07/03/2022

Key stats: Russia’s alcohol market

As vodka comes under the spotlight amidst Russia’s invasion of Ukraine, IWSR takes a deeper look at the Russian alcohol market

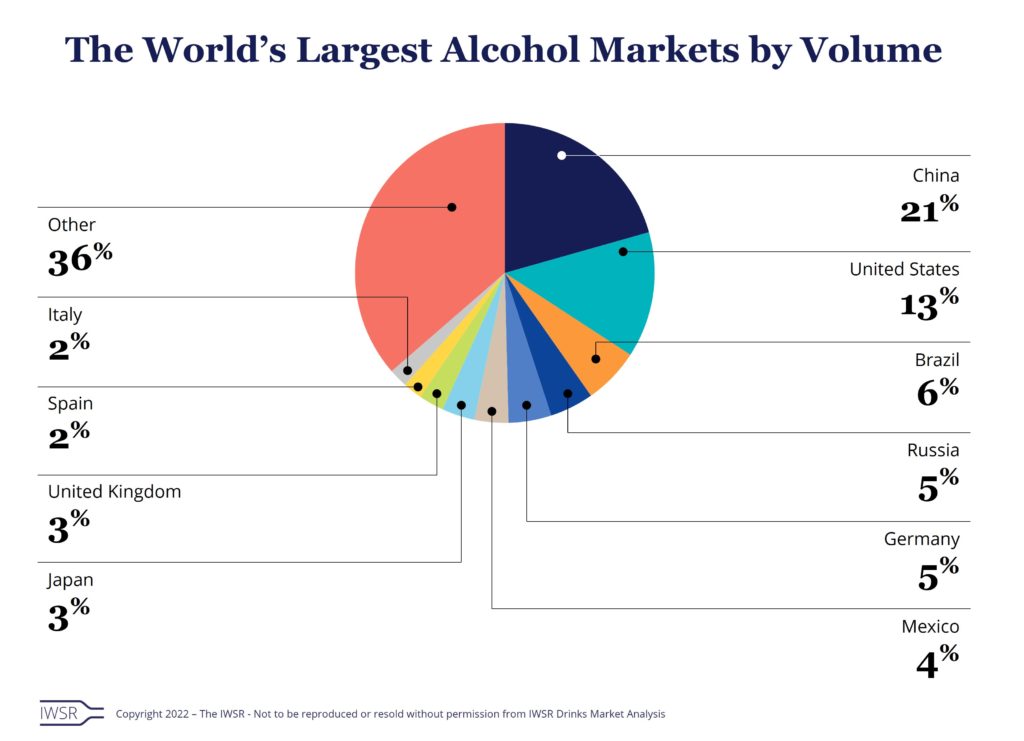

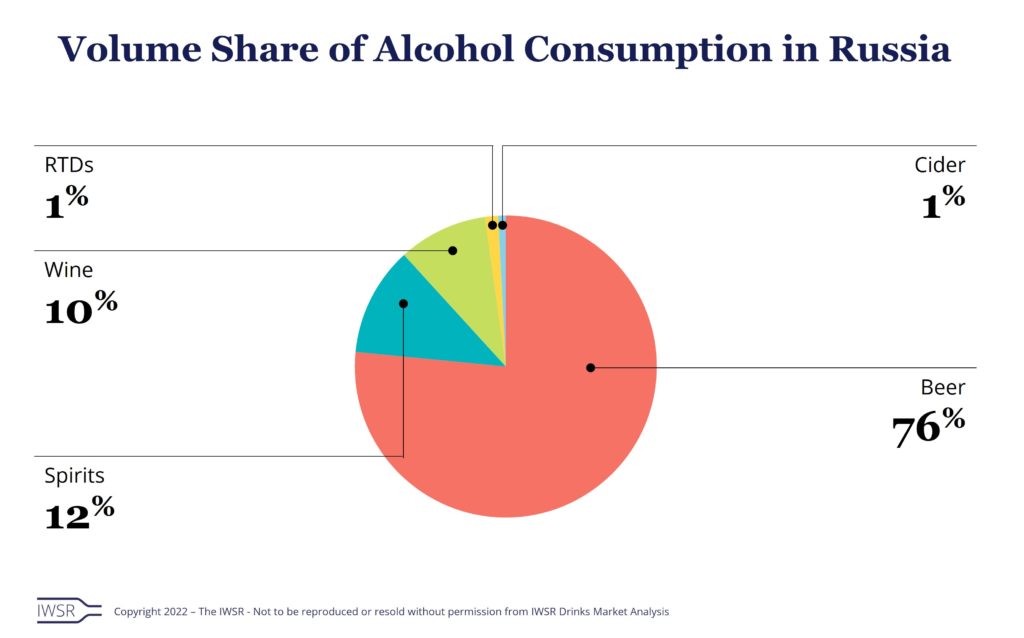

Russia is the 4th largest alcohol market in the world in terms of volume, with imports accounting for 9% of total consumption.

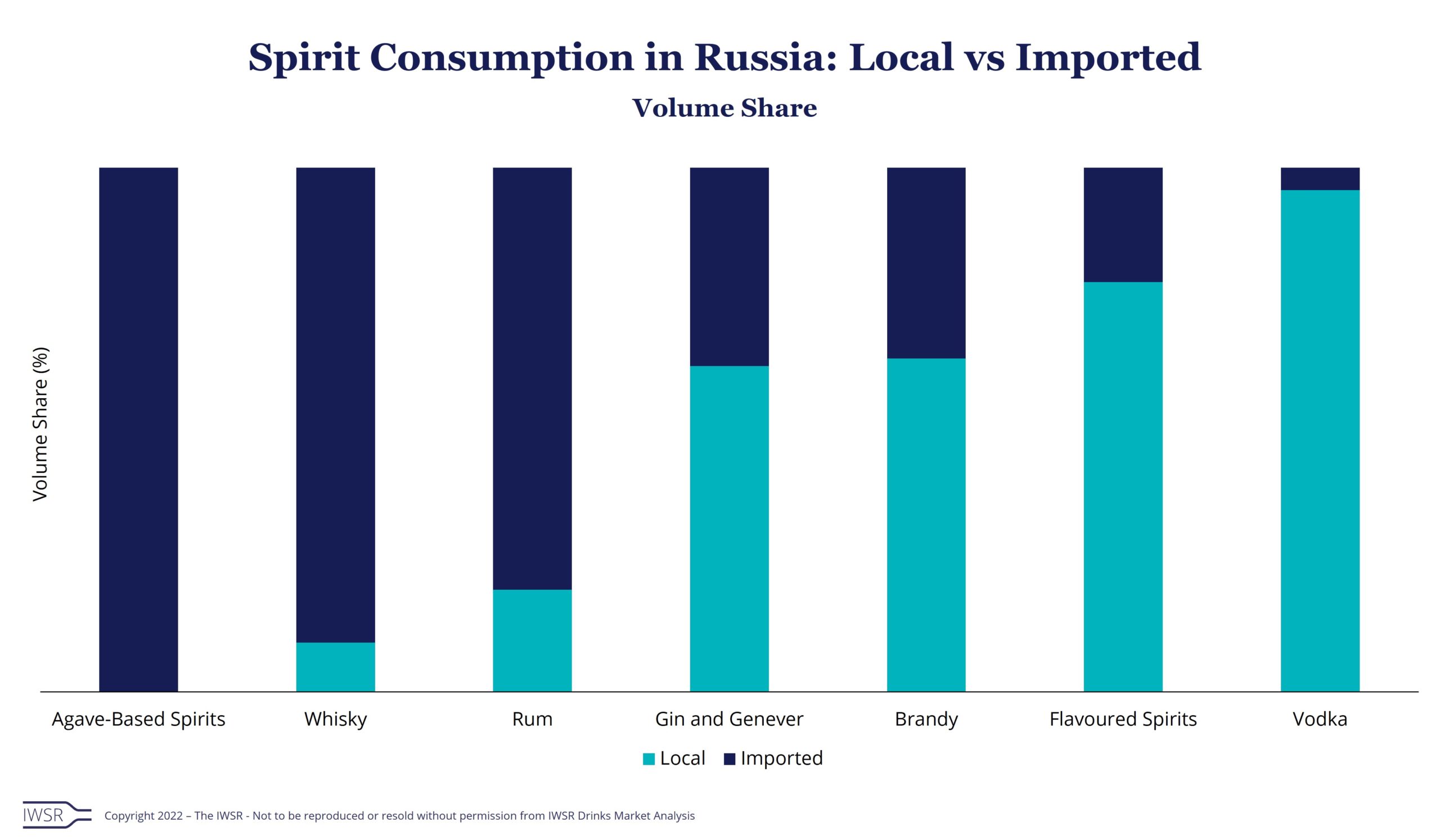

- Whisky makes up 5% of Russia’s spirits consumption, and a third of its spirits imports.

- 91% of Russia’s whisky consumption is from imported whisky

While there have been calls to ban Russian-made goods in light of the country’s invasion of Ukraine, boycotts of Russian vodka brands will have a fairly minimal impact on Russian vodka producers. Any significant impact is more likely to be symbolic.

- While Russia is the largest vodka producer in the world, with over 30% of global production, the vast majority (over 90%) of Russian-made vodka is consumed domestically.

- Outside of Russia, the UK, Germany, the US and Israel round out the top 5 markets for Russian-made vodka, although volumes are relatively small.

- Russian vodka accounts for under 3% of all vodka consumed in Europe (excluding CIS) by volume.

- In the US, the world’s 2nd largest vodka market by volume, Russian vodka accounts for less than 1% of all vodka consumed.

- Approximately half of all vodka consumed in the US is made in the US.

While vodka is the country’s largest export, Russia is also a relatively large producer of beer and wine – though much of this is consumed domestically.

- Russian beer makes up 1% of the global beer market. Over 99% of Russian beer is consumed domestically.

- Similarly, Russia produces 2% of the world’s still wine, with almost all of it consumed locally.

- Russia also produces 6% of the world’s sparkling wine, with 99% of it consumed domestically.

[table id=11 responsive=stack /]

You may also be interested in reading:

Beverage alcohol ecommerce value expected to grow +66% across key markets 2020-2025

Key trends driving the global beverage alcohol drinks industry in 2022

Should brand owners buy their way into ecommerce?

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, Asia Pacific | TREND: All |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.