14/04/2022

Ecommerce channel evolves into two overlapping worlds

Significant variations have developed both across and within markets in how different consumer groups shop online and what their priorities are

Ecommerce is now a major channel for beverage alcohol drinks, especially wine and spirits. Around one quarter of global alcohol drinks consumers say that they buy online. By 2025, sales are expected to total over $42bn across 16 key markets considered by IWSR, including China, Brazil and the US. This is almost as large as the UK’s current total beverage alcohol market, highlighting the importance of this channel moving forward.

Consumer research conducted by IWSR suggests that when it comes to purchasing beverage alcohol online, there are two distinct but overlapping worlds: one based around traditional internet browsers and online ordering, generally favoured by older consumers seeking value; the other, based around smartphone apps, generally favoured by younger consumers seeking convenience and novelty.

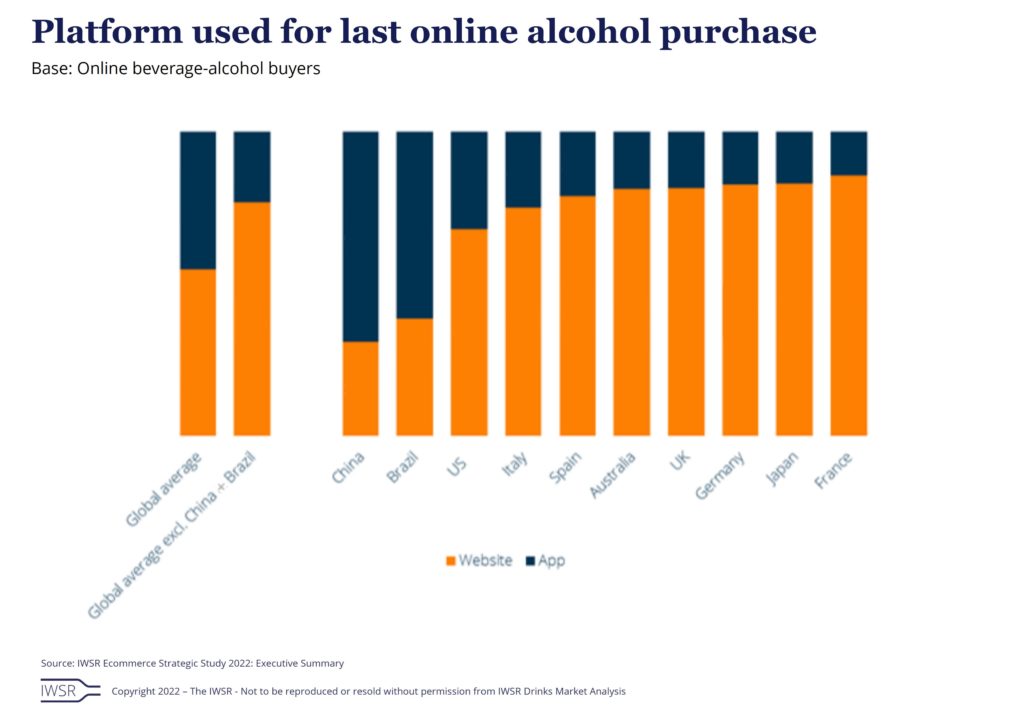

Purchasing platform is the most telling way in which these two worlds can be differentiated. While consumers across all markets buy alcohol beverages through both websites and apps, there are significant variations by country. Websites are dominant overall, with 55% of consumers who buy alcohol online saying that they most recently used this type of platform. Indeed, in most markets, including France (86%), Japan (83%) and the UK (83%), the figure is much higher. Website purchases generally skew towards the Omnichannel and Online Specialist channels.

App-focused buying

China and Brazil are two significant exceptions. Consumers in these markets show a preference for apps, at 69% and 62% respectively. The US also has a relatively high number of app users, with 32% purchasing alcohol on their phones.

Higher app use broadly corresponds to a greater prevalence of On-Demand services. In Brazil for instance, where many retailers lack their own delivery infrastructure, players like Rappi, James Delivery, and iFood have emerged to fill this gap by connecting consumers with a wide range of vendors, including sellers of alcohol drinks, and facilitating fast delivery.

The US also has a strong On-Demand channel. Some popular apps such as Instacart and Fresh Direct offer general grocery delivery, including alcohol. Consumers are likely to use these to purchase alcohol as part of a broader order. Others like Drizly, which was acquired by Uber for $1.1bn in 2021, and Minibar, focus specifically on alcohol drinks by partnering with liquor stores and other similar retailers. Each of these offer delivery in under 60 minutes.

In China, app use is a little different. Consumers commonly use apps to access Marketplaces, which offer a vast range of products, including beverage alcohol. They are hugely significant channels for alcohol sales, accounting for over 90% of total online alcohol sales in 2021. Two major players dominate the Marketplace space – JD.com and Tmall, which is owned by Alibaba. The dominance of these two marketplaces is so great that many brands have opened flagship stores on these platforms with the goal of driving sales and increasing brand awareness.

Purchasing behaviour

Across the board, consumer selection of ecommerce alcohol retailer is influenced by a range of factors including price, the quality and range of products offered, and convenience. However, priorities vary by market.

In website-led markets, such as the UK, Japan, and France, IWSR consumer research shows that online buyers find the breadth of product range very important. They are also more likely to cite price as a key factor in purchase decision making.

By contrast, consumers in app-driven markets show different preferences. Although they are still influenced by special offers, factors relating to price are less important to them overall. But convenience, including rapid delivery, is more important than in website-led markets.

High quality products are also rated as important in these markets. In China, it is actually the most important driver for consumers. This reflects the fact that convenience is assumed, but there have been longstanding issues with counterfeit wines and spirits in the market.

What this demonstrates is that the priorities of consumers are heavily influenced by their entry point to ecommerce and the kind of service to which they subsequently become accustomed.

“In countries where On-Demand apps have become the leaders in alcohol ecommerce, shoppers have come to expect rapid delivery and are therefore extremely unwilling to give this up, even if it means a greater choice of products or lower delivery costs” says Guy Wolfe, Strategic Insights Manager at IWSR.

“But this works both ways. Where consumers primarily buy from Omnichannel and Online Specialist retailers via websites that offer a strong product range and competitive prices, there is likely to be some initial hesitance to adopt rapid delivery services if it comes with a higher cost and/or narrower range of products.”

Generational shifts

Alongside variations by country, there is also a clear generational divide in ecommerce purchasing behaviour.

Across all markets surveyed by IWSR, millennials demonstrate a much greater willingness to pay extra for convenience when compared with boomers. This is particularly striking in the US, where millennials have a very high net willingness to pay more for delivery within one hour of ordering. In other key markets, such as Italy, Brazil, Germany and Spain, millennials also show high willingness to pay for convenience.

But even boomers in app-led markets such as Brazil are more willing to pay for fast delivery than those in website-led markets, again demonstrating that they have become more accustomed to paying for convenience.

You may also be interested in reading:

Beverage alcohol ecommerce value expected to grow +66% across key markets 2020-2025

Key trends driving the global beverage alcohol drinks industry in 2022

Should brand owners buy their way into ecommerce?

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Digitalisation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.