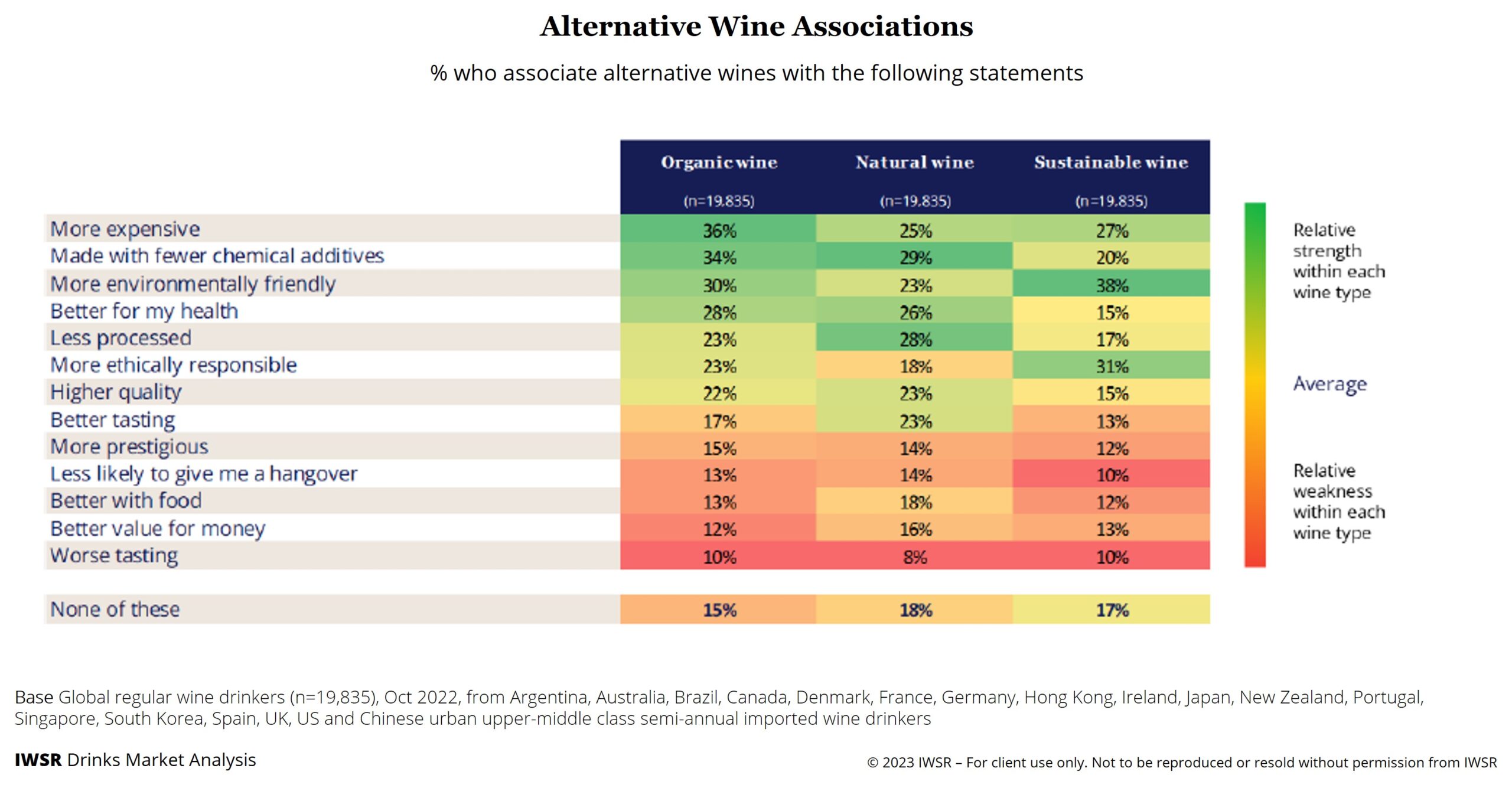

The general perception of natural wine as more healthy, less harmful to the environment, better tasting and higher quality are fundamental to its success. Even though the technical definition of ‘natural’ wine is often not well understood by consumers, the word’s positive associations mean it is still a sought-after attribute. Indeed, as part of IWSR’s ongoing tracking of consumer attitudes to wine labels, findings show that a wine bottle label that is focused on “natural wine” continues to be amongst the claims that influences wine consumers the most.

While natural wines are often associated with being ‘less processed’, consumers perceive sustainable wines as being better for the environment and more ethically responsible. In the US and the UK, the proportion of regular wine drinkers willing to pay more for sustainable wine has significantly increased between 2021 and 2022. Almost half (46%) of US regular wine drinkers also say they will always choose a sustainable wine when given the choice. In the UK, consumers with high engagement on sustainability are more likely to be millennials. In the US, men, millennials and Gen X are the main buyers of the majority of alternative wine types.

Organic wines have been showing positive volume growth in most markets: globally, organic wines grew by +5% volume CAGR, 2017-2022. In many markets, the organic wine segment is showing growth while the non-organic still wine market shows declining or flat performance. In the US, for example, organic wine volumes grew +7%, volume CAGR, 2017-2022, while the non-organic segment is on a long-term downward trend. A similar trend can be seen in the UK, where organic wine volumes grew at a +6% volume CAGR, 2017-2022.

Wine consumers across markets generally view organic wine as the most expensive type of alternative wine, although this does vary by region. European and North American wine drinkers associate organic wine more strongly with higher prices, while Asian wine consumers focus more on product qualities such as fewer additives or being less processed.

Concern about products being modified or processed is an overarching theme amongst Asian consumers, and is a reason China stands out as one of the strongest potential markets for most alternative wines.

Chinese wine drinkers are more likely to be affluent, on-trend, and seeking healthy and wellbeing-enhancing food and drink options generally. In 2022, China entered our Global Opportunity Index for Alternative Wines in first place for organic wine, and second for both sustainably-produced wines and natural wines. In 2023, China ranks in first place for all three wine types. This is reflected in the market data as well: China’s organic wine market, for example, grew by +8% volume CAGR, 2017-2022.

Looking ahead, increased costs of living in many markets may pose a threat to the alternative wine segment, which is often perceived as more expensive but is not always associated with higher quality or better taste. Overall awareness for a wide range of alternative wine types also remains low, possibly limiting the category’s growth potential. However, wine labels can help with tapping into consumer interest in sustainable wines: in Australia, China, the US and UK, for example, over half of all regular wine drinkers only trust the sustainability of wines if they show official certification.

You may also be interested in reading:

Key trends for wine in 2023 and beyond

Key statistics: the no-alcohol and low-alcohol market

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Wine | MARKET: All | TREND: All |