30/09/2021

Will wine take off in India?

IWSR analyses the outlook and drivers of the wine category in India

Domestic and imported wine brands in India have a bright future ahead of them as cultural shifts create beneficial consumer trends and penetration into less tapped demographics, such as younger LDA drinkers and men.

An increased focus on higher quality offerings by the dominant domestic wine industry and increased consumption without food are also likely to boost demand – but imported wines face familiar hurdles in the shape of high taxes and tariffs, and a cumbersome regulatory system.

In the short term, the Covid-19 pandemic had a significant impact on wine sales during 2020. The on-trade is an important channel for wine in India, and closures and lockdowns led to sales volumes plummeting by about -20% in 12 months, according to IWSR data. Imports were also adversely affected by supply disruption and the scaling back of distribution, as well as challenges with international logistics and liquidity.

But longer-term pre-pandemic trends show wine becoming more approachable and acceptable in Indian society. “In both TV and film, young and discerning characters are drinking wine, most importantly without food, beginning to break a connection in many consumers’ minds,” reports IWSR research analyst Jason Holway. “These characters are both male and female, subtly questioning the conventional view that wine is more of a woman’s drink.”

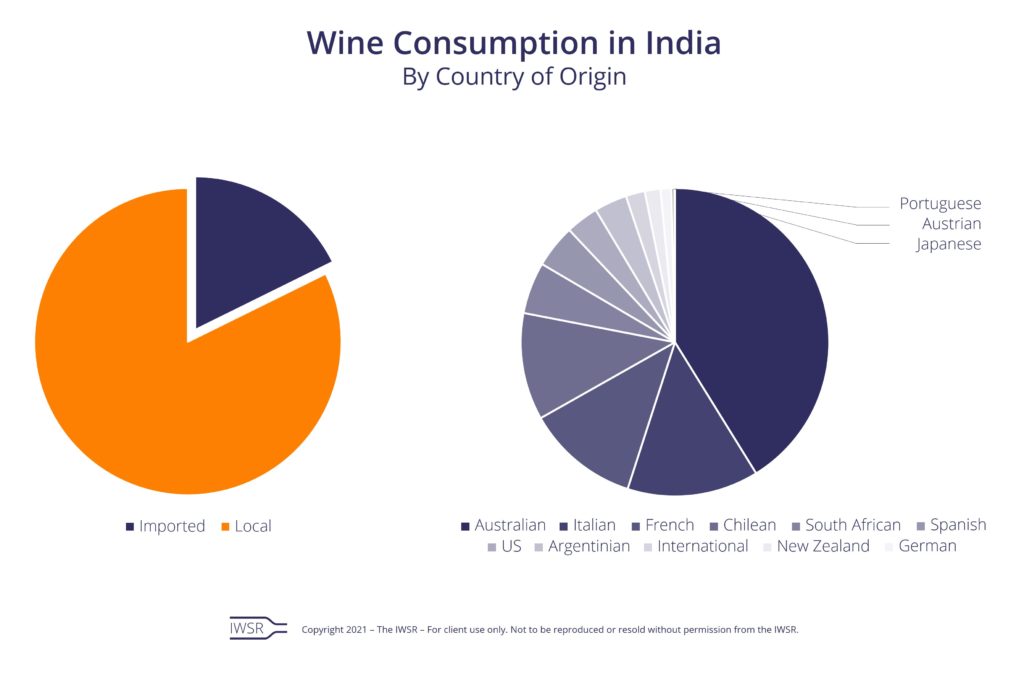

Domestic producers account for 70% of still wine consumption, 80% of the sparkling wine category, and over 80% of the total wine category in India.

The pandemic afforded these domestic brand owners an opportunity to rethink their strategies, focusing more on their higher-margin products and concentrating more on their retail routes to market as on-trade opportunities contracted. “Consumer education remains a key priority, but there is a sense that the category has attracted new consumers within more affluent, metro households,” says Holway.

This has also encompassed the creation of innovative, more egalitarian products, including wine in cans. Sula and Fratelli, for example, have launched canned products in the still and sparkling wine spaces with Dia and Tilt respectively.

“There is a sense that local players, deprived of on-trade opportunities for much of 2020, have taken a step back and reassessed their priorities,” says Holway. “They have focused on better-quality yet still very much affordable wines and sought to weaken associations with food and female customers, without entirely breaking connections to what will remain important consumer drivers.”

For imported wines, 2020 was an immensely challenging year, thanks to Covid-19 restrictions and disruptions to supply and distribution. All origins and price bands registered volume declines during the year – except for premium wines from South Africa, which owed their increase to the anomalous stocking and promotion of one brand.

Nonetheless, international wine companies are eyeing growth in India as a key strategic goal in the longer term, with the country named as a target market in trade body Australian Grape & Wine’s 2021-22 Pre-Budget Submission to the Australian Government.

The submission identifies India as a “significant growth opportunity” for Australian wine, which it says is “already the primary importer of wine in the relatively small wine market”, outlining a 10-year plan of short-, medium- and long-term objectives.

“It is certainly the right time for the governments of Australia and India to get started on the work to help improve market access for Australian wine exporters and foster a regulatory environment that supports all wine producers hoping to sell wine in India – both Indian and Australian,” says Lee McLean, general manager, government relations and external affairs at Australian Grape & Wine.

The Australian approach is to try to collaborate with India’s domestic wine industry, rather than compete with it. “We believe there is real opportunity for Australian and Indian grape growers and winemakers to work together to grow the market for wine in India,” says McLean.

“We already have a number of Australian viticultural and winemaking consultants working with India’s industry, forming relationships and sharing information and expertise. If the regulatory, taxation and tariff environment improves over time, there is also a great opportunity for Australian wine businesses to invest in Indian businesses to further develop the Indian wine sector.”

However, the approach of individual wine companies will vary according to their size and priorities. “For some businesses, there will be benefit in getting into the Indian market early to establish brand recognition and distribution channels,” says McLean. “However, for many others, the current regulatory, tax and tariff barriers will mean the market is not the right fit for them.”

In the short term, India’s recovery from the restrictions brought by the Covid-19 pandemic will be key to the future development of the wine market. “Any recovery in demand will be linked to the reopening of the on-trade and the reinstatement of such key social events as weddings, although the possibility of retaining a premium-priced presence in the off-premise should also not be ignored,” says Holway. “The industry is well-placed to recover from the downturn in demand, not least because penetration remains very low, but awareness is increasing.

“As long as all parties – domestic producers, imported brands and their distribution partners – get the balance right between educating consumers and offering choice at accessible price-points, and invest in distribution – both at home and overseas – the prospects are bright for growth.”

You may also be interested in reading:

The US and China offer resilience and opportunity for drinks groups

5 key trends that will shape the global beverage alcohol market in 2021

Alcohol ecommerce maturity in Asia Pacific

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Wine | MARKET: All, Asia Pacific | TREND: All |