10/02/2022

Tequila and vodka are the most popular bases for spirit-based RTDs in the US

Spirit-based RTDs drive premiumisation cues

As the RTD category evolves, brand owners in many markets, including the US, UK, Mexico, Australia and South Africa, are increasingly leaning on spirit-based RTDs to drive premiumisation cues. While flavour is the primary driver of consumer RTD selection, alcohol base (as well as cocktail type) is also a significant motivating factor. As the RTD category becomes more sophisticated and better understood, consumers are increasingly showing a preference for spirit-based products, which they are more likely to perceive as higher quality.

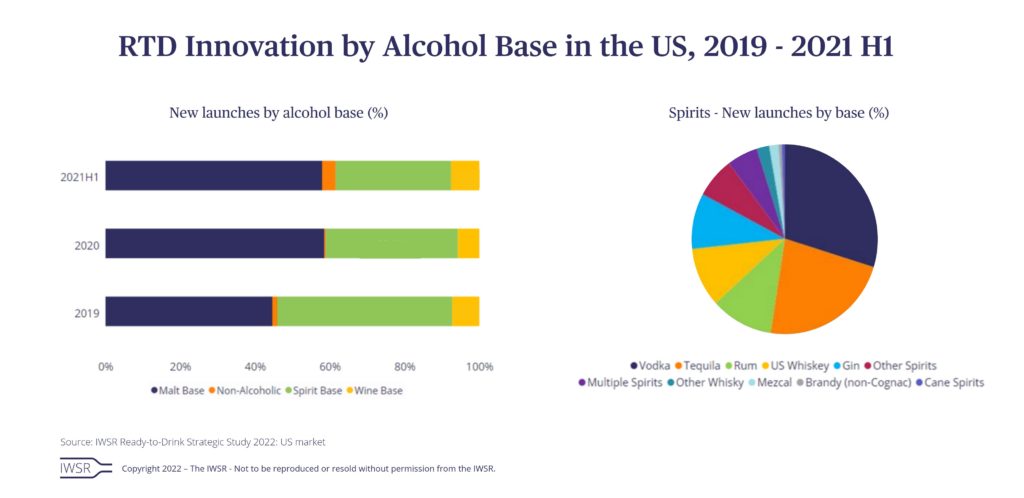

In the US, where malt-based hard seltzers have spearheaded the dramatic expansion of the RTD category, spirit-based RTDs open up a whole new spectrum of familiar cocktails and taste profiles that dovetail with trends in the spirits category.

“By 2025, spirit-based RTDs are expected to see annual volume growth of 33% in the US, and many producers and distributors are leveraging the opportunity,” says Adam Rogers, Research Director at IWSR. “Some are exploring the spirit-based RTD space for the first time, and others are expanding their existing portfolios.

“Examples emerge almost daily in the US where large brewers venture into Tequila- or vodka-based RTDs, while traditionally pure spirits players are extending their core ranges into the category, aiming to capitalise on their established brand equity.”

This phenomenon extends into the hard seltzer sub-category as well: in 2019, hard seltzers accounted for only 5% of spirit-based RTD innovations in the US, but that share figure rose to 12% of recent launches in 2021, according to IWSR data.

The trend is being further fuelled by the growth of pre-mixed cocktails and long drinks, the majority of which are spirit-based.

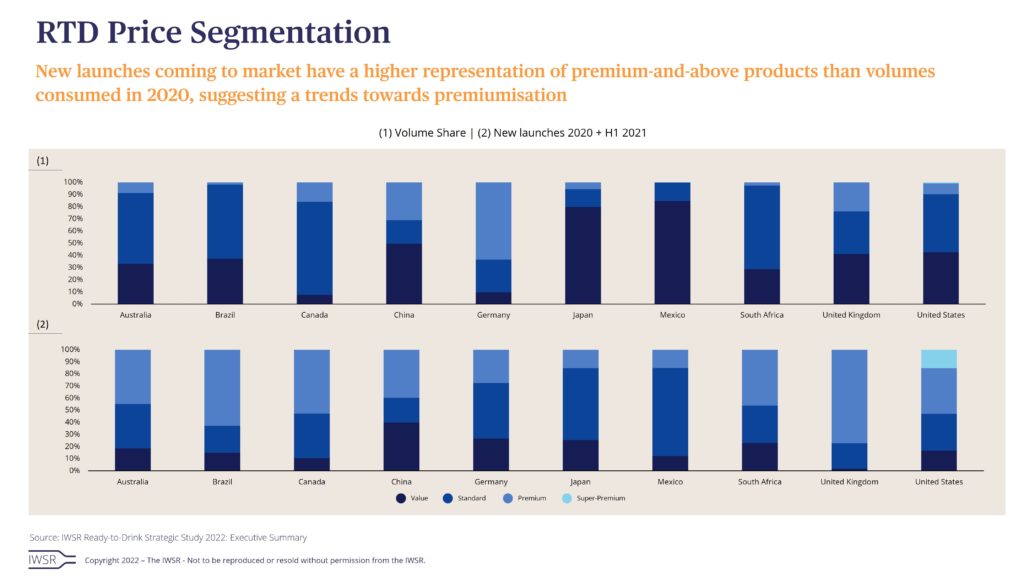

For the moment, however, the RTD category in the US remains dominated by malt-based products, which accounted for almost 90% of volumes in 2020 – in part because they incur lower tax rates than spirit- or wine-based products.

Many states also have regulations barring the sale of spirit-based products, including RTDs, in outlets such as grocery/convenience stores and gas stations. However, this legislation, as well as the disparity in tax rates, is now being reviewed in a number of US states.

Among the rising numbers of spirit-based RTD products, vodka and tequila bases are dominant, together accounting for more than 50% of new spirit-based RTD launches between 2019 and the first half of 2021, according to IWSR data.

“The majority of new spirit-based releases use vodka and tequila, partly because consumers prefer them and partly because these spirits tend to be more mixable than whisky,” says Rogers.. “Relatively few new launches use rum as a base, however, despite it being consumers’ second-favourite RTD spirits base. This could offer a possible opportunity for new product development.”

Another area that might be ripe for future expansion is whisky-based RTDs, which have so far lagged behind vodka, tequila and rum in terms of new product launch numbers. “During the current RTD disruption, whisky-based combinations are set to grow the most in the spirit-based segment over the next few years (+84% volume CAGR 2020–25), reflecting the momentum taking place in the broader whisky category,” says Rogers. Their share is expected to rise from a mere 3% of all spirit-based RTDs in 2020 to 17% by the end of 2025.

As this growth continues, it will be crucial for brand owners to identify the right flavour combinations and marketing strategies to maximise the potential of whisky-based RTDs and drive growth in the physical and digital spaces.

One example that has emerged through IWSR research is that consumers are more likely to report consumption of whisky-based RTDs while online with family and friends (49%), or in a virtual gaming event with other players (64%), compared to the total US sample of RTD drinkers. Gin-based RTDs are also more likely to be enjoyed during virtual gaming occasions.

The virtual gaming and online occasions have undoubtedly been driven by the Covid-19 lockdowns. “If these trends continue,” notes Rogers, “whisky-based RTD brands have an opportunity to elevate their brand-activation strategies online – perhaps by creating branded digital storefronts or virtual experiences, for example.”

As more spirit-based RTDs enter the US market, innovation is being driven by packaging formats and flavour profiles. “We are seeing brands increasingly innovating on the Ready-to-Serve (RTS) format by using premium glass bottled premixed cocktails,” comments Rogers. IWSR has also identified two clear segments of flavour profiles entering the spirit-based RTD market – complex flavours that offer a full-flavour alcoholic beverage taste profile, and simple flavours, which often offer cues of moderation and wellbeing.

[table id=11 responsive=stack /]

You may also be interested in reading:

Premiumisation and the rise of RTDs drive shifts in category share

Key trends driving the global beverage alcohol drinks industry in 2022

RTD volume share expected to double in next five years in top markets

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, RTDs, Spirits | MARKET: All, North America | TREND: All |