This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

28/04/2022

Are consumers willing to pay more for faster delivery?

IWSR findings show that delivery speed is now a key battleground for online alcohol sales

The importance of delivery speed has risen as consumers increasingly expect, and show willingness to pay for, rapid fulfilment. A growing number of on-demand delivery services has emerged to fulfil this need – but this sector is not without challenges.

Meeting consumer expectations

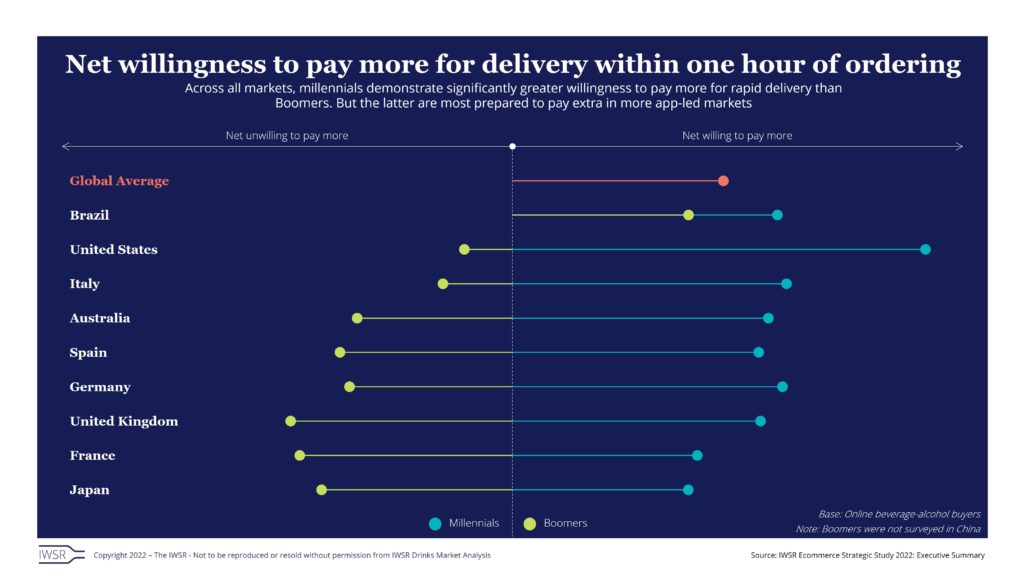

Across 16 focus markets researched by IWSR, consumers show a strong net willingness to pay more for delivery within one hour of ordering. This is particularly strong in markets including Brazil, the US and Italy. In some markets, like the UK and Japan, delivery speed is less important currently, but demand for speed is increasing.

In some countries, such as in China, shoppers have become accustomed to rapid delivery for ecommerce in general – and they expect the same offering for beverage alcohol, even if it means less product choice or higher delivery costs.

In contrast, consumers in countries such as the UK – where alcohol ecommerce is primarily bought from omnichannel retailers or specialist websites that offer strong product range and competitive prices, there is likely to be some initial hesitance to adopt rapid delivery services if it comes with a higher cost and/or narrower range of products.

However, demand for rapid delivery is growing: “Although consumers in different global markets place different levels of importance on delivery speed, one clear trend that we’ve identified is that speed is growing in importance everywhere,” says Guy Wolfe, Strategic Insights Manager at IWSR.

Speed is particularly important for younger consumers, including millennials and Gen Z consumers (of legal drinking age). “Millennials in all markets are strongly willing to pay more for fast delivery. Boomers, on the other hand, are currently unwilling in general,” says Wolfe.

Concerns around delivery continue to deter some consumers from ecommerce. Overall, 21% of consumers said that waiting for delivery is a barrier to shopping for alcohol online. This issue was particularly important among LDA Gen Z and millennial consumers. In addition, around a third of overall respondents cited delivery charges as a blocker, and 11% expressed concern about deliveries getting lost or stolen.

Quick commerce expanding

On-demand delivery services, including ‘quick commerce’ players, are emerging – and growing – to compete on speed. Some are offering delivery in as little as 15-20 minutes.

One example is the anticipated growth of Drizly in the US, which was purchased by Uber for $1.1bn in 2021. It offers delivery of beer, wine and spirits in under 60 minutes. Its marketplace features will be shown in the Uber Eats app, as well as in its own app and website. The merger of the two companies is expected to dramatically increase Drizly’s reach from 1,400 American cities to 6,000.

In the UK, rapid delivery has been less important historically, but this is changing. More on-demand services are coming to market or expanding into the UK. Gorillas, for example, is an app that offers grocery delivery in as little as 10 minutes. It is now operating across the UK in London, Manchester, Nottingham, Reading and Southampton. Another example is Wineapp, which focuses specifically on wine. It offers delivery in as little as 20 minutes in central London.

Logistical hurdles

While rapid delivery has proven popular across markets, this sector has also been facing challenges. On-demand delivery is highly capital intensive. As the number of providers rise, increased competition, coupled with a general slowdown in ecommerce post-pandemic, is proving to be problematic for some. Gopuff, an instant delivery firm with operations in both the US and Europe, employs around 15,000 people. It recently announced plans to cut 3% of its global workforce, citing the importance of “balancing scaling the business with fiscal responsibility and long-term value creation”. Doordash, a food delivery service, saw its share price drop considerably towards the end of 2021.

With consumers increasingly accustomed to convenience, delivery speed is now much more important than it has ever been. But meeting this demand is also becoming a much greater challenge.

You may also be interested in reading:

Beverage alcohol ecommerce value expected to grow +66% across key markets 2020-2025

Ecommerce channel evolves into two overlapping worlds

Should brand owners buy their way into ecommerce?

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Digitalisation |